The Ultimate EASY Guide to Buying Crypto

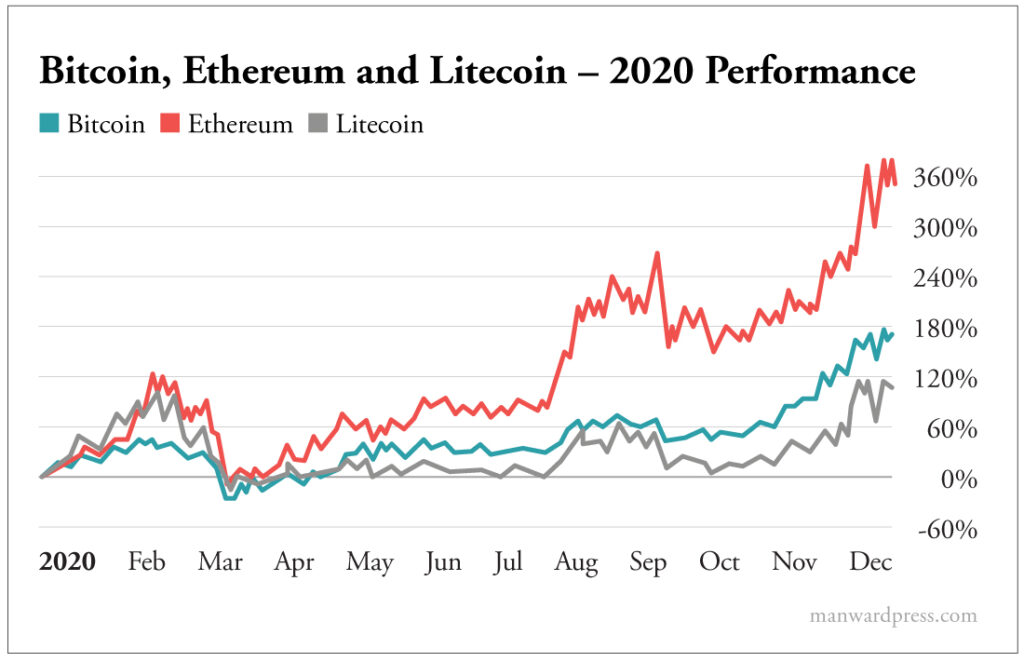

The profit potential of crypto is huge.

In 2020 alone, we saw triple-digit gains across the biggest and most established cryptocurrencies. And the action was even more explosive among the smaller altcoins.

In 2021, we saw more of the same. And despite a dip at the start of 2022, cryptocurrency rebounded, and it continued growing through 2023… and we expect that trend to continue through 2024 and beyond.

So if you’ve been sitting on the sidelines, it’s critical that you get started now.

This short guide will quickly walk you through those key introductory steps.

By the time we’re done, we think you’ll see that buying crypto is as easy as buying stocks… if not easier.

Let’s get into it.

