Special Report

Trade War Master Plan

It’s an old cliché in investing: Be fearful when others are brave and brave when others are fearful. But here’s the thing about clichés… they tend to ring true.

Chaos is an opportunity, and too much stability is stagnation.

Whenever markets are shaken up and become volatile, you have a chance to get rich. High volatility means stocks will be making big swings.

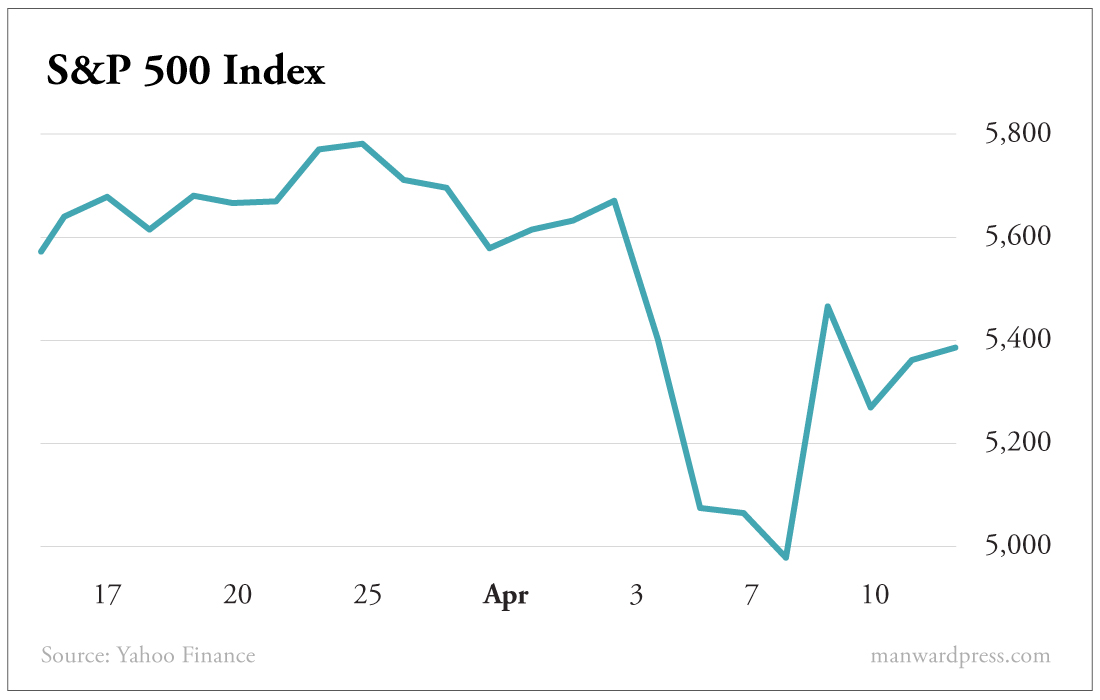

We saw an excellent example in early April when stocks plummeted, losing $5 trillion in two days, in response to Trump’s tariffs, only to surge a few days later with another development in the tariff plan.

Trump’s moves might seem erratic, crazy even. But in the words of Shakespeare, “Though this be madness, yet there is method in it.” There’s nothing crazy about Trump’s actions.

With the mere threat of tariffs, numerous countries came to the table to negotiate trade deals fairer to the U.S., namely Vietnam and the European Union. But China raised tariffs in retaliation. Trump forced China to play its hand and leave itself isolated.

What’s more, companies are responding to Trump’s clear desire to reshore American industry. In an unexpected move, Nvidia, the GPU giant, has announced it will be building its advanced Blackwell chips exclusively in the U.S. and will open a new supercomputer factory in Texas.

As a side effect of Trump’s actions, the market plunged into chaos and volatility soared.

But this is all part of his four-step master plan:

- Create chaos in the market.

- Don’t act until you have leverage.

- Through the worst of times bring out the best opportunities.

- Make America rich!

We have a great window to get rich, with hundreds of incredible companies trading at sizable discounts.

And the three companies in this report are the best ways to play the “madness.”

