Special Report

Nvidia’s Secret Partner: This Single AI Stock Could Help Fund Your Retirement

Artificial intelligence has changed nearly everything: how we write and learn… how we do business… how we practice medicine and make drug discoveries… and how we interact online. And it’s likely only going to get faster and smarter.

But not if it can’t solve one serious problem. Fortunately, one small, unknown company has the solution… and its shares will soar into the stratosphere once its partnership with the biggest chipmaker in the world goes public.

This company – “Nvidia’s Secret Partner” – is positioned just like startups Microsoft and Apple were back in the early stages of the internet.

And I want to tell you about this opportunity now to make sure you get in early and don’t miss the biggest innovation I’ve seen in decades…

The speed of technological growth over the last century is positively mind-blowing.

In 1924, not too many people drove cars. Most folks got around on horseback… or simply walked.

Fifty years later… we had put a man on the moon.

And think about this… When NASA achieved that lunar mission, it had less computing power at its fingertips than you have in the smartphone in your back pocket.

And that’s all thanks to one single innovation… the semiconductor chip.

All of our modern technology – including AI – is made possible by semiconductor chips.

But AI is already operating at the limits of the chips we use today… and that’s why the company in this report is so critical.

Solving an Industry Weakness

The thing that makes semiconductors work is in the name.

Semiconductors are halfway between an electric conductor, like copper, and a resistor, like rubber. They allow computers to become both smaller and more powerful.

They also heat up as they conduct electricity. This makes them useful for computing processes.

But it’s a weakness for tech as powerful as AI and its generative large language models. AI needs a huge number of semiconductor chips to run. That generates a vast amount of heat. Too few chips, and the AI will fry its hardware.

Because of that, an AI’s “brain” is made up of many semiconductor-based chips – such as GPUs (graphics processing units) and CPUs (central processing units) – linked together to share the load of running complex AI programs.

To keep up with the powerful needs of AI, Nvidia has just announced a new generation of AI chips. Its new, ultra-powerful Blackwell chip will be built out in AI chip GPU clusters. Blackwell promises to perform up to 30 times faster than Nvidia’s current AI chips… and with 25 times better energy consumption.

There is only one company that has built new technology that can connect all the chips in these clusters. This technology allows the AI to operate properly so it doesn’t overheat and fry its hardware.

In addition, this company’s technology has doubled the data transfer rates and cut energy usage in half.

Simply put, the Blackwell chip that the world’s largest tech companies are banking their futures on… wouldn’t be possible without this company’s product.

And it’s exactly why Nvidia (and many other companies working on AI projects) teamed up with who I’m convinced will be the next blockbuster tech company: Astera Labs (ALAB)… a company essential for the success of next-gen AI chips.

An AI Pick-and-Shovel Play

There’s no denying Nvidia makes solid GPUs… the chips that many AI programs rely on. It’s the reason it’s the most important company in the world right now.

But an AI program needs far more than one GPU to form its brain. And the linking hardware Astera makes helps create the best brain for AI applications.

You can think of these links as neurons in a biological brain… Astera’s neurons transmit larger quantities of information faster than the competition’s – all while consuming less electricity.

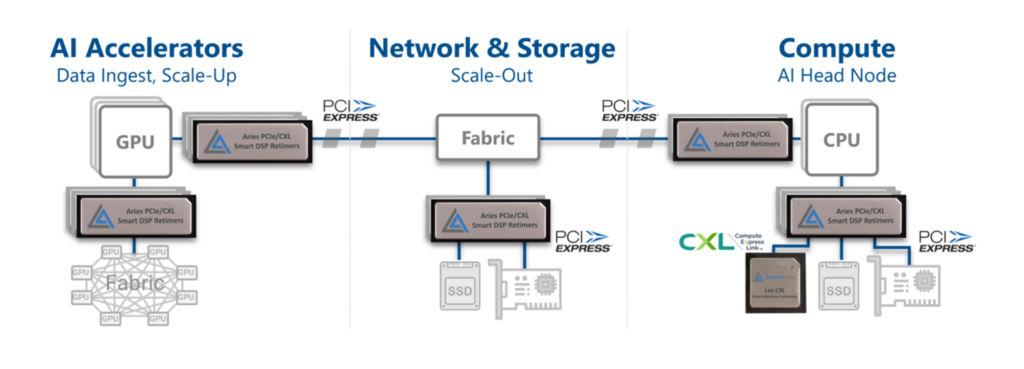

Astera offers three product lines: Aries, Taurus and Leo.

