Update - July 11, 2023

Boring Is Good When It Gives You Steady Growth

Someone once asked famed American banker John Pierpont Morgan about his prediction for the stock market’s future.

His response? “It will fluctuate.”

You may argue that his answer isn’t useful. But I see it differently.

No one enjoys volatility. But stock price movements give traders and investors alike the chance to seek profits. Without them, traders could never benefit from sudden market moves, and investors would never have a chance to snap up shares at bargain prices.

Volatility also means that our positions won’t always move in the direction we expect.

Extra Space Storage (EXR) is one of just a couple of laggards in our Modern Asset Portfolio. While our shares are not down by all that much, their fall is noticeable against the backdrop of the broad market rally.

That, of course, may cause many nearsighted stock traders to look for other options. Fine by me!

After all, we are not trading this stock. We’re invested for the long haul.

Here’s a reminder of why…

Extra Space isn’t a hypergrowth tech disrupter. Nor is it some wide-eyed startup with little more than a dollar and a dream. It’s a sure and steady rainmaker that operates a simple business – renting out secure storage space to everyday people – very soundly.

So, yeah, it’s a boring business. But boring can be very good.

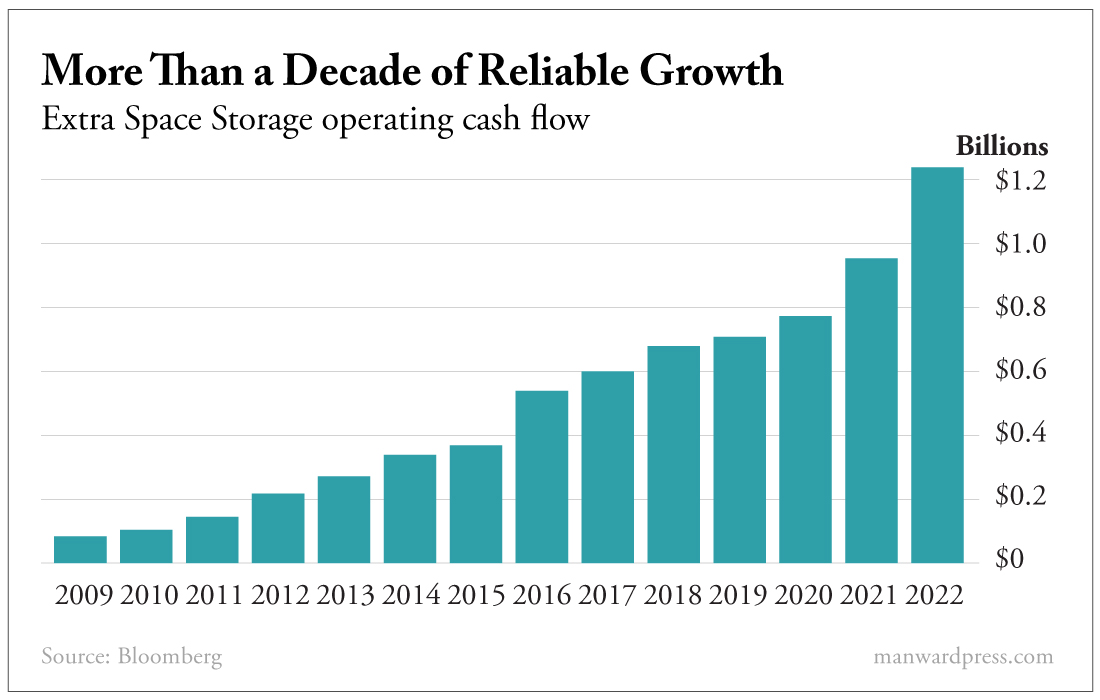

Over the past 13 years, Extra Space has shown steady year-over-year operating cash flow growth. It’s risen at an average pace of 24%.

This growth has followed the company’s expansion organically. Extra Space’s operations grew from just 500,000 units across more than 800 properties in 2010 to over 1.6 million units across more than 2,300 properties in 2022. And with an occupancy rate averaging 87% over the past decade, 9 out of 10 units are active moneymakers for the company.

This is how real businesses grow: They offer folks valuable goods or services at great prices, and they market those goods or services to more and more people. It’s pure and simple.

But it’s not the only way this business is growing…

Back in April, Extra Space announced plans to acquire Life Storage (LSI). The post-merger company will be the largest storage unit operator in the nation by number of locations.

The ink on this deal is expected to dry soon. But in the meantime, it’s important to note how the deal will impact our upcoming dividend.

In light of the expected merger, each company’s board has agreed to cut its next dividend payment. This means we’ll be getting $1.01 per share this quarter, down from $1.62 last quarter.

It also means that the stock will show a dividend yield of about 2.7% based on this upcoming payout. That’s lower than the 4.2% yield for the past 12 months of payments.

Don’t let that confuse you.

After the close of this merger, Extra Space plans to pay a special dividend. This will ensure that our total dividend payout will remain in line with what shareholders are used to.

In other words, while the regular dividend has been “cut” this quarter, Extra Space will soon make it up to us with a special dividend once the merger is done.

So, really, the dividends we’ll collect in the end will not have been cut at all.

The value of this stock is clear. And it’ll remain a “Buy” in our portfolio until something substantial changes in the core business.