Double Your Money as AI Transforms Online Learning in Corporate America

Thanks to OpenAI’s ChatGPT, artificial intelligence (AI) has taken the world by storm.

While the technology has been around for many years and is already being used in many industries… many folks – investors especially – are now paying attention.

The bulk of that attention is on the incredible potential that has opened up in content creation. ChatGPT and other AI programs can create short stories, scripts and even poetry with just a prompt. They won’t be cranking out War and Peace or Hamlet anytime soon, but for simple, short-form content, these programs are perfect.

And one area where simple, short-form AI-generated content is useful and efficient – which you may not realize – is employee training.

Employee training is vital to the modern workplace – especially in a post-COVID-19 world, where hybrid work arrangements have become the norm and in-office training is no longer a guarantee.

Another aspect to consider with training is translations. Companies that operate around the world need to have their training content produced in multiple languages. Writing, filming and producing a training video in one language is a time-consuming process. Translating that video into numerous other languages makes that process even longer.

Fortunately for employers, AI can solve all of those problems. And there’s one company many of them are turning to…

A Learning Machine

Based in Toronto and founded back in 2005, when AI was still considered science fiction, Docebo (DCBO) provides dozens of major companies with a cloud-based learning management system to train internal and external workforces around the world.

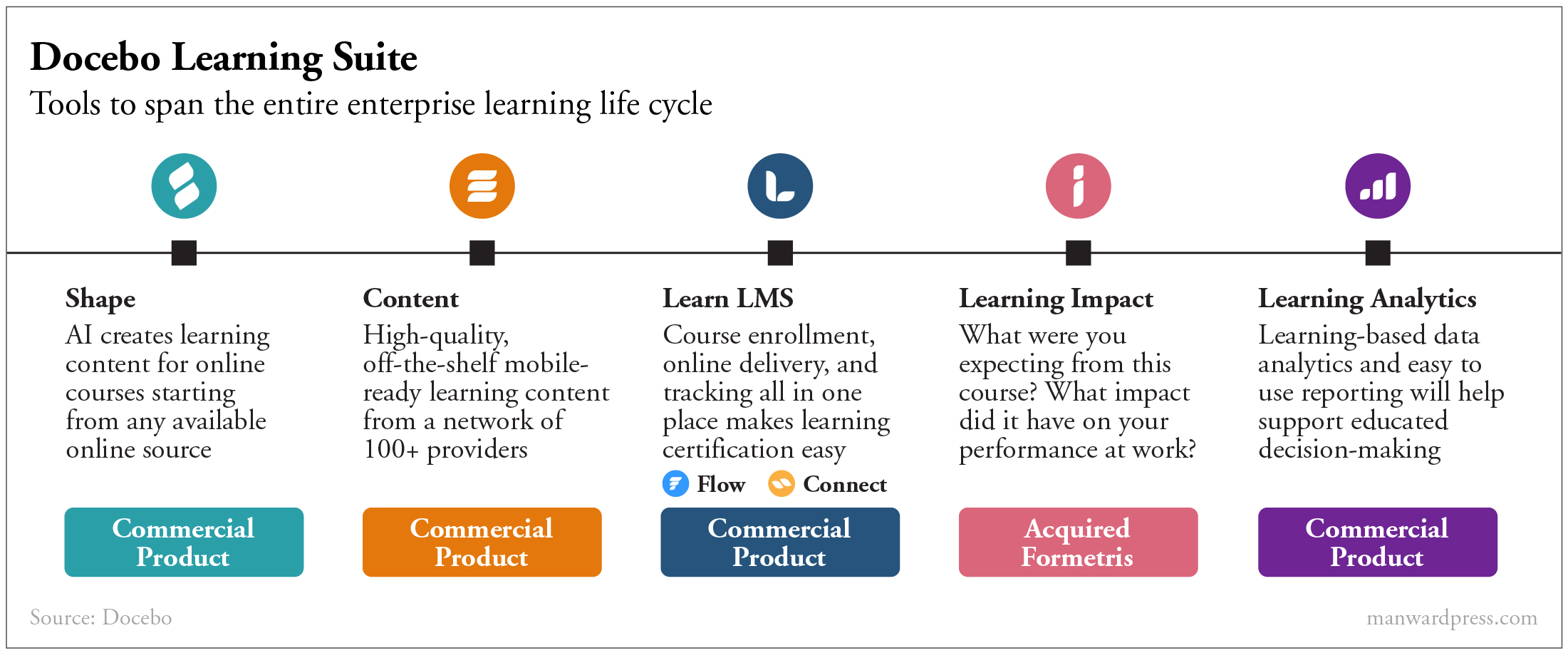

To achieve this, the company offers its Docebo Learning Suite, a five-part toolbox that enables businesses to create learning content quickly and easily and distribute it across their entire employee bases – regardless of language.