Rare Earth

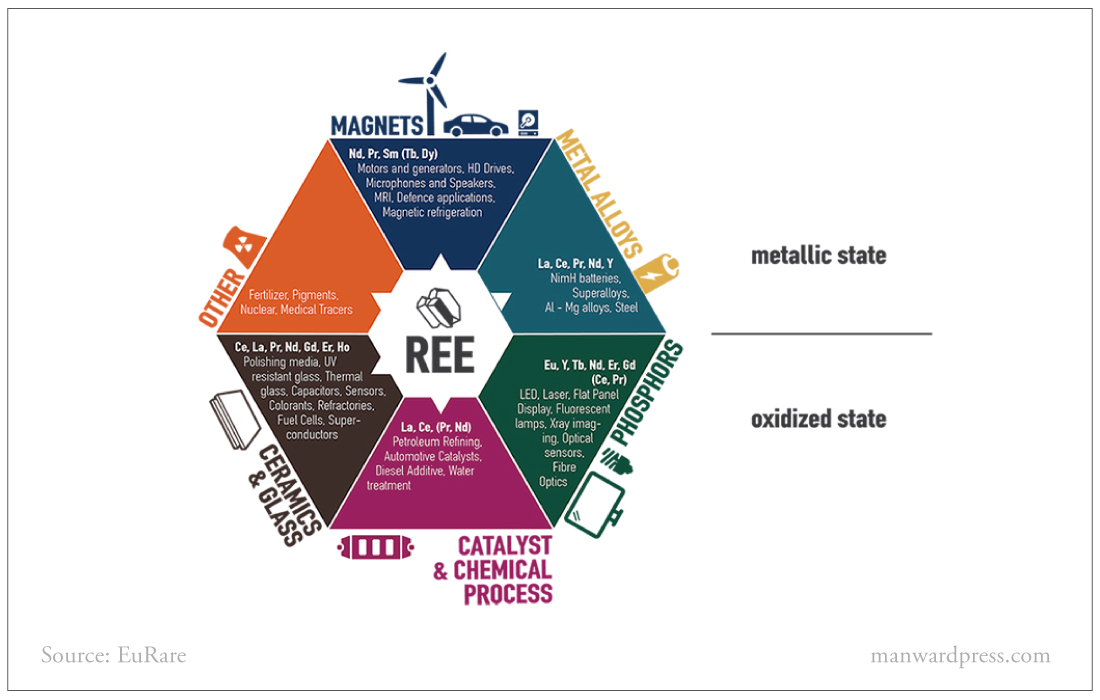

Rare earth elements come from a small section of the periodic table. There are 17 in all, just barely distinguishable from one another.

Though they’re not “rare” in the sense of being scarce – in fact, one of them is more prevalent in the Earth’s crust than copper – they’re called rare earth elements because finding quantities that are pure enough for industrial use is expensive and requires processing enormous amounts of raw ore.

These elements are an increasingly large component of the technologies being developed to power the modern world, and they are used widely in electrical systems, semiconductor chips, magnets, different types of high-tech glass, and laser emitters.

Demand for them will only increase as production ramps up in sectors like electric vehicles and the next generation of AI-enabled microchips…

And China controls the largest reserves on the planet. Beijing controls 70% of the world’s rare earth metal production and 90% of its refining capacity.

That’s why the ability to mine and refine rare earth elements is at the heart of the conflict between the U.S. and China over access to chip technology.

As the U.S. has sought to limit China’s access to the cloud computing platforms that would allow it to develop AI applications, China has responded by placing export restrictions on gallium and germanium, two critical elements used in semiconductor production.

Analysts fear that rare earth elements may be the next escalation in this conflict because China controls so much of the world’s supply. Because of that, the rest of the world is moving quickly to reduce its dependencies and create domestic supply chains for semiconductor manufacturing.

That means this sector is about to become a growth industry. And, given that China just shot the last arrow in its quiver and cut not just the U.S. but the entire world off from its rare earth exports, it’s set to create a roaring bull market for any domestic firms able to meet that demand.

It so happens we already have a company headquartered in Las Vegas that’s positioned to take advantage of this, and the upside potential here is massive.

MP Materials Corp. (NYSE: MP) was founded in 2017 when the Mountain Pass mine in California was acquired by JHL Capital Group, which quickly created an entity to take over operations and reopen the mine. With very few competitors in the space, MP quickly rose over the next six years to become a leader in rare earth oxide mining, providing an estimated 15% of total global production and boasting a soaring $3.71 billion market cap.