Aries is purpose-built for AI and cloud applications. The Aries smart cable uses Astera’s Smart DSP Retimer chip paired with the first 7-meter copper cables on the market to link numerous GPU clusters and allow them to operate as one.

It allows AI programs to ingest data more quickly, store it more efficiently and interface with users better than anything else on the market today. And the smart cables are totally modular. Their simple board design allows them to link almost any hardware needed.

Aries allows an AI program to operate faster while being scaled up to a larger hardware network than ever before. The cables even have their own software program called Cosmos. This program enables an end user to debug them, run deep diagnostics and receive in-field upgrades seamlessly online.

The larger the GPU cluster, the more sophisticated the AI programs it can run. And no matter what chip you’re using, it’s Astera Labs cables you’ll want linking them together. They will transmit more data faster and more efficiently than anything else.

Astera’s next product, the Taurus line of Ethernet cables, solves another problem faced by modern AI – internet speed.

The wireless internet your laptop computer uses is likely convenient and fast enough for most purposes. But it has a few drawbacks: speed, reliability and lag.

A wireless connection is slower than an Ethernet cable… and it’s significantly more likely to go out. Hardwiring your machine to the internet with an Ethernet cable makes it more reliable.

It also eliminates the lag found in wireless internet. That’s the delay that results as the wireless router communicates with the internet and the device connected to it.

Again, for most people, this lag isn’t a problem, nor is the slower speed of wireless internet. But a business using AI needs it to run faster and better than the competition. And for that, it needs Astera’s Taurus Ethernet cables.

The cables are up to 10 feet long and able to handle multiple load capacities. They’re equipped with the Cosmos suite to optimize them and manage the devices they’re connecting to the internet.

Taurus is becoming the gold-standard Ethernet cable on the market.

Finally, there’s the Leo CXL Smart Memory Controllers. These controllers allow AI to be scaled up faster by rapidly expanding its memory capacity by up to 2 terabytes.

Astera’s products all work together to allow an AI brain to hold more data, think faster, and communicate with the internet more quickly and reliably.

AI already processes data 40,000 times faster than a normal computer. Modern AI needs the best hardware on the market to function properly, and that’s what Astera provides…

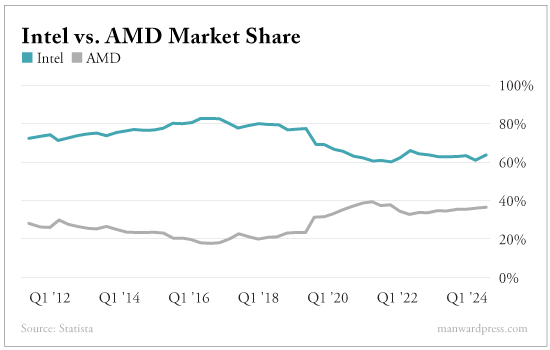

Considering all of that, is it any wonder that Nvidia, Intel and Amazon Web Services have all partnered with Astera?

Beyond that, investors are piling in left, right and center. Atreides Management, Fidelity and Sutter Hill Ventures – among others – have all invested in Astera and given it a considerable pool of friends in high places.

It Pays to Have Friends

Astera is a major supplier to AMD, Intel and Amazon. But what’s most exciting is that it provides Nvidia with the linking hardware to combine its GPUs and form the brain of a modern AI.

Nvidia, after all, controls 80% of the AI chip market. And with companies like Microsoft, OpenAI, Google and Meta all upgrading to Nvidia’s new Blackwell chips… Astera Labs is looking at huge revenue and earnings growth.

Because of how critical Astera’s products are to the industry, Amazon has recently invested $114 million in the company. It also agreed to buy at least $650 million worth of Astera’s products in the near future.

Astera now is exactly where Cisco was decades ago. Back in the ’90s, when the internet was in its infancy, Cisco developed the hardware that allowed computers to connect and “talk” to each other over the internet.

Its routers allowed data to travel between computers, networks and the internet. It didn’t matter to Cisco which company dominated the dot-com boom or the personal computer race. They were all buying its technology.

If you’d bought Cisco when it went public in 1990, you’d have seen a 6,000% gain by 1995 and a 100,600% gain by 2000. Astera stands to do the exact same thing with chips like GPUs and CPUs, allowing them to link up and communicate more easily.

