Create Your Own Bank

How to Acquire and Store the Physical Money of the Future

Physical money has been with us for thousands of years. And while electronic payments have grown tremendously over the last decade, physical assets continue to play a vital role in wealth preservation and financial privacy.

Think about it. While digital payments have become increasingly common, cash and physical assets still offer unique advantages: they’re reliable in times of electronic system outages, they provide a degree of privacy in transactions, and they’re widely accepted across different contexts.

Even with advances in technology, many aspects of physical assets simply aren’t reproducible just yet.

Yet despite these clear advantages, traditional physical currency faces growing challenges in our increasingly digital world.

The global financial system is rapidly evolving, with many nations exploring or implementing Central Bank Digital Currencies (CBDCs) while private digital payment systems continue to gain prominence.

And, of course, it’s entirely for their own benefit.

When all payments must go through an electronic system, every transaction can be tracked, monitored and taxed at all times.

Can you imagine having your transactions constantly monitored by the government? What if you spend your money in a way it doesn’t like?

You better believe it will come and talk to you about that.

And if the government knows where all money is… at all times… it can do something else it’s wanted to do for a very long time.

See, as long as there is cash, the government cannot implement a wealth tax, because people would simply pull cash out of the banks and hide it at home where it can’t be taxed.

But with everything electronic, there is nowhere to hide. The government can slap a tax on your wealth… and you have no way to avoid it!

Bottom line: An elimination of cash gives the bankers and governments all the power. They will have ultimate control over the money supply.

But make no mistake, there are definite actions you can take to protect yourself, your wealth and your privacy as we move into an increasingly digital future.

Just remember, physical assets have always served as stores of value throughout human history. So even as digital systems evolve, society will preserve ways to store physical wealth and maintain financial privacy.

There’s a very simple and safe way to do this on your own. You’ll learn how to transfer your cash into tangible assets that the government can’t easily monitor or tax.

In addition, you’ll learn how to secure those assets at home or in a secure location.

In effect, you’ll learn how to create your own personal bank.

The Physical Money of the Future

As digital payments become increasingly dominant, you’ll want to consider multiple ways to store and protect your physical wealth.

One way to do this is by purchasing gold, silver or platinum.

These precious metals have been used throughout human history to make transactions as well as store wealth for the long term.

Yet it’s important not to put all one’s eggs in the metals basket.

History bears witness to governments confiscating the precious metals of their citizens in order to enforce their monetary policy.

So it’s important to also think of alternative ways to store physical wealth. Take collectibles and fine art, for example.

Most people don’t realize they might be sitting on a massive fortune.

Simple items such as sports cards… historical memorabilia… specialty stamps… precious jewelry… rare books… and other items can be and are often used as a store of value.

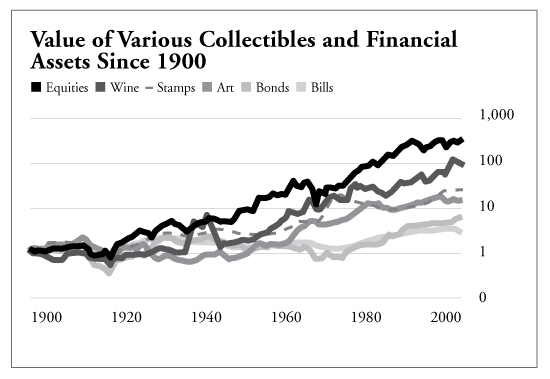

In fact, take a look at the chart below.

As you can see, from 1900 to 2000, fine art, wine and stamps offered significantly larger returns than more conservative investments like bonds and Treasury bills.

And even more recently, data from major auction houses shows the art market has remained robust. Global art sales reached $65 billion in 2023, with physical art maintaining strong demand despite the rise of digital alternatives.

Needless to say, art and collectibles offer a demonstrably safe way to preserve and grow one’s physical wealth over time.

Of course, not all collectibles are worth investing in. And just like stocks, some tangible assets can be quite speculative in nature.

Remember the Beanie Babies craze? Well, like all crazes, the craziness stopped. And countless chumps got stuck with a garage full of stuffed animals.

And with a few exceptions, those Beanie Babies are now worthless.

Simply put, you should invest in tangible assets that have a proven record of increasing in value over time. The greater the cultural and historical value of an object, the more likely it is to preserve its value and offer more stable returns.

It’s no wonder so many museums are as well guarded as banks. These institutions hold some of the most valuable tangible assets in the world.

And if you plan on investing in similar assets yourself, it’s vital that you properly store and protect them from theft and damage.

Now let’s get into how you can start preparing to create your own bank.

Understanding Your Safe Storage Options

There are two general options for storing your tangible assets.

One option is to pay for a secured storage unit at a private facility. This has its advantages. Most facilities provide 24-hour security surveillance and patrolling, as well as easy access to your storage unit at all hours of the day. Many modern facilities now offer additional services like climate control and specialized art storage.

The other option is to store your assets at home. This is often the preferred choice if the objects are for personal enjoyment or are often used, like jewelry, works of art or hard cash.

In either instance, you should seriously consider buying a safe to store especially valuable and smaller-sized items. This adds an important layer of security that will prove invaluable in promoting your peace of mind.

