Update - September 12, 2023

Banks Fire a Warning Shot

Here’s a head-scratcher for you…

Though inflation is cooling and recession talk is waning… one key sector of our economy looks to be getting into more and more trouble.

Can you guess which one? Here’s a hint…

Along with the federal government, this sector got hit by a wave of rating and outlook downgrades last month.

I’m talking, of course, about the financial sector.

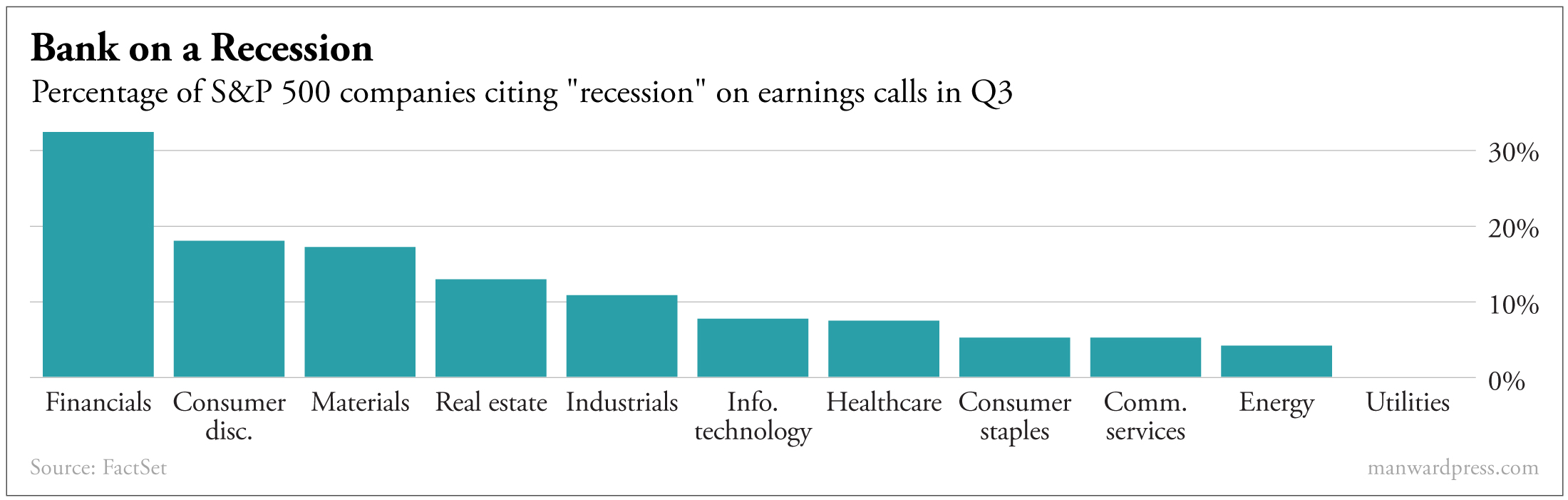

In fact, more than in any other corner of the market… in the financial sphere, recession talk seems alive and well.

It’s obvious why.

Modern banks essentially run a sophisticated magic show for the public. Too many folks don’t seem to understand that thanks to the “miracle” of modern banking known as fractional reserve lending, banks create money out of thin air to supply loans.

But the monetary illusion can continue only as long as two criteria are met. First, the demand for borrowing money must hold steady. Second, bank deposits must grow.

Unfortunately for banks… neither of these criteria is being met right now.

Lending has slowed thanks to high interest rates.

From mortgages to personal loans… all types of lending have dropped.

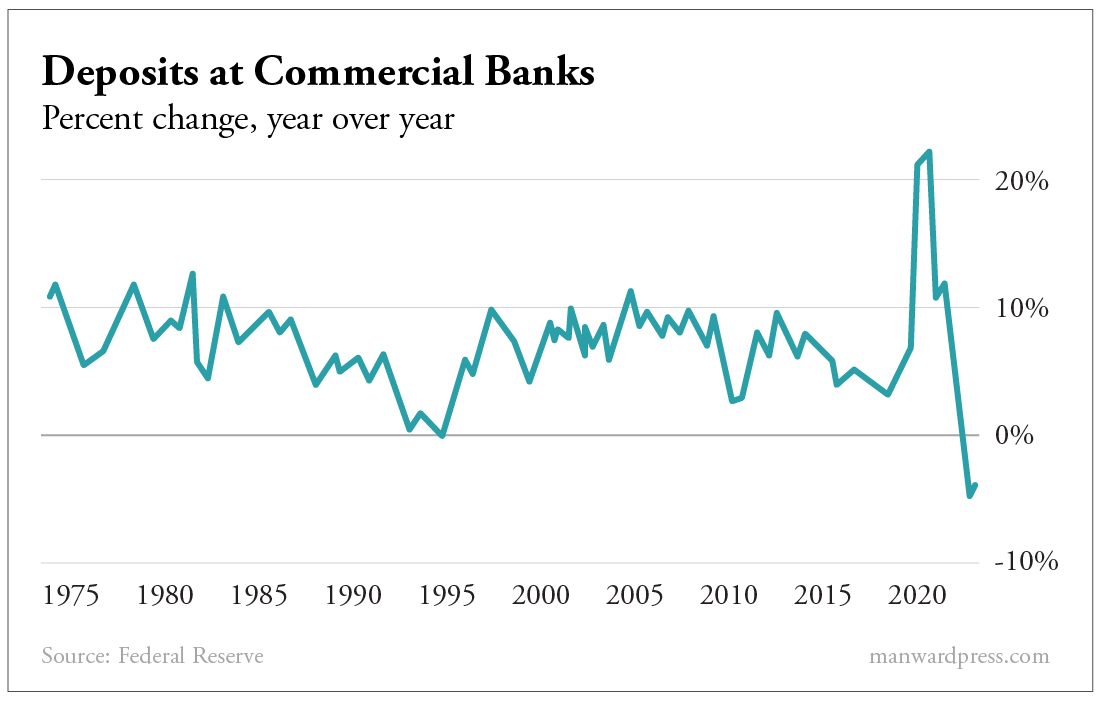

But that’s only half the problem. The other half can be seen in the chart below…

Deposits have fallen off a cliff… yet most people have heard little about this troubling trend.

For the first time in decades, we’re seeing a mass exodus of cash out of banks. It’s a clear sign of a worsening liquidity crisis that’ll continue to materialize in the months to come.

It’s not a good look… and this liquidity crunch highlights an important fact that I’ve been harping on for months…

Our country – from top to bottom – is far too riddled with debt. We simply don’t know how to function without it.

But our portfolio need not operate that way. That’s why we’ve focused on low-debt businesses that pack a huge punch.

Robert Ross’ first official recommendation is a perfect example.

SmartRent (SMRT) helps property owners and managers bring a modern edge to their residences. It offers smart home devices and software – such as smart thermostats, smart locks and smart lighting systems – to help bring apartments and homes into the 21st century.

It’s seen remarkable growth over the past few years, all while keeping its balance sheet light as a feather.

It has close to $200 million in cash on hand. And its total debt?

Nada.

In today’s world… this one breaks the mold for sure. It’s the exact kind of business we’d like to see more of in this economy.

Editor’s Note: The past two Manward Letter issues have explored the promise of AI and the opportunities it’s opening up. Now we’re taking it one step further. Join us tomorrow for the AI Super Trader Summit… where Manward’s own Alpesh Patel will show you how he’s targeting winning stocks with the help of AI. He’s the only hedge fund manager we know of sharing his strategy with everyday investors. And you can claim a front-row seat. Click here to sign up.