Its main output is neodymium-praseodymium (NdPr), a material found in high-strength magnets used in electric motors. And while the company has so far been focused on simply producing the rare earth concentrates that get refined into industrial products by factories in China, the current moment is pushing them to a much loftier goal – becoming the first vertically integrated rare earth magnetics producer in the world.

To that end, it started building a new facility in Fort Worth, Texas, a manufacturing facility that can take the raw materials produced by MP’s mines and convert them into metal alloys, magnets, and other high-tech components that American companies need. When it opened in January 2025, it became the only such facility in the world outside of China and Japan.

Of course, this means that MP Materials is attracting a bunch of attention from the entity most invested in establishing a domestic supply chain for rare earth goods: the United States government.

Since July 2020, the Department of Defense has been heavily involved in funding MP’s efforts to expand its production capabilities, with millions of dollars flowing in from multiple contracts.

A 2021 collaboration with the Department of Energy is researching new ways of extracting rare earth elements from common materials like coal.

And in 2023, the government announced a further $35 million earmarked to help expand the kinds of rare earth minerals MP can process. This includes the so-called “heavy” rare earth elements, like dysprosium and terbium, which are currently produced in only China and Myanmar.

With the annual revenue for rare earth elements projected to grow to $6.8 billion in just five years and geopolitical tensions driving a new initiative to hedge against supply chain risks, MP Materials is already way ahead of competitors in its bid to be the provider of what the United States needs for these products.

While there are a handful of other startups working on getting into the market, MP is the only one with a functioning mine, and it could be the only viable domestic producer for years.

For investors who want exposure to what could be one of the most vital growth markets of the next decade, MP is simply a must-own stock.

Action to Take: Buy MP Materials Corp. (NYSE: MP) at market. Set a 25% trailing stop to protect your principal and your profits.

Make American Steel Great Again

Steel is one of the most critical strategic industries in any economy. The metal is what the modern world is built on, quite literally. Steel construction allowed us to build taller, tougher buildings. It’s what cars, boats, industrial tools, and most anything else that needs to be durable is built out of.

And reshoring that industry is one of Trump’s biggest priorities. But there’s more to steel than the metal itself. You need two things to make high-quality steel: iron and coal. The higher the quality of the raw materials, the better the steel you can create. And that’s why America produces some of the best steel.

When most people think of coal, they likely think of Santa Claus or electricity. And while coal is best known for electrical generation, or punishing naughty children at Christmas, it can be used for far more than that.

See, it’s mostly low-quality coal called lignite that gets used in power generation. It burns hot enough to boil water and generate steam, which is all a coal plant is doing. But it doesn’t burn hot enough for much else.

It’s the high-quality coal, bituminous coal and especially anthracite, without all the impurities and moisture of lignite, that gets used in advanced metallurgy.

America has enormous coal reserves, but it’s not the only country that does. Germany also has vast reserves of it. But America’s coal is high-quality bituminous coal and anthracite for the most part, meaning it has a high carbon content and low impurities. Germany’s coal is mostly lignite.

American coal is easier to refine into metallurgical coke, the nearly pure carbon fed into blast furnaces with iron ore to produce steel…

And St. Louis, Missouri-based Peabody Energy Corporation (NYSE: BTU) produces some of the finest metallurgical coke on the market.

