Special Report

A Near-Monopoly for the EV Revolution

Our world is experiencing a massive shift.

The widespread use of high-tech devices has been driving rapid demand growth for rare earth metals.

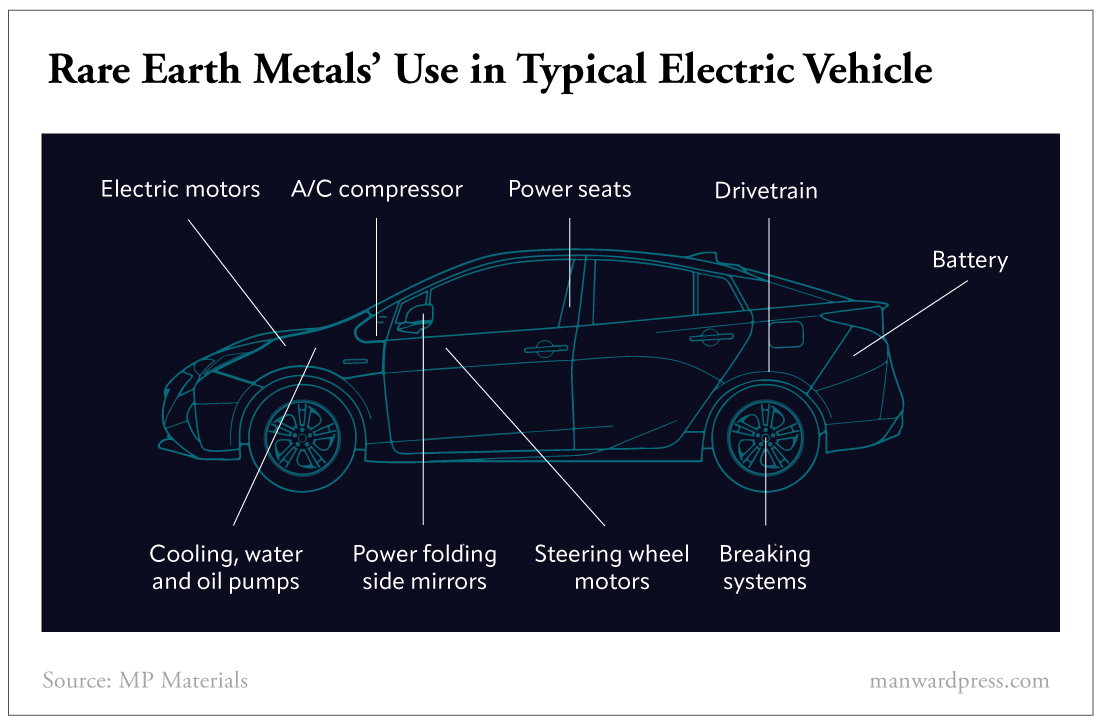

Rare earth metals are used as components in smartphones, digital cameras, computers and flat-screen televisions, among many devices. Large quantities of rare earth metals are used in clean energy, industrial applications and military technologies.

But now a huge new source of demand is emerging…

The increasing production and growing popularity of electric vehicles (EVs) – what I call the EV revolution – is dramatically increasing the need for rare earth metals.

Currently, EVs consume about 5% of annual rare earth metal production, but forecasts indicate that EVs may consume 100% of current annual production within the next 12 years.

In 2011, just 600,000 EVs were sold worldwide. By 2019, that had risen to over 2 million. And by the end of 2022, that had more than tripled to 7.8 million.

That’s a 1,200% increase in a decade!

And it’s estimated that by 2030, annual global EV sales will reach 26 million. That’s nearly four times current sales.

In total, the number of EVs on the road across the world will go from about 17.5 million today to a projected 300 million by 2030.

But it’s not just EVs driving demand…

Nearly all of the technologies of the future – EVs, aerospace, wind power, rechargeable batteries, drones, robotics and IT technologies – have rare earth metal components. (Rare earth metals are also used for various functions in conventional gas-powered cars.)

Today, China dominates the rare earth industry across the full supply chain – a troubling reality for the U.S. and a world that is rapidly transitioning toward electrification.

Fighting to Regain Its Position

Headquartered in Las Vegas, Nevada, MP Materials (MP) is on a mission to eliminate that dominance.

MP Materials owns and operates the Mountain Pass mine, located in San Bernardino County, California. Mountain Pass is one of the richest deposits of rare earth metals in the world and the only integrated rare earth mining and processing site in North America.

The company’s mission statement is… “To restore the full rare earth supply chain to the United States of America.”

Prior to the 1990s, Mountain Pass was the primary global source of rare earth metals. But it ceded this dominance to China. Mainly due to mining costs, the operation was shuttered.

MP Materials acquired Mountain Pass in 2017, upgraded the facility, restarted production and embarked on a three-stage plan to restore the full rare earth supply chain to the United States.

Over the past five years, the company has made tremendous progress…

Today, MP Materials is the largest producer of rare earth metals in the Western Hemisphere. It has created a state-of-the-art, zero-discharge operation at Mountain Pass.

The company currently delivers about 15% of global rare earth metals supply.

But it’s not only MP Materials taking action to reduce China’s rare earth metal monopoly… The U.S. government is too.

