Five Companies Protecting America (and Gushing 6G Profits Too)

Uncle Sam’s military is the best in the world.

America has been a leader in launching dozens of breakthroughs that are all around us (the EpiPen, fiber optics and, of course, the internet come to mind).

The 6G revolution will be no different.

In fact, it’s already here.

In 2020, the U.S. Strategic Command launched “Exercise Global Lightning 2020.”

Among other top-secret technologies, this program tested beaming encrypted signals to a C-12J Huron turboprop aircraft at more than 600 megabits per second… using satellites.

(For context, a fast consumer web connection is considered 50 megabits per second.)

The reason for the test is clear… A satellite network provides soldiers with vital intelligence and communications.

These days, it’s worth as much as a fleet in the water or an army in the field.

As our enemies grow more sophisticated, it’s vital that the Pentagon keeps its role as a technology leader.

There are many companies working closely with Uncle Sam to bring America’s satellite network up to speed and jump-start the development of our 6G network.

But the five companies in this report are the tip of the spear.

They will not only make you wealthier, but also make you and your country safer.

Of course, all investing comes with risk of loss, and you should never invest more than you can afford to lose…

“So Cal” Satellites

California has been America’s technology hub for decades.

Apple, Google and Facebook were all founded there. Yet it’s not the first place that comes to mind when folks think of defense stocks.

With the rise of 6G networks, though, that might soon change…

Viasat Inc. (Nasdaq: VSAT) has been a major “satcom” leader for more than 30 years.

On the front lines, reliable communication is vital.

That’s why modern militaries rely on satellite technology, like Viasat’s satellites.

In remote mountain ranges or war-torn cities, traditional communication is unreliable at best.

But low-Earth orbit satellites from Viasat can provide soldiers with reliable connections wherever they need them.

And Viasat is more than just a defense contractor.

It also offers home and business satellite internet.

That’s the beauty of 6G.

Thanks to Viasat, almost anyone can upgrade to – or have access to – safe, reliable internet… even in the most far-flung places.

And folks are beginning to take notice of the company’s efforts. It was a finalist for Fast Company’s 2020 World Changing Ideas Awards.

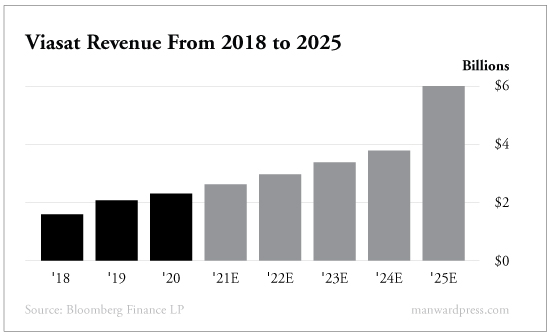

As you might expect, Viasat’s crucial business lines have led to a very healthy balance sheet.

In 2020, the company brought in $2.3 billion in revenue, representing a 12% year-over-year growth rate. Viasat claims it has the highest consolidated revenue among broadband satellite service providers.

Consolidated, adjusted EBITDA (earnings before interest, taxes, depreciation and amortization) leapt up 35% year over year to $458 million, another record-setting number. Viasat’s government systems segment revenue grew 19% year over year to $1.1 billion, and its satellite services segment grew 21% to $827 million.

What’s more, the company joined the Fortune 1000, which is no wonder considering it netted $2.3 billion worth of new contracts last year.

Today, Viasat provides in-flight connectivity for 1,390 commercial aircraft, including JetBlue and Qantas fleets. Last year, it shipped more than 250 commercial aviation shipsets for aerial internet services.

Further, approximately 590,000 Americans are now using Viasat for their internet.

The company is growing fast, and its 6G technology is being quickly adopted by civilians and soldiers.

Get in now and you could collect a double over the next year… and even more as 6G technology becomes mainstream over the next decade.

The Rocket Man

Our second play on 6G is Viasat’s neighbor to the north.

For more than 60 years, Aerojet Rocketdyne Holdings (NYSE: AJRD) has provided the U.S. military, NASA and a number of defense contractors (like Boeing, Lockheed Martin and Raytheon) with rocket parts, propulsion systems and more.

The company has two product lines: defense and space.

