The Bankruptcy Watch List: Six American Icons on Suicide Watch

Make no mistake – we’re in the middle of a financial crisis. The coronavirus pandemic has already erased trillions of dollars of market value from the global economy.

Governments around the world ordered their citizens to stay indoors. Social distancing is the new normal. The markets are in a constant state of flux, shooting up 5% one day and going down 5% the next.

Across the country, people saw their savings wiped out in a matter of weeks.

The consequences are widespread. We’re facing a devastation unlike anything we’ve seen before. And while a stimulus-fueled recovery will help some businesses bounce back… not all will survive. Just like we saw in 2008, many of them will go bankrupt… and some of them will be American icons.

Either they’re operating in industries that have become obsolete and irrelevant or their business models are inherently flawed. Some are poorly managed or are drowning in debt…

This pandemic is going to cull the herd of weak companies that were hanging on only due to the strength of the economy around them.

Here are the six American icons that are unlikely to make it. You should drop these stocks and put your money to work in stronger companies fit to survive and thrive in the post-COVID-19 economy.

The Bigger They Are, the Harder They Fall

General Electric (NYSE: GE) is an American business icon. Founded in Boston in 1892, it’s one of the oldest companies on the market today.

But it has not weathered this new century well. Its stock peaked in January 2000 at about $55. Since then, it’s been in a downward trend despite recoveries here and there. Today it routinely trades for less than $10.

GE is facing several problems that will hamper its ability to survive the coronavirus pandemic. Chief among them are its crushing debt, the slowdown of industry due to the coronavirus and the crippling of the airline industry.

First, the debt. GE is drowning under $82.4 billion of it. That’s nearly as much as its total revenue for 2019… which is declining by 2% year over year.

Things have been going in a bad direction for GE for a while. Last year, it had to sell off its entire biopharma division for $21.4 billion… and that didn’t put much of a dent in the company’s debt.

Second, the slowdown of industry. The coronavirus pandemic threw a wrench in the works of manufacturing the world over. It’s starting to recover in many places, but the virus is still slowing everything down.

The slowdown first occurred in China, where manufacturing activity plummeted as the coronavirus spread at the end of 2019. The U.S., Europe and Japan weren’t be far behind.

Finally, there’s the airline industry. As countries went into lockdown, air travel more or less stopped for all but the most essential purposes. Companies like Boeing (NYSE: BA), American Airlines (Nasdaq: AAL) and Southwest Airlines (NYSE: LUV) have all seen their share prices plummet as demand for flights and new planes has hit rock bottom.

Like manufacturing, air travel is starting to recover… slowly.

But I don’t think the recovery will come fast enough to save GE. Aviation makes up about 30% of its revenue – more than any other sector the company operates in. The company has already had to lay off 10% of its critical jet engine workforce.

So here we have a heavily indebted company that already has declining revenue and relies on an industry that’s rapidly crashing and burning. You’re better off putting your money to work elsewhere.

A Poor Sportsman

Along with parties, travel, concerts and movies, most sports were also canceled due to the coronavirus pandemic. And not just professional sports. With the move to online learning, high school and college sports have taken a hit.

That’s especially bad for Dick’s Sporting Goods (NYSE: DKS), which has lost a third of its share value since the start of 2020. Like GE, Dick’s is heavily indebted and suffering from being a part of a struggling industry.

The debt is bad, but believe it or not, it’s not the worst of it…

Dick’s has nearly $5 billion in debt between its short- and long-term liabilities, compared with just $69 million in cash. If you throw in every asset the company has, it can just barely pay its bills with $6.6 billion.

Its net sales have stagnated. Net income is down by $22 million. And the company is still taking on debt, according to Bloomberg. It has $3.1 billion in debt, 51 times the debt it carried in 2019, which was a paltry $60 million. Worse, its competition is making paying its bills even more difficult.

Amazon (Nasdaq: AMZN) was already bringing about the slow death of most physical retail stores before there was a deadly virus keeping most people at home. The virus has just accelerated that process.

Big department stores, like Target (NYSE: TGT) and Walmart (NYSE: WMT), are weathering the pandemic about as well as the broader market and have both begun to stabilize. In addition to having a broad range of products gathered in one place, both stores have expanded into food, pharmacy services and even health clinics.

But specialized retail stores, like Dick’s and GameStop (NYSE: GME), for example, are hurting and are unlikely to survive the pandemic. Dick’s couldn’t expand into diversified products and services even if it wanted to. It simply lacks the resources.

Dick’s is too indebted, and it has too much of its market share gobbled up by department stores and online competitors that carry the same sorts of products at lower prices and offer greater convenience.

Sell Dick’s and put your money into a retailer – either physical or online – that has the foresight and the resources to adapt to an ever-changing market.