I expect Astera to see astronomical growth as Cisco did.

And I’m not the only one…

One of Astera’s biggest investors, which I mentioned earlier, is a venture capital (VC) firm called Sutter Hill.

And Sutter Hill has a very different approach to venture capital.

Normally, the best VC firms invest in hundreds of startups. They do this to hedge their bets… because, on average, 80% of startups fail.

So most VCs will invest in a lot of startups… and will only need a few huge winners, like Google or Facebook, to bring in 10X returns or more.

Sutter Hill, however, does the exact opposite. Instead of investing in a hundred good companies, it invests 80% of its money in just ONE great company.

Sutter Hill backed Nvidia in 1999 before anyone had ever heard of it.

But the VC was so confident in Nvidia’s future, it decided to bet its business on the chipmaker’s future.

That worked out very well for it… and anyone who followed Sutter Hill into Nvidia after its IPO in 1999 could be sitting on a 100,000% return today.

History is about to repeat. Sutter Hill just took a big position in Astera Labs. It’s a massive 12.6% stake that shows just how serious it is about Astera’s future.

The Bottom Line

It should come as no surprise that with a partner like Sutter Hill… and multimillion-dollar investments… Astera Labs has a solid bottom line.

The most incredible thing about Astera’s financials is the incredible revenue growth it had last year. Revenues surged from $10.7 million in the second quarter of 2023 to $36.9 million in the third quarter.

That’s 244.8% growth in just one quarter.

Meanwhile, net losses dropped from $20 million to just $3.1 million over the same time frame. The company is very close to being profitable.

Astera also holds $149.31 million in cash to fuel its growing operations. But that’s not all. The company also has a gross margin of 68.94% and net debt of just $146.38 million.

Those are strong numbers for a company that just went public in March 2024.

You can see why getting into Astera is a no-brainer.

But we will take an extra step with this young stock to protect our investment by setting a trailing stop.

A trailing stop, in case you aren’t familiar, is an exit strategy that follows the price of a stock up… but not down. Say we buy a $10 stock and set a 25% trailing stop. So long as the stock stays at $10, we will automatically sell if the price were to suddenly drop to $7.50, 25% lower than $10.

But say our $10 stock were to jump up to $15. Then our 25% trailing stop would follow it, going up to $11.25, or 25% lower than $15. If our stock then dropped to $12, our trailing stop would stay at $11.25. In this example, the trailing stop would always limit your losses to 25% of the share price’s high from the date you entered it.

That’s why I’m recommending you place a 25% trailing stop on Astera Labs.

Action to Take: Buy Astera Labs (Nasdaq: ALAB) and set a 25% trailing stop to protect your principal and your profits.

Profiting From the Secret Partner

AI is going to change the economy we all operate in and the entire world in ways we can only imagine. It’s already grown far faster than anyone could have predicted even a year or two ago

But it won’t be able to keep growing without Astera Labs’ connective technology. The most advanced GPUs and CPUs in the world won’t be particularly useful if they overwhelm the cables binding them together.

No matter which company comes out on top in the chip race, Astera Labs is setting itself up to be like Cisco during the rise of the internet. It will be able to sit back and sell picks and shovels to all the companies duking it out for domination in the AI hardware space.

If you missed the boat on Cisco back in the day, now is your chance to lock in a position in what’s shaping up to be one of the defining stocks of the decade.

Note: We’ve found that readers tend to buy the stocks in these special reports at different times. Keep in mind that we may have taken profits or stopped out of a recommendation by the time you read this report. Please refer to the current portfolios for the most up-to-date recommendations.

© 2024 Manward Press | All Rights Reserved

Nothing published by Manward Press should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investment advice. We allow the editors of our publications to recommend securities that they own themselves. However, our policy prohibits editors from exiting a personal trade while the recommendation to subscribers is open. In no circumstance may an editor sell a security before subscribers have a fair opportunity to exit. The length of time an editor must wait after subscribers have been advised to exit a play depends on the type of publication. All other employees and agents must wait 24 hours after publication before trading on a recommendation.

Any investments recommended by Manward Press should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Protected by copyright laws of the United States and international treaties. The information found on this website may only be used pursuant to the membership or subscription agreement and any reproduction, copying or redistribution (electronic or otherwise, including on the world wide web), in whole or in part, is strictly prohibited without the express written permission of Manward Press, 14 West Mount Vernon Place, Baltimore, MD 21201.

May 2024.