Sounds Familiar

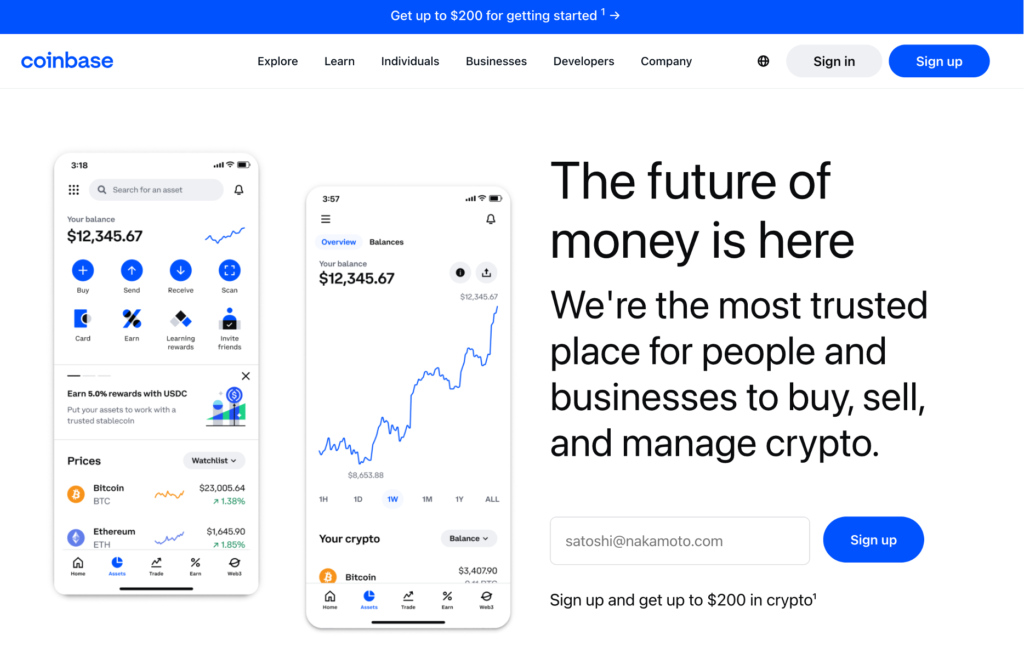

It all starts with creating an account at a crypto exchange. There are many options you can choose from, but for simplicity’s sake we’ll focus on Coinbase.

Think of it as the E-Trade of the crypto world: It is easy to use and has plenty of educational tools and support built in. In other words, it’s great for beginners.

This much is made clear when you arrive at the Coinbase homepage:

Creating an account is free. Simply follow the on-screen prompts to fill out your data and sign up.

You’ll be asked to verify your email address and add a mobile number for two-step verification – i.e., the same security requirements you can expect these days when creating a new email account.

Next, you’ll enter personal info, like your name, date of birth, address, etc. You’ll also be asked questions about your income and employment status, just as you would when signing up for any brokerage account.

And lastly, you’ll just need to fund your account by connecting to your preferred financial institution.

Again… it’s virtually identical to the process you’d go through to sign up for any stock brokerage. And, many of those brokers have added cryptocurrencies to their platforms.

Picking Up a Highflier

Now that we’ve got our account set up, it’s time to make our first purchase.

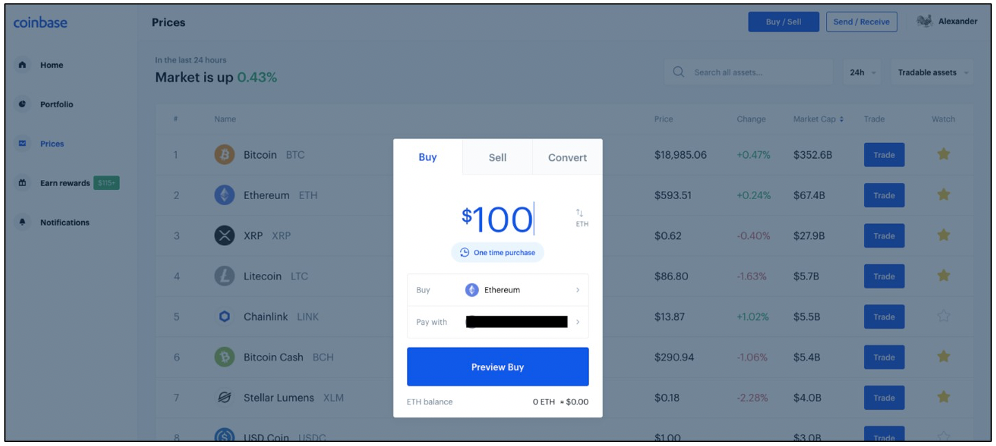

How about we pick up $100 worth of Ethereum (ETH)? It’s one of the best-known cryptocurrencies aside from Bitcoin (BTC).