Its defense products range from propulsion systems and structural components to high-tech armament systems (rockets, missiles, etc.).

The space line is different. It includes launch vehicles, spacecraft, upper-stage engines and more.

In other words, it makes the systems that send 6G satellites into low-Earth orbit.

But there’s something even more special about the satellites Aerojet launches. Some of them are part of a system that can blast enemy rockets out of the sky… And the Department of Defense is very interested in that technology.

With a large product lineup and a client list that includes the military, NASA and Big Defense contractors, Aerojet is doing well.

Net sales for 2020 topped $2 billion, up 5% from net sales for 2019. Free cash flow exceeded $309 million, and Aerojet’s cash and marketable securities exceeded $1.16 billion. Net income exceeded $137.7 million and adjusted earnings per share (EPS) grew 7% year over year.

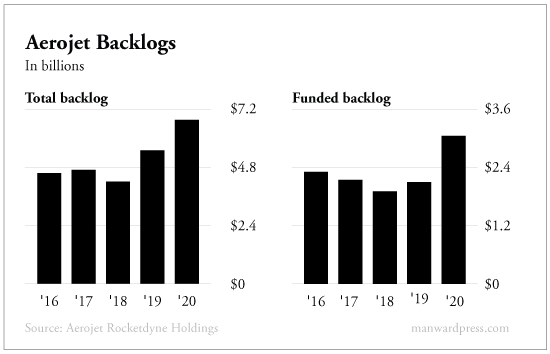

The company’s backlog showed impressive growth from 2019 to 2020, implying Aerojet has no shortage of new customers. Its total backlog climbed 23.18% to $6.7 billion, and its funded backlog increased by nearly $1 billion, topping $3 billion and growing 45.35% from 2019.

Aerojet protects America’s interests on land and in space.

As the future of warheads to the stars, this company and its products will be what our national safety will depend on.

I’ve recommended this stock before. Last time, its shares surged by 50%. I expect even bigger gains over the next two years.

An American Standard Reaching for the Stars

No matter how high-tech we get, we can’t forget that all space missions start the same way…

Namely, a bunch of very smart people punch gravity clean in the jaw to shoot a tin can at the tip of a rocket into the endless void of space using violently explosive fuel.

And Ball Corporation (NYSE: BLL), best known for its beverage packaging business, is working on some very advanced tin cans these days.

Ball operates in two major divisions. Of course, there’s its famous packaging business, which dates back to 1880. You’ve probably seen Ball Mason jars in old-timey markets or cafés. Less well-known, Ball Aerospace & Technologies was founded in 1956.

Today, Ball is responsible for everything from weather satellites to spy satellites. It’s like a front company for the Department of Defense. The company is on the DOD’s short list when it needs a job done…

Ball Aerospace is an end-to-end business. It develops components and even entire systems for the rockets sending satellites into orbit. And it develops the satellites going into orbit.

Plus, the company handles the software as well as the hardware. From electronic warfare to data analytics and engineering services, Ball is truly a capsule-to-thruster aerospace firm.

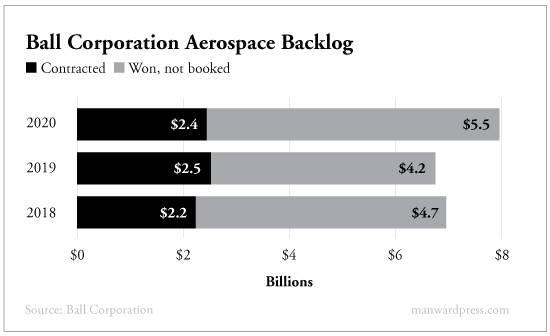

Ball is in high demand. At the end of 2020, its Aerospace backlog topped $7.9 billion, including $2.4 billion in its contracted backlog and $5.5 billion in its “won, not booked” backlog. It gets awarded fresh contracts regularly, and its services have no shortage of takers.

Ball brought in more than $11.7 billion in revenue for 2020, up $307 million from 2019’s number. The company recorded net earnings of $585 million, and EPS grew by 4.6%.

Ball’s assets topped $18.2 billion at the end of 2020, and it raised its dividend by $0.05 to $0.60 per share. This is the rare blue chip that’s also a pioneer in a new industry. Ball has its traditional container industry to fund its journeys beyond the atmosphere.