Coughing and Sputtering Out of the Mine

Since peaking at $2,485 per ton in April 2018, the price of aluminum has been sliding. It was in a steady decline until the start of this year. From January to May 2020, the price of aluminum was in free fall, plummeting from roughly $1,800 per ton to just $1,499 per ton. Today, the price has rebounded from its low earlier this year, but it’s still down considerably from that 2018 peak.

And while all aluminum companies are hurting, Alcoa (NYSE: AA) has been affected the most out of the large aluminum producers.

Last year, Alcoa’s sales were down $3 billion over 2018. In 2019, it also took a $1.5 billion loss compared with 2018’s $250 million in net income. Bloomberg projects the company’s 2020 revenues will either break even with 2019 or decline again. The company also has more than $1.8 billion in total debt, compared with just $897 million in cash and cash equivalents.

In short, the company was already on the ropes before the COVID-19 pandemic and the market crash. Those have only exacerbated the company’s problems, and it’s not setting itself up for recovery and long-term profit either.

Over the next five years, Alcoa will be divesting itself from a number of its assets, which will lower its production. When aluminum prices recover, which some say won’t be until 2022, it will be too late. Alcoa will lose out to Rusal and Rio Tinto (NYSE: RIO). Both companies will gobble up its market share and further cripple its ability to recover.

So, in Alcoa, we have a heavily indebted company with shrinking revenues that is divesting itself of the means to recover those revenues. This one is better avoided.

Something’s Rotten in the Kingdom of Magic

This one may be tough to handle. Few companies are as iconic as The Walt Disney Company (NYSE: DIS).

From the outside, it seems like an unstoppable media juggernaut. But look a little deeper, and you can see sleight of hand behind that Disney magic.

Disney is iconic. Its films, theme parks, cruises and TV shows have shaped American childhoods for the better part of a century. Whether you were born in 1943, 1993 or even 2003, odds are you have some fond memories of a Disney product.

However, the media landscape is changing, and Disney was slow to respond to that change. It’s currently being kept afloat by a streaming service that can’t compete with other companies’ streaming services, as they deliver more bang for their customers’ buck. For the past few years, Disney’s revenue has been fairly stagnant, hovering between $55 billion and $60 billion annually.

It enjoyed a significant spike last year because of the launch of Disney+. Revenue leapt to $69 billion.

But that growth is unsustainable for two reasons. One, its competition is simply too strong. And two, the financial uncertainty we’ve been experiencing will prevent Disney from catching up to the existing streaming juggernauts…

Netflix (Nasdaq: NFLX) is the reigning king in the world of online TV and movie streaming. Amazon comes in second place.

Other services, like Apple TV and HBO Go, don’t even hold a candle to what they offer. Disney+ is the only real competition either has had in years, aside from each other, of course.

Let’s start by describing what Disney+ offers. Disney+ is the cheapest service at the moment, with the standard subscription costing $6.99 per month. It will add in Hulu and ESPN+ for $12.99 per month.

For the standard $6.99, you gain access to 7,000 episodes of various TV shows and 500 movies. You get a seven-day free trial as well. However, it’s available in only 13 countries at the moment.

That pales in comparison to Netflix, which offers 47,000 episodes of TV shows and 4,000 movies for $8.99 per month. It’s available in more than 190 countries.

Amazon offers prime subscriptions for $12.99 per month. Video-only subscriptions match Netflix’s $8.99. Amazon Prime Video is available in more than 200 countries and offers 17,000 movies, not to mention thousands of TV episodes.

Netflix and Amazon also offer more variety than Disney+. They have everything from comedy and documentaries to fantasy and sci-fi. Disney+ offers only its own shows and movies, Marvel productions, the Star Wars franchise, and National Geographic shows.

So Disney’s service offers vastly less content than the competition at only a slight discount. And it won’t be catching up to Netflix and Amazon anytime soon…

Both Netflix and Amazon have used their head start to build a stable of hit original shows while there was plenty of money out there for them to take risks.

Further, Disney’s brand is limited in scope. It’s aimed squarely at families with young children, while Netflix and Amazon have more mass appeal.

In short, Disney came too late to the streaming game. Both Netflix and Amazon offer far more bang for the buck, and in the potential recession we’re heading toward, that will matter more than ever.

So while Disney looks strong on paper, it won’t be able to measure up to its streaming rivals when the belt-tightening really starts. Netflix and Amazon offer more and have larger subscriber bases than Disney+.

Empty Theaters, Empty Pockets

One silver lining of the coronavirus crash, for investors at least, is that it’s going to show us which companies are genuinely good investments and which ones were just being propped up by the incredible economy of the last four years.