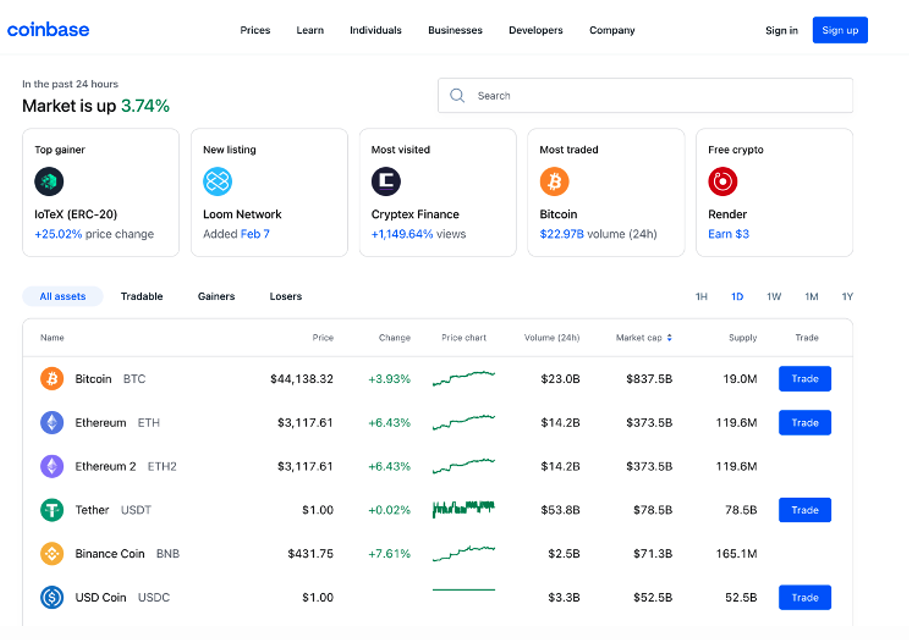

We could search for Ethereum in Coinbase by typing “ETH” into the search bar. Or we could take a look at all of the cryptos available to us by clicking “Prices” on the main menu.

That would take us to this screen:

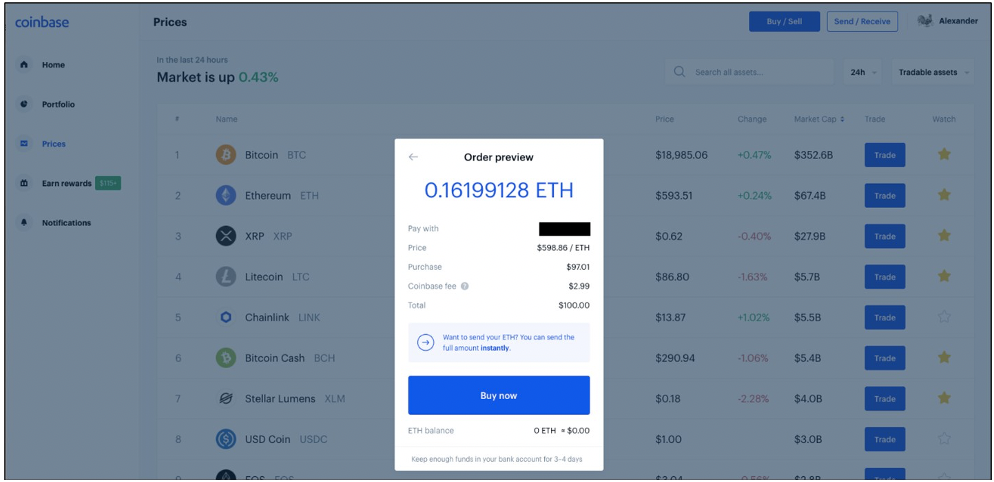

As you can see, Ethereum is listed right behind Bitcoin in terms of market cap. To initiate our purchase, we simply click the “Trade” button.

From here we enter our desired purchase amount and click the “Preview Buy” button.

The next screen tells us exactly how much Ethereum our $100 will buy, minus a small exchange fee.

If everything looks good on our end, we hit the “Buy now” button, and within minutes, we’re the proud owner of some Ethereum.

It’s just that easy.

But we’re not quite done…

You may be asking: “What should I do with my crypto after I buy it?”

Let’s talk crypto wallets.

A Billfold for Bitcoin

Coinbase allows you to store crypto right in your account – or “on the exchange.” You can do this with other exchanges as well, but most crypto traders don’t for fear of getting hacked.

(It probably goes without saying that, unlike the dollars in your bank account, Bitcoin and other digital currencies are just like gold or artwork and are not insured by the Federal Deposit Insurance Corporation. So if a hacker rips you off… well, that’s between you and the police.)

