Special Report

The Perfect AI Stock

Artificial intelligence (AI) is everywhere.

You can’t watch TV, scroll through the internet, or even walk down the street without seeing an ad for it or a business using it for some new purpose.

But as big as AI is in the United States, no American AI company comes close to the size and potential of my “Perfect AI Stock.”

Charlie Munger – Warren Buffett’s investing partner of 60 years – was rumored to have quietly invested 23% of his primary portfolio in this little-known investment. Kiplinger reports that this one company has created more wealth for investors than household-name AI stocks like Nvidia, Samsung, Facebook, or Tesla.

Ninety-nine percent of Americans have never heard of it, and that’s by design…

We take for granted here in the U.S. that we have freedom of speech. Unless the content we post online is expressly illegal or soliciting a crime, the government can’t punish us for what we say.

My Perfect AI Stock operates in the single largest domestic market in the world. I’m talking about China, a nation of 1.4 billion with its separate intranet protected by what the Chinese government has dubbed the “Great Firewall.”

Nothing is allowed on China’s internet without the state’s approval. So Western internet staples like YouTube, X (formerly Twitter), Facebook, Instagram, and even Google are either inaccessible in China or exist in forms unrecognizable to non-Chinese citizens.

Of course, the Chinese don’t go without those services. They have their own. China has its own versions of YouTube, Instagram, Facebook, etc., and they are just as eager for AI technology as their Western counterparts.

China’s population is larger than the combined population of North and South America. Together the Americas have just 1 billion people between them.

Now, take a Western internet staple, Netflix. Netflix has 282.7 million paid subscribers around the world. The company featured in this report operates the Chinese equivalent of Netflix and has 120 million paid subscribers. With China alone, it’s the fourth-largest streaming service in the world, behind only Netflix, Amazon Prime, and Disney+.

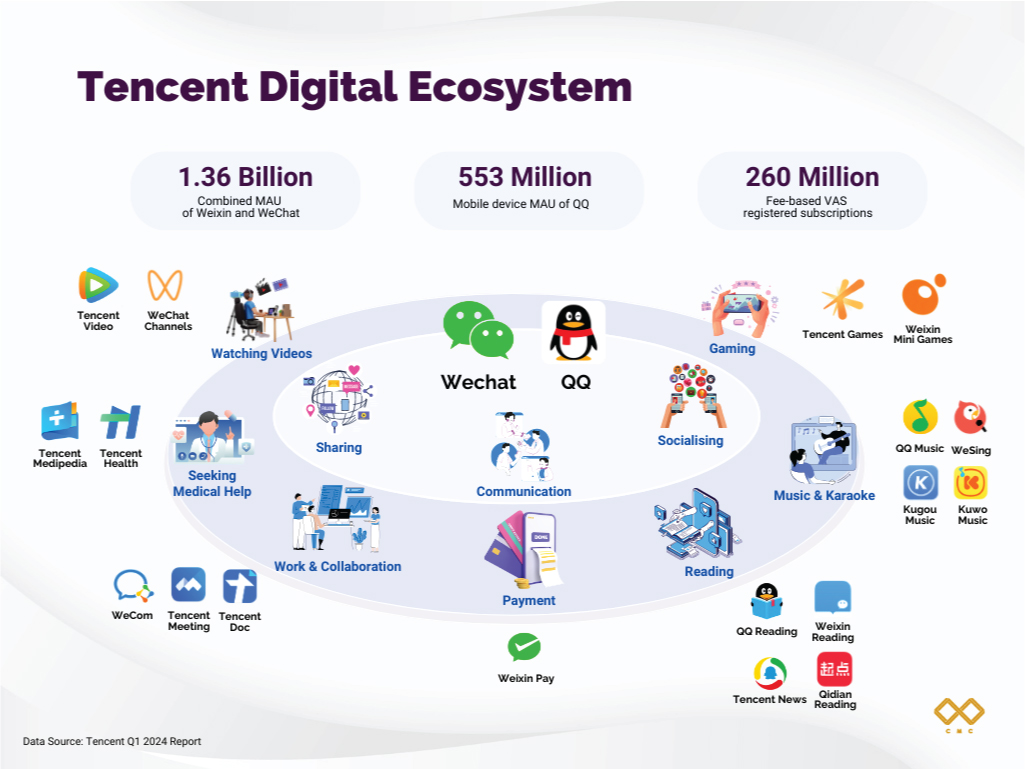

And that’s not all. This company operates the Chinese equivalents of WhatsApp, Google Docs, YouTube, Instagram, and Google Play.

It’s also just as committed to developing AI… and in many ways it’s more advanced than its Western counterparts…

I’m talking about Tencent Holdings (OTC: TCEHY). It’s the biggest company you’ve never heard of… and the best AI stock for the long haul…

The Manchurian Candidate

Based in Shenzhen, Tencent is the premier player in China’s intranet. But it also has an enormous international presence through its investment efforts. It would be easier to list what Tencent doesn’t do, but here’s a very condensed overview.

