Powerhouse Combo: Crypto and AI Combine to Create 2024’s Hottest Play

Crypto has been on an incredible run over the past year.

And that’s surprised a lot of people. After a chaotic 2022 that saw Bitcoin crash 75%… many altcoins fall 95%… and the world’s second-largest crypto exchange turn out to be an elaborate fraud… many people thought crypto was dead.

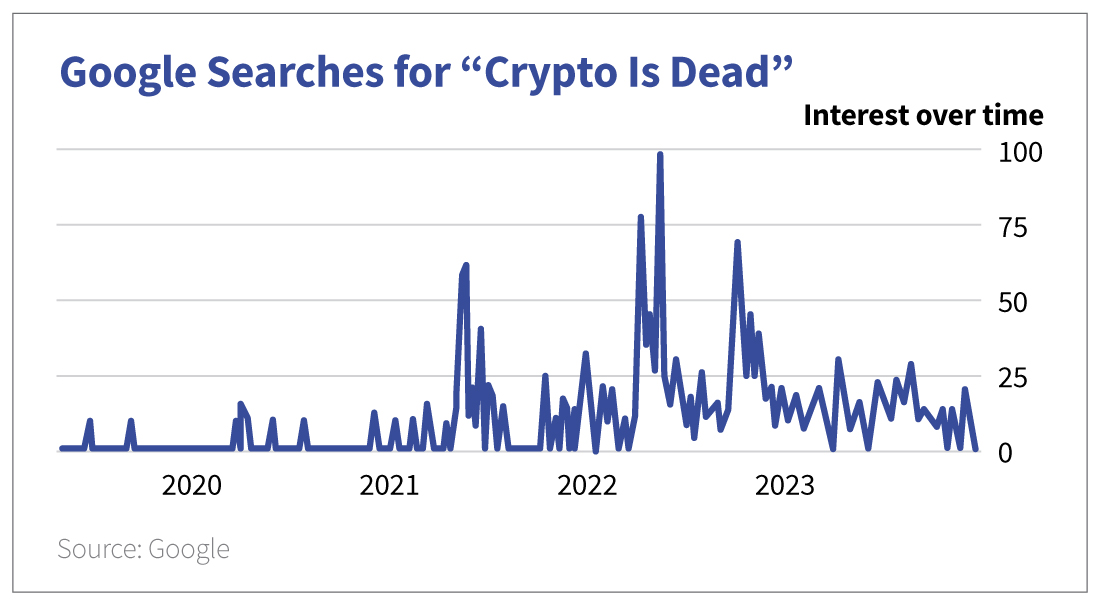

This isn’t an assumption on my part. Google search data for the phrase “crypto is dead” hit a four-year high in June 2022…

Even many analysts and “experts” believed crypto was history after the last cycle.

But the typically volatile industry proved the doubters wrong once again.