You can always lower your risk by doing things like changing your password once a month… using two-factor authentication… downloading a password manager… etc.

But most crypto investors would rather take their coins off the exchange entirely and transfer them to a wallet.

A crypto wallet is exactly what it sounds like: a safe place for you to store your crypto until you’re ready to use it. It’s an added layer of complexity, sure. But it creates an added layer of protection for your investment.

There are a few types of wallets you can choose from…

- Paper wallet: There are numerous sites that will generate a random QR code or a private key specific to your crypto. Simply enter your unique crypto address (here’s an example of what that might look like: 1BvBMSEYstWetqTFn5Au4m4GFg7xJaNVN2). You can then print the resulting code and store it with your other important documents. It should look something like this:

- Mobile wallet: This is a smartphone app that secures your crypto and enables you to access it on the go. Coinbase offers its own secure wallet app – helpfully labeled “Wallet.” Jaxx Liberty is another free option.

- “Cold” wallet: This allows you to take your crypto completely offline and put it on a mini hard drive or USB stick.

Each wallet comes with its own pluses and minuses.

A mobile wallet, for example, is probably the most convenient option for crypto traders. It grants you the ability to buy and sell quickly. Some mobile wallets will even allow you to use your crypto as a currency to pay for goods and services on the go. However… it is less secure than cold storage in the same way that the cash in your billfold is less secure than the cash in your home safe.

A paper wallet comes with caveats as well. The most glaring concern is that you’re required to upload your crypto details to a third-party website. It’s recommended that you take your computer offline while your random key is being generated, among other security measures. There’s a solid rundown of the procedure here from bitcoinpaperwallet.

The bottom line is that crypto wallets are not one-size-fits-all. Before you create one, you should consider all of the details above.

Still looking for answers? Below, you’ll find our responses to some common (and even some advanced) questions on crypto.

Everything You Wanted to Know About Crypto

What Is Cryptocurrency?

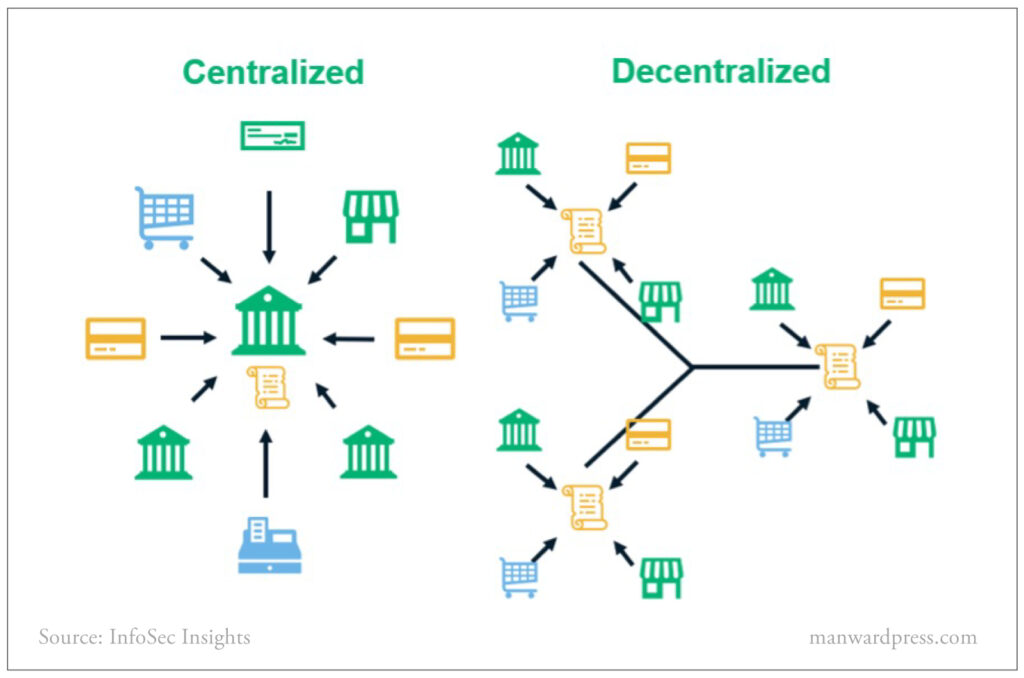

In the simplest terms, a cryptocurrency (crypto) is a digital asset that can be bought, sold or exchanged via a decentralized system. Transactions are verifiably and permanently recorded in a public ledger, aka a blockchain. (See: What Is a Blockchain?)