Shape is one part of the toolbox. It’s a program that uses AI to create learning content for online courses, starting from any online source. All you need to do is feed the program a link, and it will make content out of it. Then a human user can tweak that content. The Shape program is capable of producing a training video in a number of different languages.

And businesses don’t even have to create their own content. The company’s Content toolbox has a large catalog of high-quality content from more than 100 providers.

And the suite’s Learn LMS tool allows businesses to deliver and track all of their content in one place and manage course enrollment. It goes hand in hand with the company’s Learning Impact solution, which tracks the impact content has on employees.

Finally, there’s Learning Analytics, which helps with decision making based on a company’s learning content and its impact through data analytics.

The impact Docebo has can be measured by the sheer number of heavy hitters that have adopted its software. Amazon Web Services, Thomson Reuters, L’Oréal, HP, Experian and Denny’s have all chosen Docebo for their training and corporate learning content.

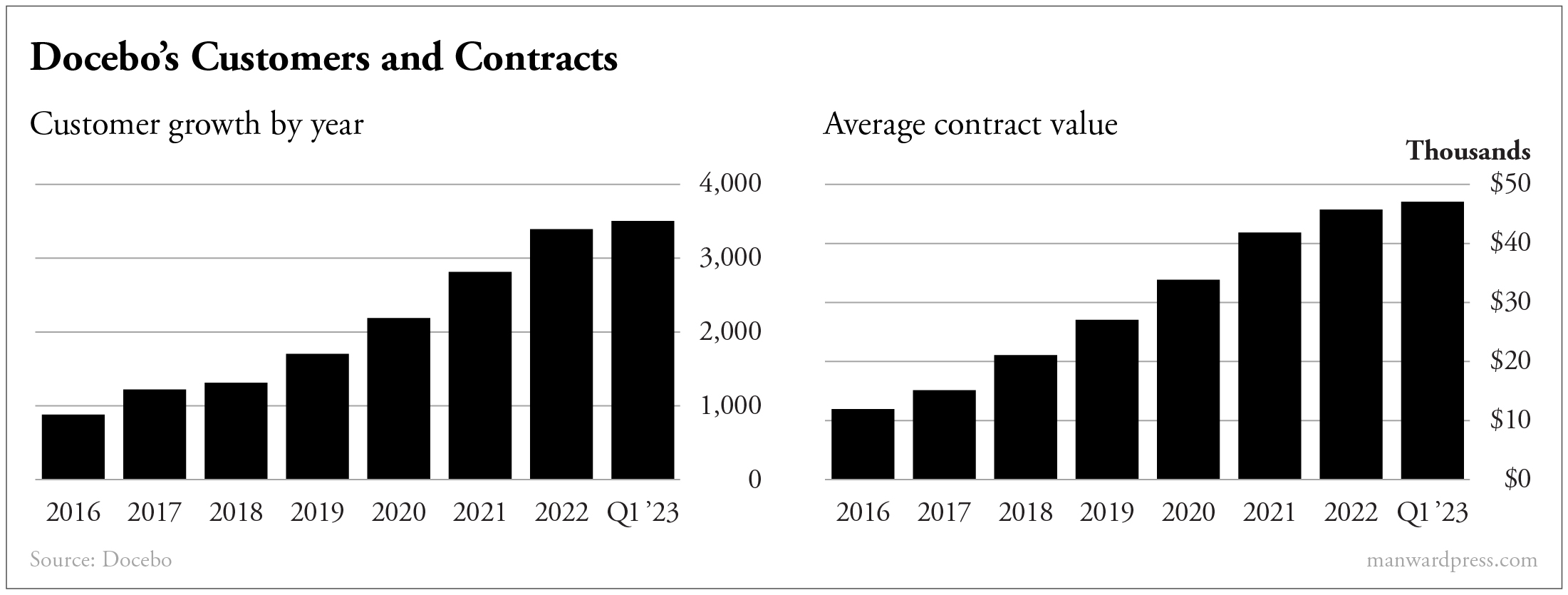

In all, 3,500 customers around the world in a variety of industries have turned to Docebo… 76% of them from North America and 24% of them from the rest of the world.

One customer, a tech certification company in Germany called TÜV Rheinland, adopted Docebo’s software and in just four months created over 3,000 courses in 11 languages, plus a web shop for its audiences around the world .