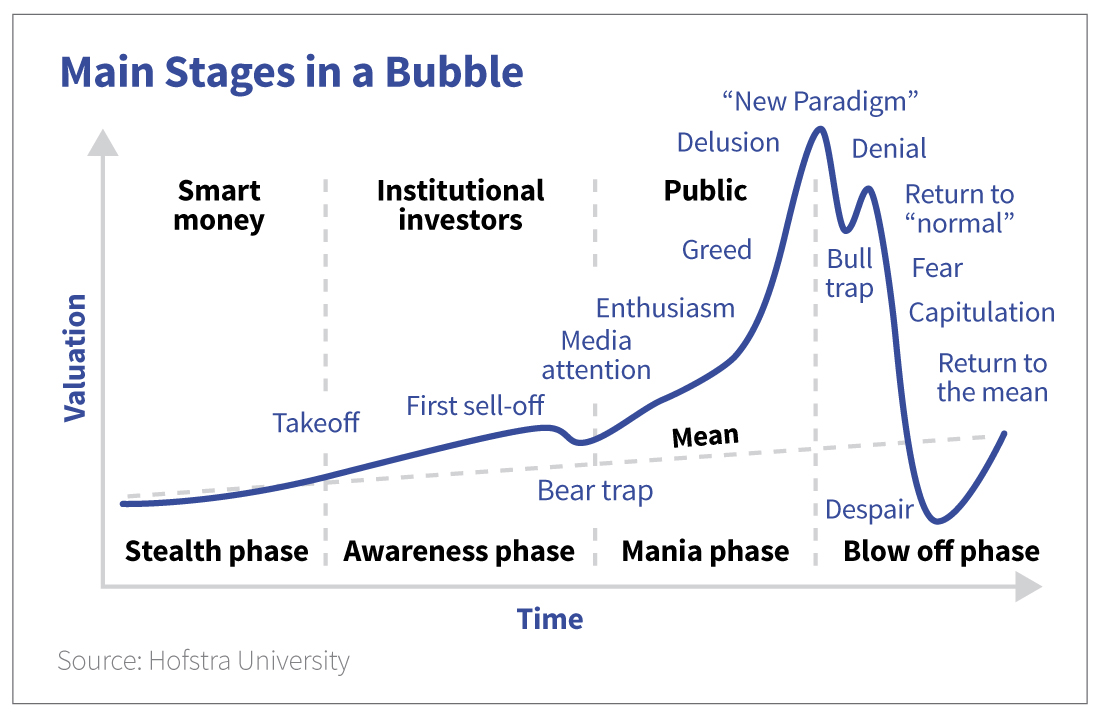

The truth is, volatility is a feature of the crypto market, not a bug. It makes crypto one of the most predictable financial markets on the planet.

I know that may come as a surprise to you. But each cycle, the crypto sector follows a very similar pattern. And it’s about to enter one of the most lucrative parts of the cycle. I expect the entire asset class to have a great 2024. But there’s one crypto “subsector” that should be on every investor’s radar.

The “Early” Crypto Cycle Is Over

Back in April 2023, I wrote to my investing community…

I’ve invested in bitcoin since 2017. I wrote about my experience investing in the crypto space in my 2022 book A Beginner’s Guide to High-Risk, High-Reward Investing. Based on my background, I’d say we’re currently near the start of a new market cycle.

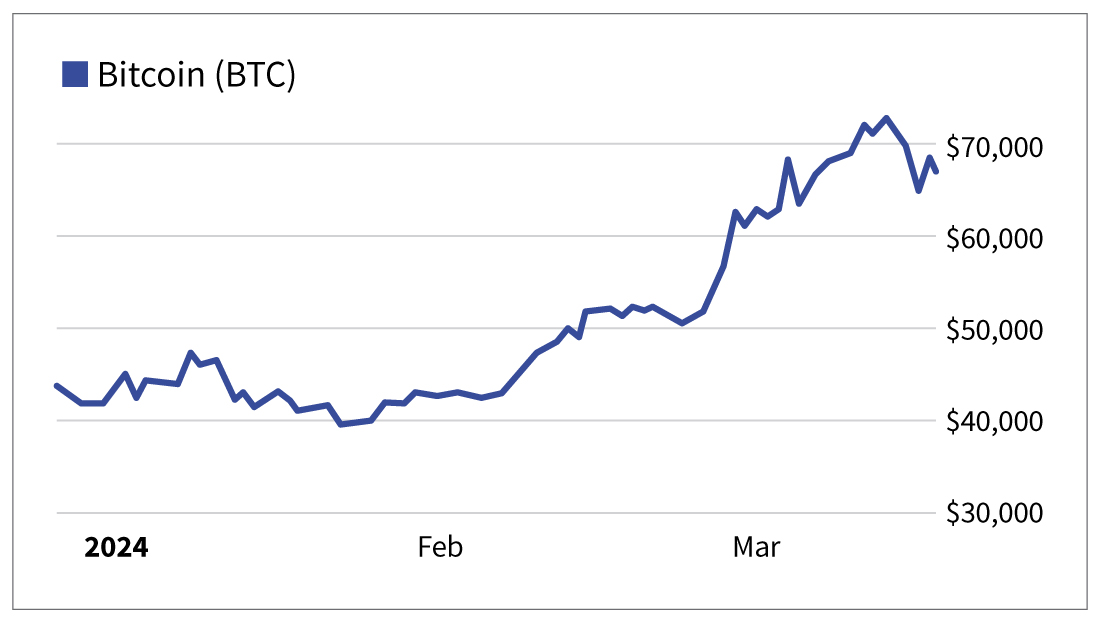

This analysis proved prescient, as Bitcoin is up nearly 200% since and many “altcoins” – cryptocurrencies other than Bitcoin – are up 1,000% or more.