Most cryptos represent a unique technology with real-world applications. For example, Ethereum is built on the idea of “smart contracts” that can be executed through its blockchain. Aave (AAVE) is using its system to securely connect borrowers and lenders without the need for a middleman. And Monero (XMR) aims to become the world’s most private, untraceable currency.

Just like stocks, every crypto has its own fundamentals, purpose and story.

How Many Cryptos Are There?

New cryptos are being developed all the time. As of September 2024, there were about 10,000 cryptocurrencies on the market.

That means – in terms of options available – the crypto market is over twice the size of the American stock market.

Between the New York Stock Exchange and the Nasdaq, there are 5,600 companies represented.

What’s So Special About Bitcoin?

Everyone knows Bitcoin because, well, it’s been around the longest. Bitcoin launched in 2009 as the first-ever decentralized digital currency. And unlike some of its more sophisticated brethren, Bitcoin simply acts as a form of digital money. That’s its sole purpose, and so…

Thanks to an easy-to-understand mission, plus Bitcoin’s first-mover advantage, it’s become the world’s most popular crypto. Whether it’s the “best” crypto or will ever be a true form of money remains up for debate… which is what makes the sector volatile and exciting.

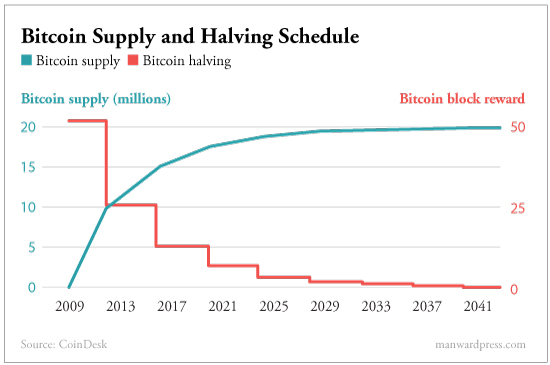

What Was the “Bitcoin Halving”?

Unlike fiat currencies, Bitcoin was intentionally designed with a sort of inflation “schedule.” There is a finite number of Bitcoin. And every four years (roughly), the number of new Bitcoin that can be mined gets reduced by – you guessed it – half. In 2009, 50 new Bitcoin were mined every 10 minutes. In 2011, the number dropped to 25. In 2016, it fell to 12.5. And after the “halving” in May 2020, the number of Bitcoin mined every 10 minutes dropped to 6.25. Which brings us to the most recent halving which occurred in April 2024, bringing the reward to 3.125 Bitcoin every 10 minutes. According to CoinDesk, “This process will end with a total of 21 million coins, probably in the year 2140.” (See: What Is Crypto Mining?)

What Is an “Altcoin”?

The term “altcoin” refers to every crypto that isn’t Bitcoin. It was coined as other cryptos began to emerge. In those days, every new crypto was viewed as a “Bitcoin competitor,” even if their technologies had nothing in common. And here we are still using the term, more than a decade later.

If it ain’t Bitcoin… it’s an altcoin.

What Is a “Stablecoin”?

Stablecoins are cryptos that stabilize their price by tying themselves to assets outside of cryptocurrency. Tether (USDT) is the most well-known example. It was designed to always be worth $1. There are an estimated 200 stablecoins available right now, with more on the way as nations seek to develop cryptos based on their own fiat currencies.

Which Crypto Has the Most Potential?

As we said above, every crypto has its own unique purpose. Some are used to help machines communicate. Some connect competing blockchains. And some are even seeking to solve problems that we don’t have yet, like ethical and privacy-related issues that will come with artificial intelligence (AI) adoption.

There are cryptos disrupting everything, including…

- Monetary transactions

- Transfers of medical data

- Secure electronic voting

- Supply chain monitoring

- Internet of Things (IoT) device connection.

The possibilities are endless. As such, it would be foolish to “put it all on one horse.” A smarter – and less risky – approach would be to spread your investment across multiple promising cryptos.