How to Choose the Right Personal Safe

The first thing you’ll need to decide is how large of a safe you’ll need.

Depending on the size of the assets you’re storing, a small safe can often be sufficient. But not if you have large items or a large number of smaller items.

You’ll also want to ensure that the safe is burglar-proof.

Modern safes now come with advanced security features that go well beyond traditional combination locks. Many offer biometric access, smartphone connectivity for remote monitoring, and even environmental controls to protect sensitive items.

For example, some safes allow you to attach an additional lock to the door. Other safes have a built-in keypad that requires a security password. Still other safes provide fingerprint identification features. The latest models provide fingerprint identification features and can even send alerts to your phone if someone attempts to access them.

How much security you want will depend on your preferences and budget. But the more protected the safe’s contents, the better.

This is your wealth at stake. So I would advise you to invest in a safe that incorporates modern security features like biometric access or encrypted digital keypads.

While the common burglar could easily have lock-cutting tools, few burglars are professional hackers. So entering a passcode or scanning your fingerprint will provide much greater security to your assets.

Next, you’ll need to decide what type of safe will best protect the stored contents.

This includes protection from not just theft, but also fire and water damage.

Safes are designed with different materials, varying thicknesses and a variety of features to prevent their contents from being damaged. There are a number of independent agencies that test and rate safes. These can help you to determine which safe is best for you.

The average safe will provide about 30 minutes of protection in the event of a fire. That means it will take up to 30 minutes for the fire to get through the safe’s material.

Of course, you can get a safe with greater endurance, but the price will go up accordingly. Just be mindful that the safer the safe, the pricier it gets.

Ultimately, you should do your own research based on your needs, but to help you get started, here’s a short list of popular and reliable safe brands.

- SentrySafe

- AMSEC (American Security Products)

- Brown Safe

- FireKing Security Group

- Fort Knox

- Hamilton Security

- Liberty Safe

- Stockinger

Setting Up Your Personal Security System

If you’re going to store your physical wealth at an off-site facility, you’ll have the benefit of having a security system already set up for you. But if you’ve decided to store your assets at home, you may want to ensure that your home is properly secured.

Setting up a security system at home is an excellent idea even if you’re not creating your own bank. It acts as a disincentive to thieves who know they will be caught on camera.

And if someone does manage to break into your home, you’ll have video evidence to take to both the police and your insurer.

So what will you need for your personal security system?

First, you’ll need to set up camera surveillance around your home and possibly in your home as well.

Modern security cameras offer features that were once only available to professional installations. Today’s systems include high-definition video, night vision, motion detection, and even artificial intelligence that can distinguish between people, animals, and vehicles.

There are professional services that will install a security system for you. However, the installation can be a bit pricey.

If you’d prefer to do it yourself, that’s fine too. The entire process is actually much easier than people realize.

Today’s wireless security cameras connect directly to your home’s internet network and can be monitored from anywhere using your smartphone.

Many systems even offer cloud storage of footage and can send instant alerts when they detect movement.

You should install the cameras near the front and back doors of your home. But don’t forget the less obvious places, such as off-street windows, garages and cellar doors. You should also have cameras covering your backyard, patio and driveway.

Inside the home, you may want to install cameras facing any staircases, common areas, hallways… and, most importantly, the location of your safe and other valuables.

To help you get started with the process of choosing the right camera for your home, here are a few well-respected brands on the market today.

- Zmodo

- Canary

- Lorex

- Samsung SmartCam

- Ucam

There are many other great brands out there, so do your own research and figure out what’s best for your budget and preferences.

Some features you may want to look out for are high-definition video, night vision optics, weatherproofing and even motion detection.

Your wireless camera system should come with instructions for connecting your camera system to your computer or mobile device. Most modern systems make this process simple through user-friendly apps.

Once it’s all set up, you’re good to go. You can keep an eye on your assets 24/7. It’s really that easy.

Keeping your physical assets secure is an absolute necessity… and it will become even more important as we move further into our digital future. So start turning part of your wealth into physical assets as soon as possible.

Because when digital payments become the norm, it might be too late to take action.

Note: We’ve found that readers tend to buy the stocks in these special reports at different times. Keep in mind that we may have taken profits or stopped out of a recommendation by the time you read this report. Please refer to the current portfolios for the most up-to-date recommendations.

© 2025 Manward Press | All Rights Reserved

Nothing published by Manward Press should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investment advice. We allow the editors of our publications to recommend securities that they own themselves. However, our policy prohibits editors from exiting a personal trade while the recommendation to subscribers is open. In no circumstance may an editor sell a security before subscribers have a fair opportunity to exit. The length of time an editor must wait after subscribers have been advised to exit a play depends on the type of publication. All other employees and agents must wait 24 hours after publication before trading on a recommendation.

Any investments recommended by Manward Press should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Protected by copyright laws of the United States and international treaties. The information found on this website may only be used pursuant to the membership or subscription agreement and any reproduction, copying or redistribution (electronic or otherwise, including on the world wide web), in whole or in part, is strictly prohibited without the express written permission of Manward Press, 14 West Mount Vernon Place, Baltimore, MD 21201.

January 2025.