Right now, Ball is a blue chip that will allow you to cash in on the 6G revolution. Buy it to bring some nice, predictable growth to your 6G portfolio.

Advancing the Final Frontier

Best known as a top plane manufacturer and defense contractor, Boeing (NYSE: BA) is also a surprising leader in the new space race.

Make no mistake, 6G satellites are the start of something big…

The first space race was between the United States and the Soviet Union.

The Soviets put a man into space first… but America won the race by landing a man on the moon in 1969.

And now, there’s a new space race brewing.

This time, it’s between different private firms and the rich men who run them.

Companies like Elon Musk’s SpaceX, Richard Branson’s Virgin Galactic, Jeff Bezos’ Blue Origin – and, of course, Boeing – want to return to the final frontier and push it even further.

SpaceX’s rocket launch earlier this year was an impressive feat, but Boeing is better positioned to take advantage of 6G and the new space race.

It has deeper pockets, more resources and more friends in high places… like the Pentagon.

Aside from planes, Boeing plans and builds satellites and defense, launch and communications systems.

With satellites and launch systems, Boeing can take advantage of both sides of the 6G revolution – a rare treat for investors.

What’s more, this is a great time to get into Boeing. The company had a rough 2019, and the pandemic has been keeping its stock down. But Boeing remains a strong company that has become a vital part of NATO’s defense industry.

In short, it’s not going anywhere.

In 2019, Boeing took a significant hit financially. (Even so, it brought in $76.5 billion and had a backlog of $436.4 million.) But COVID-19 didn’t help matters. 2020 revenue came in at just more than $58 billion, definitely the nadir of the company’s recent fortunes…

But brighter days are on the horizon. Bloomberg’s projections have Boeing rebounding this year in a big way, hitting $80.5 billion in annual revenue and reaching new heights of $139 billion by 2025.

There’s rarely been a better time to buy Boeing than right now. COVID-19 slowed its recovery, creating a rare opportunity for investors.

It’s still only about half as valuable as it was during its previous all-time high of $440. It has been trading in the $230-to-$270 range lately. If it recovers to its previous all-time high, then you’ll be looking at a win of 80% or more.

I think it will happen by the end of this year. After Boeing returns to its old high, I expect the remarkable new growth in the space and satellite markets will propel it much higher.

But this isn’t a quick in-and-out trade.

You’ll want to hold on to your shares. Boeing not only will be key to the growth of 6G but also will be a leader in the new space race and the emerging space economy.

NASA’s Next-Door Neighbor

Cape Canaveral is a special place.

It’s where we first struck out beyond this little blue marble.

Just 20 miles south of the Kennedy Space Center on Cape Canaveral is Melbourne, Florida, the home of my final 6G defense play, L3Harris Technologies (NYSE: LHX).

NASA’s next-door neighbor has been a vital part of America’s defense industry for decades.

It has amassed 3,000 patents and now employs more than 20,000 folks.

L3Harris is a large defense contractor. It provides high-tech services for government and commercial customers in more than 130 countries.

While aerospace and technology are where L3Harris shines, it has a long list of other types of products too. Among the highlights are surveillance systems, satellite communications and battle management software. It even makes items like night vision goggles and radios.

The company’s financial data speaks for itself…

In 2020, L3Harris brought in $18.1 billion in revenue. It grew its backlog to $21.67 billion and decreased its debt from $6.1 billion to $5.6 billion. The company got a serious boost to its cash reserves too, climbing from $824 million in 2019 to $1.27 billion in 2020 – an increase of more than 54%.

L3Harris’ shareholders are enjoying its success as well. This January, it boosted its quarterly dividend rate from $0.85 per share to $1.02 per share, an increase of 20%. That tells me this company anticipates good years to come…

If you’re looking to the future, this is a must for your portfolio. If any company can win with 6G while protecting the United States, it’s L3Harris.

6G Is Just the Start

A half-century ago, a man took one small step into the unknown.

Since that first trip beyond the tethers of Earth’s gravity, we have only just begun to take advantage of the potential of space.

The 6G revolution marks the next chapter.

And thanks to the companies in this report, America will be leading the way.