What Is a Blockchain?

A blockchain is an ever-growing list of records, represented as “blocks.” Every transaction creates a new block that is interlinked with the previous block and so on. The result is a permanent, decentralized public ledger that – as defined by Harvard Business Review – “can record transactions between two parties efficiently and in a verifiable and permanent way.”

Bitcoin’s was the first blockchain ever created. In the decade since, hundreds more have emerged, many with their own unique tweaks to Bitcoin’s original formula. There are four main types of blockchain networks:

- Public – anyone can make or view transactions (Bitcoin uses this type of blockchain).

- Private – permission is required to make or view transactions.

- Hybrid – varying combinations of public/private network features.

- Sidechain – runs parallel to another existing blockchain.

Why Are Blockchains Important?

Blockchains keep crypto users honest. By offering permanent, inalterable records of every transaction, blockchains eliminate the need for a central authority. And because the process is electronic and fully automated, users can freely exchange cryptos 24 hours a day… quickly, securely and with zero fees.

Their unprecedented safety and reliability give blockchains the potential to completely reshape the financial world. But the applications don’t stop there. Healthcare, real estate, legal contracts and supply chains are just some of the areas where blockchains are being applied right now.

What Does “DeFi” Mean?

DeFi is an abbreviation of “decentralized finance.” As we’ve covered, most cryptocurrencies are not part of any centralized system. DeFi refers to the use of blockchains as a way to disrupt traditional financial institutions.

How Do I Buy Crypto?

You can acquire crypto several ways, but the most common – and easiest – is to purchase it through a crypto exchange. Crypto exchanges are to cryptos what brokerage accounts are to stocks. The only difference is certain cryptos are available only via certain exchanges.

Most exchanges list the cryptos available to purchase on their sites. For example, the popular exchange Coinbase lists its supported cryptos here. Kraken, another well-known exchange, lists its supported cryptos here.

Just as you would research the pros and cons of a stock brokerage before signing up, you should be sure to read reviews of any crypto exchange you’re considering.

Can I Buy Crypto in My Stock Brokerage Account?

If you’re a Robinhood user, yes. However, there are only 15 cryptos currently available for trading in the Robinhood app (details here). So if you want to invest beyond the most well-known cryptos, you’re out of luck. Plus, with Robinhood, you never take full possession of your coins. You can’t go out and spend them on, say, a new Tesla.

A few traditional brokerages, including Schwab and TD Ameritrade, have made Bitcoin futures available. But at the moment, there is no way to directly invest in cryptocurrencies through the big brokerage platforms.

What’s Required to Create a Crypto Exchange Account?

The requirements vary depending on the exchange. But in most cases, creating an account is no more complicated than getting set up with a stockbroker. The process for joining Coinbase, for example, looks like this:

- Verify your email address and add a mobile number for two-step verification.

- Enter personal information, like your name, date of birth, address, etc.

- Answer basic questions about your income and employment status (just as you would when signing up for any brokerage account). In some cases, you may be asked to verify your identity by snapping a picture of your ID and uploading it to your account.

- Fund your account by connecting to your preferred financial institution.

And that’s it. Most crypto exchanges list the requirements for creating an account on their website. It’s wise to get these details before you start the sign-up process. That way you can make sure to have everything handy.

Why Do Some Crypto Exchanges Not Operate in Certain States?

It has to do with states’ licensing requirements and regulations. Binance, for example, isn’t available to residents of New York, Texas and some other states because it doesn’t yet have a license to operate in those places… or it doesn’t meet the states’ current requirements (which likely don’t address crypto).

Unfortunately, the only way to get around this is to shop around for exchanges that are approved to operate in those states.

The good news is that these situations can largely be chalked up to growing pains. As cryptos go mainstream (the shift is already underway), the barriers to access will continue to shrink.

Do I Have to Pay Taxes on My Crypto Returns?

Yes. According to the IRS, crypto gains and losses should be reported the same as you would report gains and losses associated with stocks. Here’s a blurb from the IRS:

A taxpayer generally realizes capital gain or loss on the sale or exchange of virtual currency that is a capital asset in the hands of the taxpayer. For example, stocks, bonds and other investment property are generally capital assets. A taxpayer generally realizes ordinary gain or loss on the sale or exchange of virtual currency that is not a capital asset in the hands of the taxpayer.