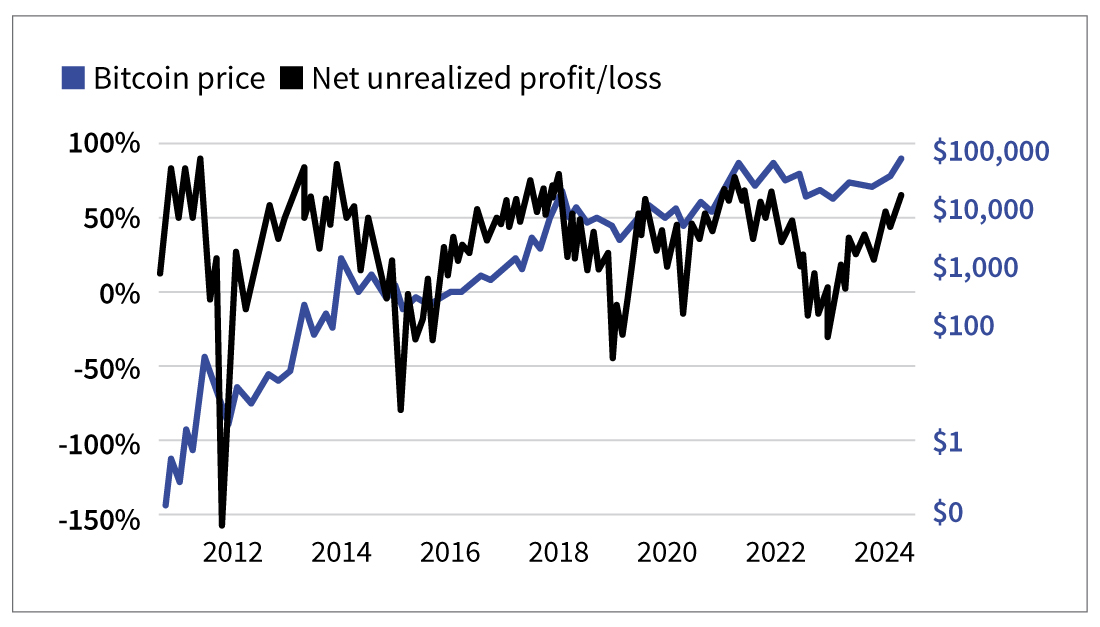

But there are signs we’re now moving into a “midcycle” for crypto. First, my favorite buy indicator for crypto – net unrealized profit/loss – is now at 64%…

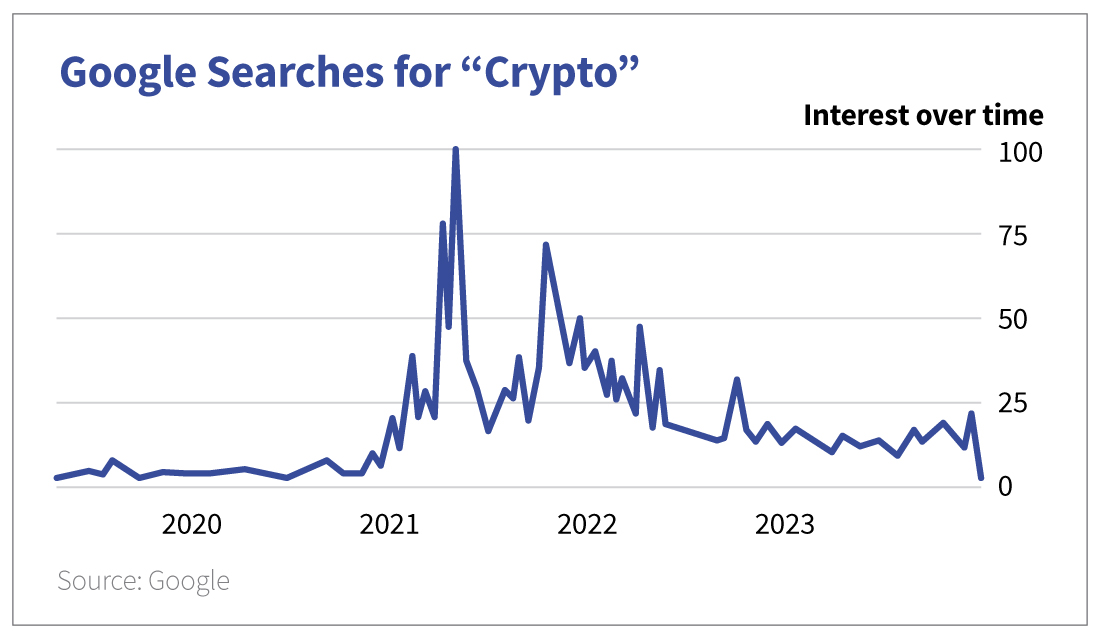

And since a net unrealized profit/loss reading of 75% marks the high for each cycle, this indicator says the bull is no longer a spring chicken. Some upside remains, as Google searches for “crypto” are still near cycle lows…

That means retail investors have yet to pile back into the crypto market. In addition, social media sentiment for crypto is still mostly negative. That also points to further upside in this bull cycle.