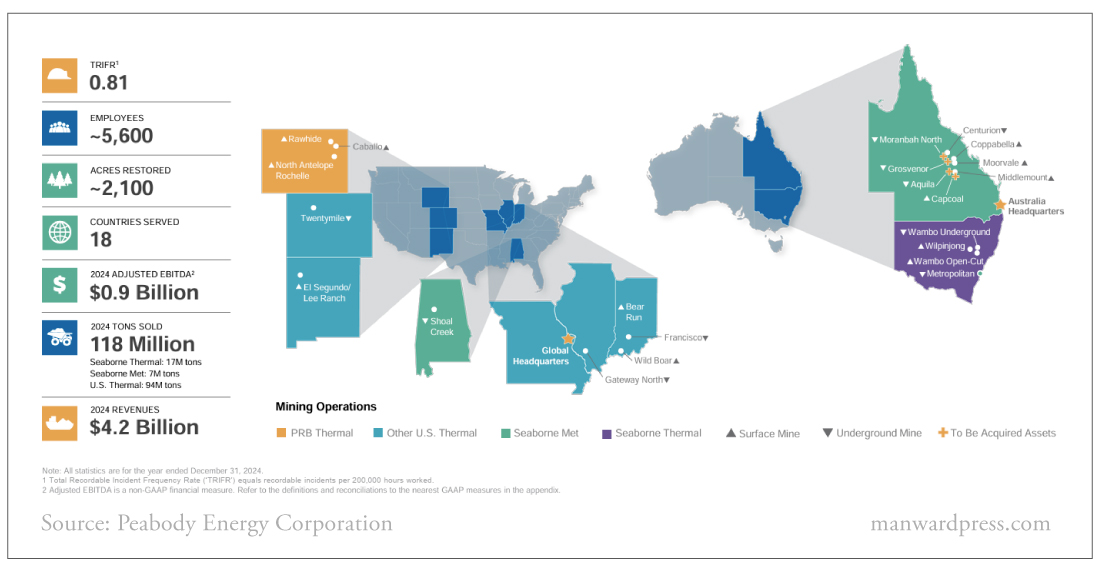

Peabody has 17 mines and facilities across the United States, in Colorado, Wyoming, New Mexico, Alabama, Missouri, Indiana, and Illinois, and it recently acquired a large mining rival in Australia, specifically to boost its production of high-carbon steel to produce coke.

The company’s business model is extracting, refining, and selling coal to energy producers, the steel industry, and others. And Peabody is making a mint doing it…

Peabody produced 115 million tons of steel in 2024. Revenue for that year came in at $4.2 billion. Q4 2024 saw revenues top $1.1 billion. And that revenue has increased at a CAGR of 8.5% over the past three years despite the Biden administration’s general antipathy toward the coal industry.

And right now it’s trading for less than $12. But, during Trump’s first term, Peabody surged to $45 thanks to the president’s pro-coal policies. What’s more, if you invest now you can lock in a 2.1% dividend yield.

The company also has an impressive cash position of $700.4 million and free cash flow of $205.2 million.

That means you can pick up shares of Peabody at a 75% discount right now. The average analyst 12-month price target for the company is $21.40, which is 77% upside with current prices.

You’ll want to buy some shares as soon as possible.

Action to Take: Buy Peabody Energy Corporation (NYSE: BTU) at market. Set a 25% trailing stop to protect your principal and your profits.

Deus Ex Machina

In ancient Greco-Roman theater, there was a plot device called “deus ex machina,” or “god from the machine.”

At the end of a play, a crane (the machine) would lower a statue of one of the gods in the Greco-Roman pantheon onto the stage. The deity would tie up all the loose ends of the plot in a convenient little bow.

In essence, that’s what AI technology offers companies – a convenient solution to their business problems, including problems they didn’t even know they had. And it’s what makes the technology so appealing and powerful…

However, AI technology is incredibly complex. It has great power to advance the way we do business, but only a fraction of computer scientists truly understand it.

Fortunately, it’s a field in which America has a considerable edge over China already. OpenAI, Palantir, IBM, Microsoft, and Meta are all industry leaders in AI software. On the hardware side, we have Nvidia, which produces the hardware required to run the most advanced AI.

And the companies that want to make use of the power of AI don’t necessarily have the tech know-how to build their own systems. But there’s one company making AI simpler for businesses to integrate than ever before, truly unlocking the technology’s potential to revolutionize how we do business in the United States.

Enter UiPath Inc. (NYSE: PATH) and its plug-and-play AI. These are AI algorithms and toolkits that anyone can use to tailor an AI system to their specific needs with little to no complex computing knowledge. UiPath’s programs are low-code AI systems that offer user-friendly toolboxes and flexible programs that companies or individuals can use to build custom robots to perform myriad tasks.

UiPath offers the ultimate AI toolkit for companies to find uses for AI in their businesses, build custom bots to make their businesses more efficient, and scale those bots up as they grow…

The company’s eponymous AI toolkit operates on three levels: discovery, automation, and operation.