You can learn more – including how taxes affect crypto miners and crypto received as a gift – on the IRS website here.

Coinbase also offers a helpful crypto tax guide here.

What Are the Risks Involved in Buying and Selling Crypto?

Despite the fact that cryptocurrencies have been around for more than a decade, they are still an emerging asset. So beyond the usual risk posed by any investment, be it stocks, bonds or options (i.e., losing money), cryptos are vulnerable to the whims of lawmakers and regulatory bodies.

But with that said… we may have already reached the tipping point for crypto. Consider this…

- The market cap for all cryptos is rising constantly…

- Bitcoin is being bought up by pension fund managers, insurance companies and corporate treasurers…

- Several major payment processors now offer digital currency transactions…

- JPMorgan Chase, the world’s most valuable bank, has hopped on the bandwagon and developed its own cryptocurrency, called JPM Coin (JPM).

Cryptos are going mainstream. And as they do, it will only get harder for regulators to put the lid back on the jar.

None of that is to say you shouldn’t take every precautionary step before you invest in crypto. The same simple rules that you apply to stocks should be applied here: Do your research… have an exit plan… and NEVER put in more money than you can afford to lose.

Why Are Some Cryptos So Volatile?

Crypto trading volume has increased exponentially… but it’s still nowhere near what you’d see in midcap or even small cap stocks. With prices low and volume thin, even a modest surge in interest can send crypto prices soaring. And on the flip side… when investors suddenly pull out of a crypto, prices can quickly deflate.

It’s the type of action that should be quite familiar to penny stock traders. Fortunately, as we’ve seen, that increased risk comes with tremendous upside.

Crypto 201

What Is Crypto “Mining”?

In the simplest possible terms… crypto “mining” is the process of verifying transactions on the blockchain. (Crypto miners essentially act as blockchain auditors.) To do this, tech-savvy folks around the globe use high-powered computers to solve the same complex equations. Each equation represents a transaction, and when enough users reach the same solution, the transaction is officially verified and recorded. Crypto miners are rewarded for their time – and processing power – with free crypto.

Crypto mining is important for two reasons. First, it keeps the blockchain honest. But more importantly, it releases new crypto into existence. Without Bitcoin miners, for example, no new Bitcoin would be released… ever.

Sound complex? It is. And there’s a whole lot more to it. Fortunately, most crypto investors purchase through an exchange. It’s the quickest and easiest way to get started… no mining required.

How Does “Yield Farming” Work?

Similar to crypto mining, yield farming allows holders of certain cryptos to participate in transaction validation – aka “staking” – in exchange for more crypto. It’s a way to juice your returns by contributing to the network.

Per Cointelegraph, “The general idea is that individuals can earn tokens in exchange for their participation in DeFi applications… As each new project that emerges offers new tokens or ways to earn rewards, users have been flocking to it, hoping to get a cut of the yield on offer. In turn, this creates a demand that pushes up the value invested in the project and the tokens.”

Note: We’ve found that readers tend to buy the stocks in these special reports at different times. Keep in mind that we may have taken profits or stopped out of a recommendation by the time you read this report. Please refer to the current portfolios for the most up-to-date recommendations.

© 2024 Manward Press | All Rights Reserved

Nothing published by Manward Press should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investment advice. We allow the editors of our publications to recommend securities that they own themselves. However, our policy prohibits editors from exiting a personal trade while the recommendation to subscribers is open. In no circumstance may an editor sell a security before subscribers have a fair opportunity to exit. The length of time an editor must wait after subscribers have been advised to exit a play depends on the type of publication. All other employees and agents must wait 24 hours after publication before trading on a recommendation.

Any investments recommended by Manward Press should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Protected by copyright laws of the United States and international treaties. The information found on this website may only be used pursuant to the membership or subscription agreement and any reproduction, copying or redistribution (electronic or otherwise, including on the world wide web), in whole or in part, is strictly prohibited without the express written permission of Manward Press, 14 West Mount Vernon Place, Baltimore, MD 21201.

October 2024.