Even so, the evidence points to the early part of the cycle being behind us. Bitcoin put in a new all-time high in mid-March, trading as high as $72,000 per coin.

We’re also seeing celebrities begin to talk about crypto again, including musician Drake posting clips of Bitcoin evangelist Michael Saylor…

And Elon Musk discussing Dogecoin at a recent Tesla event…

These “sentiment data points” start to crop up when we’re nearing the middle – or are already in the middle – of a crypto cycle. If that’s the case, we’ll want to start adding “speculative” positions before we enter crypto’s alt season.

And cryptocurrencies focused on the AI sector will likely see the strongest tailwinds.

First Ethereum, Then AI

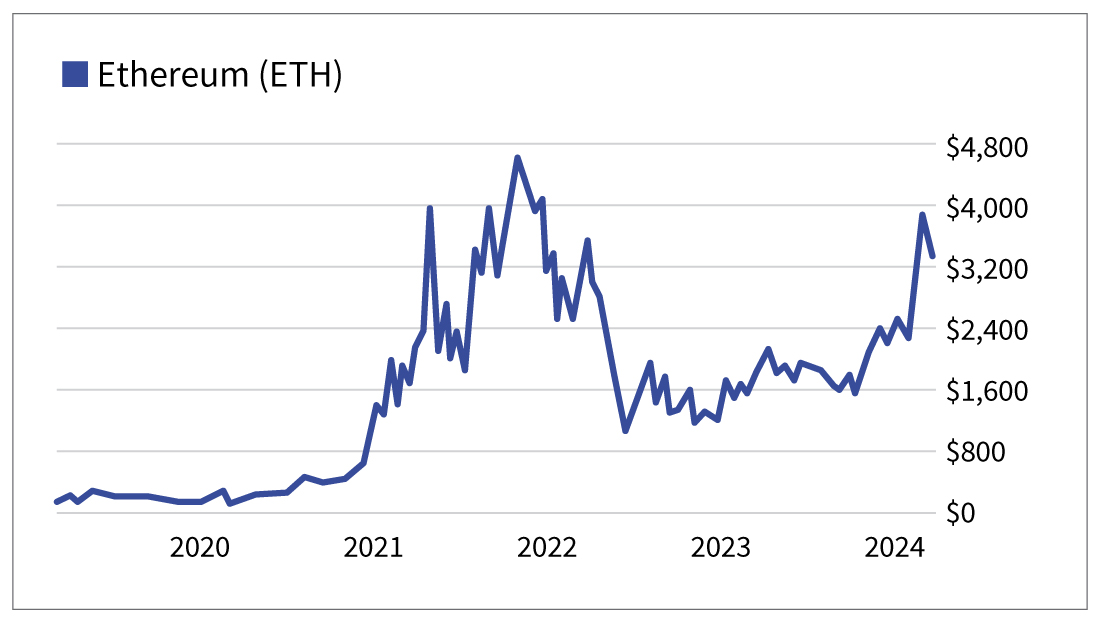

Something interesting happens when a crypto bull run moves from “early cycle” to “midcycle.” Bitcoin typically starts to consolidate, with prices grinding sideways for many months. This causes those who made money on Bitcoin in the first part of the cycle to diversify away from Bitcoin and into other large altcoins, like Ethereum (ETH).

From there, we usually see Ethereum hit a new all-time high, which looks to be right on schedule, as the world’s second-largest cryptocurrency is only 26% below its previous high.

Once Ethereum hits a new high, we’ll see the kickoff for alt season. That is when money flows from these larger altcoins into smaller, niche tokens.

I expect many alts to do well. But the best performers will be the ones that combine AI and blockchain technology.

A Powerhouse Combo

AI tokens, or cryptocurrencies that fuel AI projects and platforms, stand to benefit immensely from this next phase of the bull run. AI and blockchain are like peanut butter and jelly for the tech world – separately great… but together a powerhouse combo.