It increased its course offerings by 36%… which led to a 46% increase in active users coming to it for certifications…

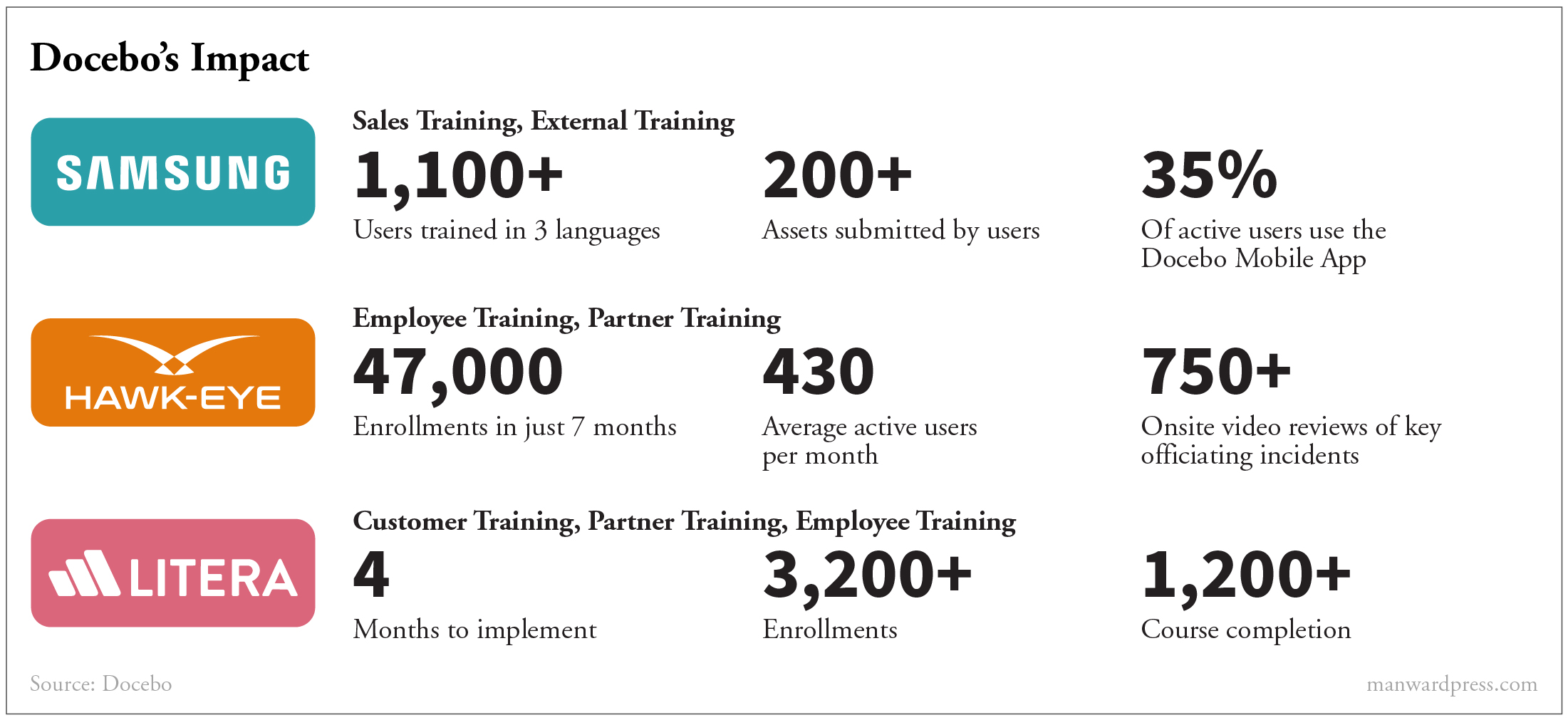

Samsung, Hawk-Eye and Litera Microsystems saw similar results…

The speed at which Docebo’s AI software can produce high-quality content is unbeatable by any human video production and writing team.

And that’s precisely why the company’s seeing incredible growth in its bottom line…