It operates social media, like WeChat (think a hybrid between WhatsApp and Instagram). It also invests in and produces vast amounts of content through Tencent Games, Tencent Video, and Tencent Pictures.

The company has recently been on a buying spree, scooping up shares of Western game developers, like Riot Games (League of Legends), Epic Games (Fortnite), Ubisoft (Assassins Creed), and Activision Blizzard (World of Warcraft), to name a few.

Tencent operates China’s equivalents of PayPal and Robinhood along with apps for wealth management, loans, and trading around the world. It even has its own web browser, email, and PC manager software, along with the Chinese equivalent of Google Maps.

If those weren’t enough, its Tencent Cloud also serves as China’s version of Amazon Web Services. It’s what China’s smart technology links up with to operate.

Plus… there’s AI. And Tencent is on the bleeding edge of that particular technology.

The company is behind YuanBao, China’s rough equivalent of ChatGPT. It can do what ChatGPT does – hold conversations, create content, etc. – but it’s also linked directly to the social media operated by Tencent.

However, Tencent is aiming far higher than a sophisticated chatbot. It’s currently developing “Tencent Ethereal Audio,” or TEA, in collaboration with Nurotron, one of China’s largest cochlear implant manufacturers.

What TEA does is use a person’s phone to pick up surrounding noise and run it through an AI noise-reduction algorithm. This first layer of refined sound is then transmitted wirelessly to the person’s implant.

Then, the implant further refines the sound and stimulates the auditory nerve with the improved speech or music. In short, it filters out the background noise that normally overloads a cochlear implant’s capabilities.

But that’s far from the only thing Tencent is applying AI to…

As I write, Tencent is working to apply AI to agriculture to improve crop yields while using less land and resources. Before a farmer plants seeds, Tencent’s AI can help select suitable crops by reading and analyzing soil composition.

It can screen the genetic codes of plants to make them taste better while monitoring for insect and disease resistance. It can process satellite imagery more accurately than a human to give farmers better data on weather patterns.

Then, when harvest time comes, the AI can guide a robotic arm to pick, inspect, and package crops. It can then analyze market conditions with big data to maximize a farm’s profits and productivity.

Tencent has also developed an image AI program that integrates with the cloud to support complete images and reduce repeat examinations. A doctor can now upload a patient’s medical images safely to the cloud, where the patient can manage them. That allows doctors to easily share patient data instantly.

The program is called AIMIS and, in addition to the cloud function, it can be used to incubate more medical AI applications. AIMIS Open Lab gives clinicians and tech companies services like data desensitization, access, annotation, model training, and testing.

AIMIS has Tencent positioned to be a leader in medical AI moving forward.

What’s more, investing in Tencent is like buying shares in an AI exchange-traded fund. The company’s venture arm works like Berkshire Hathaway, Sequoia Capital, Y Combinator, and Andreessen Horowitz all rolled into one.

Rather than sitting on the considerable cash reserves it’s built (more on that shortly), Tencent strategically channels $14 billion to $15 billion annually into share buybacks. In addition, it has been on an investing spree. I mentioned the video game companies earlier, but its investments aren’t limited to that space. In all, it has invested in over 800 companies involved in AI, robotics, machine learning, and more.

In particular, the company seems heavily focused on AI drug development. It has invested in both Illumina’s spinoff, Grail, and Aether, both of which use AI to develop drugs and enzymes faster and cheaper than conventional methods. There’s also Emagin, a company using AI to manage water infrastructure. And that’s just to name a few of them. Other investments of theirs you may have heard of are Snapchat and Tile, a Western social media app and Bluetooth tracker, respectively.

Now, you’d probably expect a company this big to have an impressive balance sheet. And you’d be right…