Blockchain provides a secure, transparent ledger that can enhance AI’s capabilities, particularly in data management and decentralization.

In turn, AI can optimize blockchain operations, making them smarter and more efficient. This synergy is what makes AI tokens incredibly promising.

AI, with its capacity to sift through mountains of data and unearth insights, and blockchain, a bastion of security and transparency, are not just complementary…

They’re a match made in tech heaven.

Consider the mutual benefits…

Blockchain provides a tamper-proof ledger, making it an ideal platform for the massive amounts of data AI needs. It ensures integrity and fosters trust.

At the same time, AI enhances blockchain’s efficiency by tackling complex problems and optimizing operations.

There are a few clear applications for this technology.

First, AI can analyze vast amounts of blockchain data to optimize DeFi (decentralized finance) protocols. That will help reduce risks and enhance returns for users.

AI can predict market trends and detect fraudulent activities, making DeFi platforms more secure and efficient. That will lead to smarter lending, borrowing and trading within the blockchain ecosystem.

Second, combining AI with blockchain technology can revolutionize supply chain management by providing real-time, transparent tracking of goods and materials. AI algorithms can predict supply chain disruptions and optimize logistics based on historical data and real-time inputs. All this data will be securely recorded on a blockchain, ensuring its integrity.

Lastly, the blockchain can securely store sensitive healthcare data.

In turn, AI can analyze this data for better patient outcomes. Together, they can enable personalized medicine… securely and efficiently manage patient records… and ensure the accessibility of medical data across institutions, enhancing both research and treatment options.

The synergy between blockchain and AI amplifies the strengths of each.

The combination promises a future in which decentralized, intelligent systems redefine our digital landscape. And the investment case for these AI tokens is compelling.

Keep Your Eyes on the Prize

Projects at the intersection of AI and blockchain are not mere speculative ventures. They are at the forefront of tech’s next leap.

As these technologies mature and intertwine, they pave the way for innovations that could transform industries like finance and healthcare.

All would become more secure, efficient and inclusive.

This dynamic will be sure to benefit a handful of top AI tokens. Those include Fetch.ai (FET), which leverages blockchain data to create an AI network for task automation. The project aims to integrate everyday data collectors into a network that can be used to optimize various real-world operations, such as analyzing traffic patterns.

There are a handful of other projects in this AI crypto basket, including NEAR Protocol (NEAR), Render (RNDR) and Bittensor (TAO). And since projects like Fetch.ai and Render use the Ethereum blockchain, Ethereum is an indirect way to play the AI token boom as well.

As we edge closer to the thrilling phases of the crypto cycle, with AI tokens gearing up to lead the charge, it’s evident we’re on the verge of a significant shift.

As history has shown, early adopters in transformative tech sectors often reap the best rewards.

With AI and blockchain proving to be a formidable duo, we’re looking at an exciting era for investors willing to dive into AI crypto tokens.

Whether it’s Fetch.ai’s ambition to streamline real-world operations or Render’s potential to revolutionize digital content creation, these projects symbolize the next frontier in technological advancement.

For those paying attention, it’s not just an opportunity for profit.

It’s a chance to be part of the next technological revolution.

As Jesse Livermore said, “It’s a bull market, you know.” But this time, it’s not just any bull market. It’s one supercharged by the transformative potential of AI and blockchain combined. And I intend to ride this bull market higher.

Note: We’ve found that readers tend to buy the stocks in these special reports at different times. Keep in mind that we may have taken profits or stopped out of a recommendation by the time you read this report. Please refer to the current portfolios for the most up-to-date recommendations.

© 2024 Manward Press | All Rights Reserved

Nothing published by Manward Press should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investment advice. We allow the editors of our publications to recommend securities that they own themselves. However, our policy prohibits editors from exiting a personal trade while the recommendation to subscribers is open. In no circumstance may an editor sell a security before subscribers have a fair opportunity to exit. The length of time an editor must wait after subscribers have been advised to exit a play depends on the type of publication. All other employees and agents must wait 24 hours after publication before trading on a recommendation.

Any investments recommended by Manward Press should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Protected by copyright laws of the United States and international treaties. The information found on this website may only be used pursuant to the membership or subscription agreement and any reproduction, copying or redistribution (electronic or otherwise, including on the world wide web), in whole or in part, is strictly prohibited without the express written permission of Manward Press, 14 West Mount Vernon Place, Baltimore, MD 21201.

October 2024.