A Brain-Powered Bottom Line

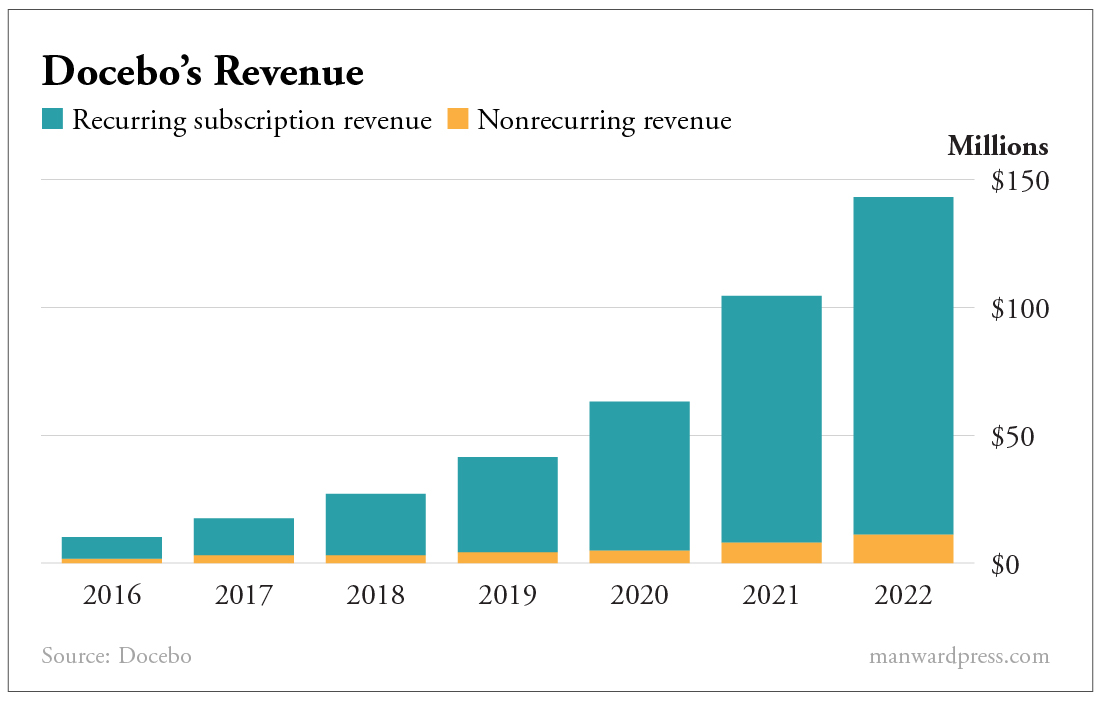

From 2016 to 2022, Docebo went on a revenue tear, shooting up every year at a compound annual growth rate of 52%. The company has annual recurring revenue of $142 million. That’s growing at a rate of 29% per year.

Docebo has also seen the number of customers and the value of the contracts those customers are signing grow in lockstep with one another over the same time frame. That’s a big part of its incredible revenue growth.

And the company’s first quarter 2023 results show that this growth is here to stay.

For the quarter, Docebo brought in total revenue of $41.5 million, up 29% year over year. Subscription revenues surged to $38.8 million, up 33% year over year. Gross profits also saw considerable growth, shooting up to $33.4 million, a 31% increase year over year.

But Docebo isn’t content with just incredible organic growth. It has also been on a merger and acquisition tear, buying three competitors in the past three years.

In 2020, Docebo acquired forMetris SAS, an analytics platform for learning impact evaluation. In 2022, it bought Skillslive, an Australia-based educational consulting agency. And in 2023, it bought PeerBoard, a California-based platform that provides community engagement and market insight for businesses.

And with its incredible revenue growth, it certainly has the war chest to make more acquisitions in the future.

Consensus estimates see Docebo’s stock reaching 35% growth in the near future.

You don’t want to miss out on this AI profit opportunity.

Action to Take: Buy Docebo (Nasdaq: DCBO) at market. Set a 25% trailing stop to protect your principal and profits.

A Safe Bet in an Uncertain World

The potential of AI is basically limitless. Nobody knows which direction the technology will go in.

But AI has already made an impact on several industries. Corporate learning and employee training is a prime example, and Docebo is the best opportunity in that industry.

It’s a sure bet in an economy that’s about to be changed forever by the rise of AI. And that’s why it’s an opportunity you can’t afford to pass up.

Note: We’ve found that readers tend to buy the stocks in these special reports at different times. Keep in mind that we may have taken profits or stopped out of a recommendation by the time you read this report. Please refer to the current portfolios for the most up-to-date recommendations.

© 2025 Manward Press | All Rights Reserved

Nothing published by Manward Press should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investment advice. We allow the editors of our publications to recommend securities that they own themselves. However, our policy prohibits editors from exiting a personal trade while the recommendation to subscribers is open. In no circumstance may an editor sell a security before subscribers have a fair opportunity to exit. The length of time an editor must wait after subscribers have been advised to exit a play depends on the type of publication. All other employees and agents must wait 24 hours after publication before trading on a recommendation.

Any investments recommended by Manward Press should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Protected by copyright laws of the United States and international treaties. The information found on this website may only be used pursuant to the membership or subscription agreement and any reproduction, copying or redistribution (electronic or otherwise, including on the world wide web), in whole or in part, is strictly prohibited without the express written permission of Manward Press, 14 West Mount Vernon Place, Baltimore, MD 21201.

June 2023.