The Beast From the East

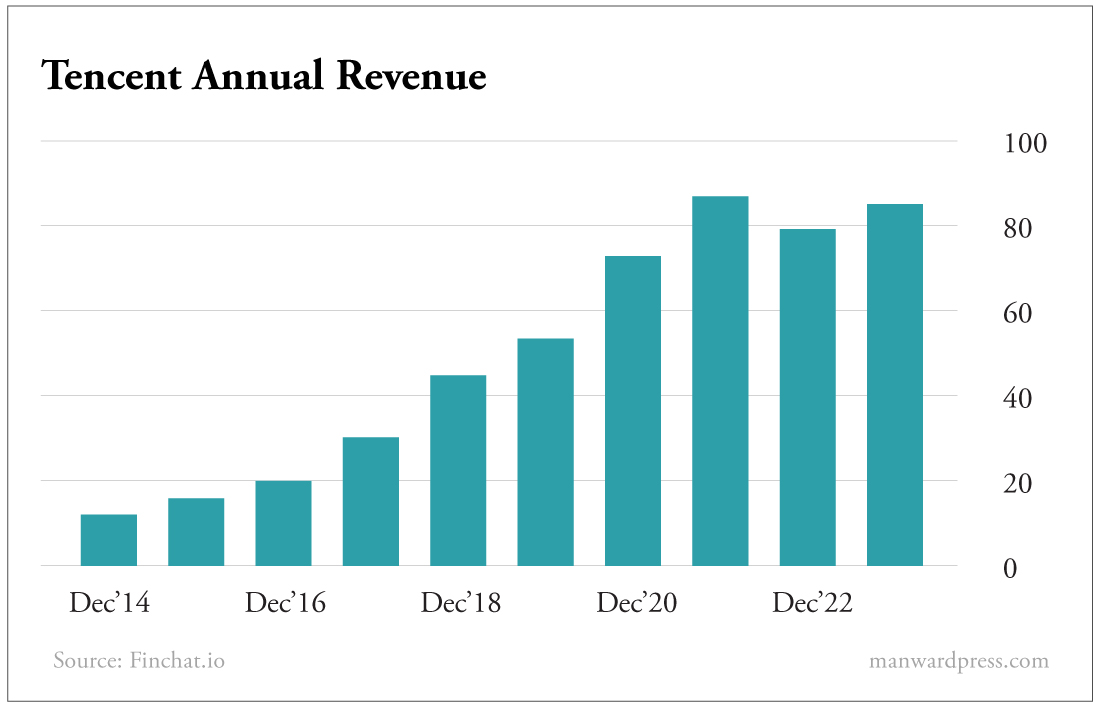

Tencent is nearly as massive as its home country. For 2023, it recorded revenue of US$85 billion, a 10.28% increase over 2022’s. Net income for 2023 topped US$16.23 billion, and gross profits hit US$41.3 billion, up 22.7% over 2022’s. Despite that, the company trades for HK$402.60, or US$51.82.

Compare that with Google’s parent company, Alphabet, the closest thing we have to Tencent. It grew its revenue by 8.68% in 2023 to $307.39 billion but costs $195.65 per share. For a company on this scale, $50 is a bargain. But unlike Google, which has long since entered slow-growth blue chip territory, Tencent still has lots of room to grow. After all, it operates primarily in China and hasn’t expanded too far outside its borders, whereas Google operates worldwide.

In its latest quarter, Q3 2024, Tencent recorded revenues of $23.62 billion, which represents a 7.99% increase over Q3 2023’s. Net income for the quarter topped $7.59 billion, up a staggering 47.12% over Q3 2023’s. EPS for Q3 2024 shot up 50.53% year over year. In addition, it has cash and cash equivalents in excess of $20 billion to fuel its investment efforts and regular share buybacks.

And the good news doesn’t end there. This company is on a long-term growth trend. Over the last 10 years, Tencent has increased its revenue at a compound annual growth rate (CAGR) of 23.98%. Its gross margin stands at 52.28%, and its net margin is 26.4%. To sweeten the deal, Tencent even pays a dividend that yields just shy of 1% at current prices. But it has grown that dividend by 32.33% over the past 10 years.

Despite all of that, this company has no following in America. The CEO rarely gives interviews. Its 10-Ks offer little insight. According to TipRanks, there is only one analyst forecast for Tencent, and it has just a few thousand followers.

Compare that with Microsoft, which is covered by 47 analysts and has 134,000 followers, Nvidia, which is covered by 47 analysts and has 173,000 followers, and Apple, which is covered by 38 analysts and has 207,000 followers. But that all could change as early as next quarter if the company announces a share buyback on its next earnings call.

If that happens, a horde of investors will pour in and drive Tencent into the mainstream… And you’ll ride the stampede of investment to massive profits because you bought it for $50.

Recent News

Now, it’s crucial to understand some recent developments that may affect Tencent’s near-term price action – and potentially create an even more attractive entry point for us.

In January, the U.S. Department of Defense added Tencent to its list of “Chinese Military Companies.” This announcement initially rattled markets, with Tencent’s Hong Kong shares falling more than 10%.

But there are several important points for investors to understand…

This designation specifically affects DoD procurement – it prevents the Department from purchasing goods or services from listed companies.

Crucially, this is NOT the OFAC (Office of Foreign Assets Control) list, which means…

- U.S. investors can still invest in Tencent.

- The stock remains eligible for inclusion in global indexes.

- No divestment is required by U.S. investors.

This situation isn’t without precedent. Chinese technology company Xiaomi faced a similar challenge in 2021 when it was added to the OFAC list (which is actually more restrictive than the current CMC listing).

Here’s what happened next….

- Xiaomi immediately engaged with the DoD.