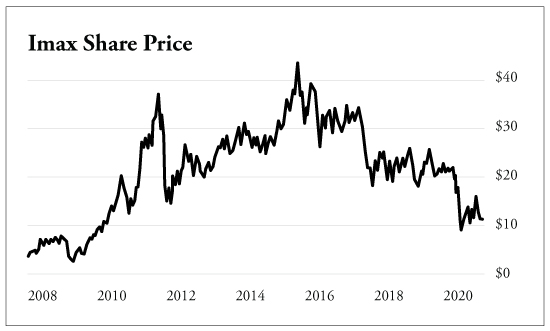

Imax Corp. (NYSE: IMAX) is one such company that has been propped up. Streaming services, as well as on-demand movies at home, have been disrupting the movie theater industry for years now.

They’re not only cheaper than going to a movie theater, but also more convenient. The main reason most folks go to a theater these days is nostalgia. But frivolous spending like that is going to go away in a potential recession. People will be looking to get the most bang for their entertainment buck.

Imax was already feeling pressure before the coronavirus hit. The company holds $300.3 million in debt as of the third quarter of 2020. It’s treading water with just $305 million in cash and cash equivalents. But all the lockdowns and quarantines due to COVID-19 have been hitting the broader film industry hard… and theaters even harder. Bloomberg projects Imax’s 2020 revenue will plummet to $128.8 million, less than one-third of its 2019 revenue.

Nearly every theater shut down in the months immediately following the start of the COVID-19 pandemic. It cost the world box office billions of dollars in missed revenues.

Since then, some movie theaters have reopened at partial capacity while some remain closed. As it turns out, an industry that relies on many people packed into a tight enclosed space is particularly vulnerable to pandemics.

Further, the industry relies on global travel to film in various locations. With air travel being strangled, so too is the film industry’s ability to create movies.

While Hollywood production companies have billions of dollars to play with and can afford to wait, your average franchised theater, Imax’s usual customer, doesn’t.

No theater is going to shell out the cash for a brand-new Imax screen when it’s struggling to survive.

The movie theater industry was already being disrupted by digital distribution. The virus will only accelerate that trend.

Imax is nearly back down to where it was in 2009. It’s been in a downward trend since 2015. That trend is likely to continue as digital movie services further dominate the industry. Dump it while you can.

Going the Way of the Drive-In

Just like gyms, commercial real estate and other industries that rely on customers’ physical presence, the movie theater industry is going to suffer even worse than the broader market from this pandemic.

The fate of the entire movie theater industry has, for the past several years, hinged on the 90-day period of exclusivity on new releases. Streaming services like Netflix and on-demand movie services from providers like Comcast and Verizon can’t release new films for the first 90 days after their release.

That has kept the theater industry afloat for the past decade or so. Companies like Cinemark (NYSE: CNK) have been able to tread water at more or less stable share prices for a decade.

However, the longer the pandemic drags on, film companies desperate to release their movies and recoup what they spent to make them may look to change or eliminate this agreement.

Disney and NBCUniversal have already started doing direct-to-customer releases online. Disney released Frozen 2 on Disney+ months early, and NBCUniversal threw the 90-day exclusivity period out the window for its film The Invisible Man.

That will likely open the floodgates as film production companies sacrifice the theater industry to save themselves. Cinemark operates hundreds of movie theaters in the U.S. and Latin America. Those screens no longer have people in front of them, and soon, the companies that own those screens will have to compete with the likes of Netflix and Amazon on even terms.

While theaters will likely survive as a novelty like some drive-in theaters have, the industry is all but doomed to shrink. Drive-in theaters have enjoyed a bit of a resurgence. Still, even if the 90-day exclusivity period is maintained in some form, there’s simply too much risk in this industry.

You’re better off dumping companies like Cinemark and putting your money elsewhere. Look at film production companies and streaming services.

The Sick Men of the Stock Market

COVID-19 has thrown the markets into turmoil. Not every company is going to survive. The six in this report will not weather this pandemic even as the broader economy recovers.

Though some of them once looked invincible, that’s no longer the case…

Ditch them if they’re in your portfolio and put your money to work in the companies setting themselves up for a post-pandemic takeoff.

Note: We’ve found that readers tend to buy the stocks in these special reports at different times. Keep in mind that we may have taken profits or stopped out of a recommendation by the time you read this report. Please refer to the current portfolios for the most up-to-date recommendations.

© 2025 Manward Press | All Rights Reserved

Nothing published by Manward Press should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investment advice. We allow the editors of our publications to recommend securities that they own themselves. However, our policy prohibits editors from exiting a personal trade while the recommendation to subscribers is open. In no circumstance may an editor sell a security before subscribers have a fair opportunity to exit. The length of time an editor must wait after subscribers have been advised to exit a play depends on the type of publication. All other employees and agents must wait 24 hours after publication before trading on a recommendation.

Any investments recommended by Manward Press should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Protected by copyright laws of the United States and international treaties. The information found on this website may only be used pursuant to the membership or subscription agreement and any reproduction, copying or redistribution (electronic or otherwise, including on the world wide web), in whole or in part, is strictly prohibited without the express written permission of Manward Press, 14 West Mount Vernon Place, Baltimore, MD 21201.

November 2020.