Discovery is fairly straightforward. Once a company adopts the UiPath toolkit, nothing changes at first. The system analyzes the business’s processes and homes in on the communications and tasks that are causing inefficiency and costing the company money.

After that comes automation, wherein a company can use the UiPath studio to build out custom AI programs to fix those inefficiencies. This can range from a bot that handles customer questions to a full-blown individualized AI assistant for every employee.

Finally, there’s operation.

All the bots created using UiPath can be monitored from one centralized location. From there, they can be further tweaked to do their jobs even more effectively, freeing up employees to focus on the critical parts of their job while leaving the menial or clerical tasks to the machine.

How does this work in practice? It’s simpler than you may think…

UiPath provides us with an example of a British insurance company that reduced its auto insurance underwriters’ workload to process a case from two to three days to just two to three hours. And one year after implementing UiPath’s tools, that company saw a return of 370,000 pounds.

We’ve all attended meetings that could have been emails. But what about emails that could have been text messages?

Well, with UiPath, companies have created bots that read and summarize emails, including their attachments, in just a sentence or two, allowing the recipient of the email to act more quickly on whatever issue the email was about.

To a company wracked with inefficiency, UiPath creates a night-and-day difference. And it’s being rewarded handsomely for it…

In its fiscal 2025, UiPath brought in revenue of $1.4 billion, up 9.3% year over year. The company’s annualized renewal run rate – which is essentially its ability to acquire new customers while maintaining its partnerships with existing ones – is up 14% year over year. Earnings are up 52% year over year, and the company has an incredible cash position of $1.6 billion compared with just $77 million in debt.

The UiPath toolkit can also integrate with the most popular cloud software, including Microsoft Azure, Google Cloud, and Amazon Web Services.

Add in a client list that includes giants like Uber (which saved $22 million by using UiPath), Deloitte (which saved over $104 million), and Fiserv (which saved over $3 billion), and it’s no wonder where that money is coming from.

The company’s current market is valued at just shy of $6 billion, but the total future addressable market is projected to be worth $93.2 billion. That’s an enormous pie for UiPath to carve a slice out of, and it’s one you can get access to right now for about $10 per share.

It won’t stay there for long, however. In the last four quarters, UiPath has positively trounced the market’s consensus earnings per share estimates.

I think the run-up is just getting started, and if you buy now, UiPath might just deliver you some seriously convenient profits from the machine.

Action to Take: Buy UiPath Inc. (NYSE: PATH) at market. Set a 25% trailing stop to protect your principal and your profits.

The Man With a Master Plan

Don’t listen to the media. Trump’s actions might seem nonsensical at first, but there’s a method to them. Provided you don’t panic like the talking heads on CNN or MSNBC want you to, you have an opportunity to make some serious money trading on the back of the president’s moves.

The chaos in the markets isn’t a bug, it’s a feature. And if you’re clever enough to sign up for my service, you’re clever enough to realize that, and you’re clever enough to buy the three stocks in this report.

Each one stands to gain from the tariffs, either by making American businesses more competitive or by challenging China’s monopoly on a given industry. And these three are just the start of our tariff trades!

Note: We’ve found that readers tend to buy the stocks in these special reports at different times. Keep in mind that we may have taken profits or stopped out of a recommendation by the time you read this report. Please refer to the current portfolios for the most up-to-date recommendations.

© 2025 Manward Press | All Rights Reserved

Nothing published by Manward Press should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investment advice. We allow the editors of our publications to recommend securities that they own themselves. However, our policy prohibits editors from exiting a personal trade while the recommendation to subscribers is open. In no circumstance may an editor sell a security before subscribers have a fair opportunity to exit. The length of time an editor must wait after subscribers have been advised to exit a play depends on the type of publication. All other employees and agents must wait 24 hours after publication before trading on a recommendation.

Any investments recommended by Manward Press should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Protected by copyright laws of the United States and international treaties. The information found on this website may only be used pursuant to the membership or subscription agreement and any reproduction, copying or redistribution (electronic or otherwise, including on the world wide web), in whole or in part, is strictly prohibited without the express written permission of Manward Press, 14 West Mount Vernon Place, Baltimore, MD 21201.

April 2025.