- When initial engagement failed, they successfully challenged the designation in U.S. court.

- The company was removed from the list within five months.

- The stock fully recovered after the initial decline.

Tencent has already stated it will engage with the DoD to address what it believes is a mistaken classification. Given that Tencent primarily derives revenue from gaming, social media, and fintech – with no clear military applications – it has a credible case for appeal.

An Even Better Opportunity

This regulatory headline risk has created an interesting dynamic…

Short-term focused investors have sold positions, creating price pressure.

Meanwhile, both Tencent itself and mainland Chinese investors have been aggressive buyers. Tencent purchased 15 million shares following the DoD announcement… and mainland investors bought $1.8 billion worth of shares in a single day through China’s “Stock Connect” program

This divergence between short-term trading pressure and strong fundamental buying support could create an attractive entry point for investors getting in now.

Several factors suggest this regulatory challenge may actually strengthen the investment case:

- The company’s massive cash position ($20+ billion) provides ample resources to navigate any regulatory challenges.

- The selling pressure is largely technical rather than fundamental.

- There’s a clear pathway to resolution through either administrative appeal or legal challenge.

- The company’s core businesses remain unaffected by the designation.

- Previous similar cases have been resolved favorably for investors.

When combined with the growth potential and valuation metrics we’ve looked at… this temporary pressure on the stock price may provide an even more attractive entry point.

Now, the symbol you’ll be using to buy Tencent isn’t the one on its native exchange in Hong Kong, SEHK-700. No, you’ll be buying the ADR, or American depositary receipt, which trades under TCEHY.

(Note: Many companies have an equivalent asset whose symbol varies. For instance, in Germany Tencent’s equivalent symbol is NNND:GR, in France it’s NNND:FRA, and in the U.K. the symbol is OLEA.L.) If you have any concerns, speak to your broker, but investors outside the U.S. should be able to find a local equivalent to the ADR.

An ADR is issued by an American bank and represents shares in a foreign company for trade on American exchanges. It’s how you go about owning shares of foreign companies that don’t trade on American exchanges normally. Sometimes a single ADR represents multiple shares of the foreign company, but in Tencent’s case, it’s 1-to-1. That means each ADR represents one share of Tencent. (And you can find the ADR as you would any other stock. Robinhood carries it, and so does Charles Schwab.)

At present, the ADR trades for $52.21, which is a little higher than the price in U.S. dollars on the Hong Kong Exchange, but there will always be a discrepancy when currency exchanges are factored in. For all intents and purposes, though, the ADR is a share in Tencent…

What I’ve shared in this report isn’t about chasing short-term gains on some hype stock.

It’s about aligning your financial future with the unstoppable force of progress.

And right now this stock is like a coiled spring…

This quarter, I believe a major new announcement could send the stock rocketing… Some of the world’s top investors are starting to back up the truck. Just recently, one of Charlie Munger’s close associates, reclusive Chinese American billionaire Duan Yongping, revealed an aggressive plan to invest $4.4 billion in Tencent.

Your timing is perfect.

A study from Harvard Law School found that when an announcement like this happens, the stock typically outperforms its peers for the next four years…

A study of 9,000 similar announcements showed significant short-term and long-term excess returns when similar announcements have happened in the past…

This is a rare second chance for you to position yourself long term in a company that’s quietly shaping the future and is so under the radar it is trading at up to an 84% discount to better-known AI companies.

It’s like Amazon in 2001… or Bitcoin in 2008… or Tesla in 2014…

If I could pick only one stock for you to buy and hold over the next two to three decades, it would be “The Perfect AI Stock.”

Action to Take: Buy Tencent Holdings ADR (OTC: TCEHY) at market. Set a 25% trailing stop to protect your principal and your profits.

Note: We’ve found that readers tend to buy the stocks in these special reports at different times. Keep in mind that we may have taken profits or stopped out of a recommendation by the time you read this report. Please refer to the current portfolios for the most up-to-date recommendations.

© 2025 Manward Press | All Rights Reserved

Nothing published by Manward Press should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investment advice. We allow the editors of our publications to recommend securities that they own themselves. However, our policy prohibits editors from exiting a personal trade while the recommendation to subscribers is open. In no circumstance may an editor sell a security before subscribers have a fair opportunity to exit. The length of time an editor must wait after subscribers have been advised to exit a play depends on the type of publication. All other employees and agents must wait 24 hours after publication before trading on a recommendation.

Any investments recommended by Manward Press should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Protected by copyright laws of the United States and international treaties. The information found on this website may only be used pursuant to the membership or subscription agreement and any reproduction, copying or redistribution (electronic or otherwise, including on the world wide web), in whole or in part, is strictly prohibited without the express written permission of Manward Press, 14 West Mount Vernon Place, Baltimore, MD 21201.

January 2025.