Uncle Sam’s Helping Hand

On March 31, 2022, President Biden invoked the Defense Production Act (DPA) of 1950 to bolster domestic production of the raw materials used to manufacture EV batteries. This was in response to rising energy prices and geopolitical tensions.

The goal is to make America less dependent on other countries for the strategic minerals – including rare earth metals – needed to power EV batteries.

Biden also believes that the domestic production of raw materials, like rare earth metals, is “essential to our national security.”

Rare earth metals are critical inputs for the magnets that enable the mobility of defense systems, drones, missile guidance systems and various high-tech military applications.

MP Materials is already seeing some of this money flow its way…

In 2022, the Department of Defense awarded MP Materials $35 million to refine and separate heavy rare earth metals at Mountain Pass.

Biden also views DPA as critical to the “development and preservation of domestic critical infrastructure.”

This gives U.S. mining companies access to $750 million under the DPA’s Title III fund. That fund covers “feasibility studies, co-product and by-product production at current operations, and productivity/safety modernizations.”

Also, the U.S. government is allocating $3 billion in the Bipartisan Infrastructure Law to boost domestic battery manufacturing and supply chains. This will fund refining and production plants for battery materials, battery cell and pack manufacturing facilities, and recycling facilities.

MP Materials is a likely candidate to receive a nice chunk of these government subsidies. Not that it needs it…

The company is only halfway through its three-stage plan, but a vast improvement in its financial performance is already underway.

Bet on This Comeback Story

In MP Materials’ third quarter 2022 report, revenue and net income continued their blistering growth.

Revenue leapt 59% for the whole of 2022 compared with 2021’s revenue.

Net income did even better… soaring 77% year over year to $388.6 million. Diluted earnings per share grew 38% year over year to $0.36.

The terrific results for 2022 followed a record 2021 performance…

Record revenue of $332 million jumped 147% when compared with 2020’s revenue. Net income was $135 million compared with a loss in 2020.

Operating cash flow in 2022 was $357 million, and the company has $1.2 billion in cash and equivalents. So there’s plenty of money to finance the company’s expansion plans without diluting shareholders.

And as I mentioned, the company is only about halfway through its three-stage plan to become a fully self-sufficient rare earth metal operation, which, when completed, will increase production, add to the company’s processing capabilities and reduce costs.

Stage one was to reopen the Mountain Pass mine and begin producing rare earth metals… Mission accomplished there.

Stage two, which involves recommissioning a processing facility that can produce separated rare earth metals, is nearly complete and should begin operations this year.

Stage three is also now underway with the start of construction of a rare earth magnetics factory in Fort Worth, Texas. This facility – scheduled for partial completion (and limited operation) in the second half of 2023 – will source materials from Mountain Pass and transform them into finished products.

When the entire plan is complete, MP Materials will be a one-stop shop for a wide range of EV, clean energy, information technology, defense and industrial applications.

One of those final products will be magnets for powering approximately 500,000 EV motors per year.

MP Materials and General Motors (GM) have announced a definitive supply agreement commencing in late 2023, in which MP Materials will provide rare earth magnets for GM’s EV output.

With the completion of the Texas magnetics factory, MP Materials will become a full-service operation – delivering an end-to-end solution, including mining and refining; metal, alloy and magnet manufacturing; and recycling.

Warren Buffett has long advocated for finding businesses with a wide and long-lasting moat around it… A near-monopoly like MP Materials qualifies.

Action to Take: Buy MP Materials (NYSE: MP) at market. Use a 25% trailing stop on your position.

A Near Monopoly

Imagine being the only company in North America selling a product…

Plus, you’ve got a lot of the product… The proven and probable reserve estimate at Mountain Pass gives the mine an estimated life of 35 years.

You’ve also got a lot of customers interested in buying your product… Rare earth metals are vital to multiple industries – automotive, clean energy, military and digital technologies.

And there’s another thing working in your favor… Demand is exceeding supply. There’s a projected, and growing, deficit in rare earth metals forecast for at least the next decade.

This near-monopoly might just be the ultimate inflation- and recession-proof play.

Note: We’ve found that readers tend to buy the stocks in these special reports at different times. Keep in mind that we may have taken profits or stopped out of a recommendation by the time you read this report. Please refer to the current portfolios for the most up-to-date recommendations.

© 2024 Manward Press | All Rights Reserved

Nothing published by Manward Press should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investment advice. We allow the editors of our publications to recommend securities that they own themselves. However, our policy prohibits editors from exiting a personal trade while the recommendation to subscribers is open. In no circumstance may an editor sell a security before subscribers have a fair opportunity to exit. The length of time an editor must wait after subscribers have been advised to exit a play depends on the type of publication. All other employees and agents must wait 24 hours after publication before trading on a recommendation.

Any investments recommended by Manward Press should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Protected by copyright laws of the United States and international treaties. The information found on this website may only be used pursuant to the membership or subscription agreement and any reproduction, copying or redistribution (electronic or otherwise, including on the world wide web), in whole or in part, is strictly prohibited without the express written permission of Manward Press, 14 West Mount Vernon Place, Baltimore, MD 21201.

May 2023.