Update - October 31, 2023

Our Strategy for a Debt-Addicted Economy

Here’s a head-scratcher for you…

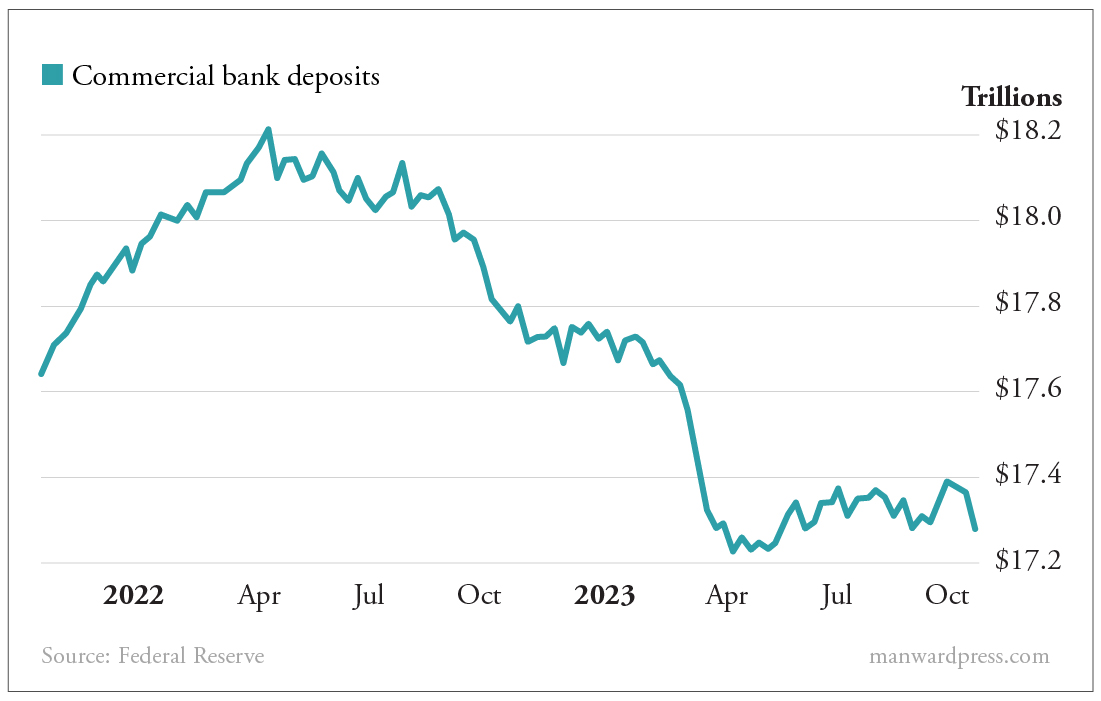

Over the past 18 months or so… nearly $1 trillion in cash deposits has been sucked out of our banking system. It’s part of the liquidity crisis no one is talking about.

Why is this happening… and what does it mean for investors?

One simple answer is that in the face of mounting inflationary pressures, money flowed to where it would be treated better.

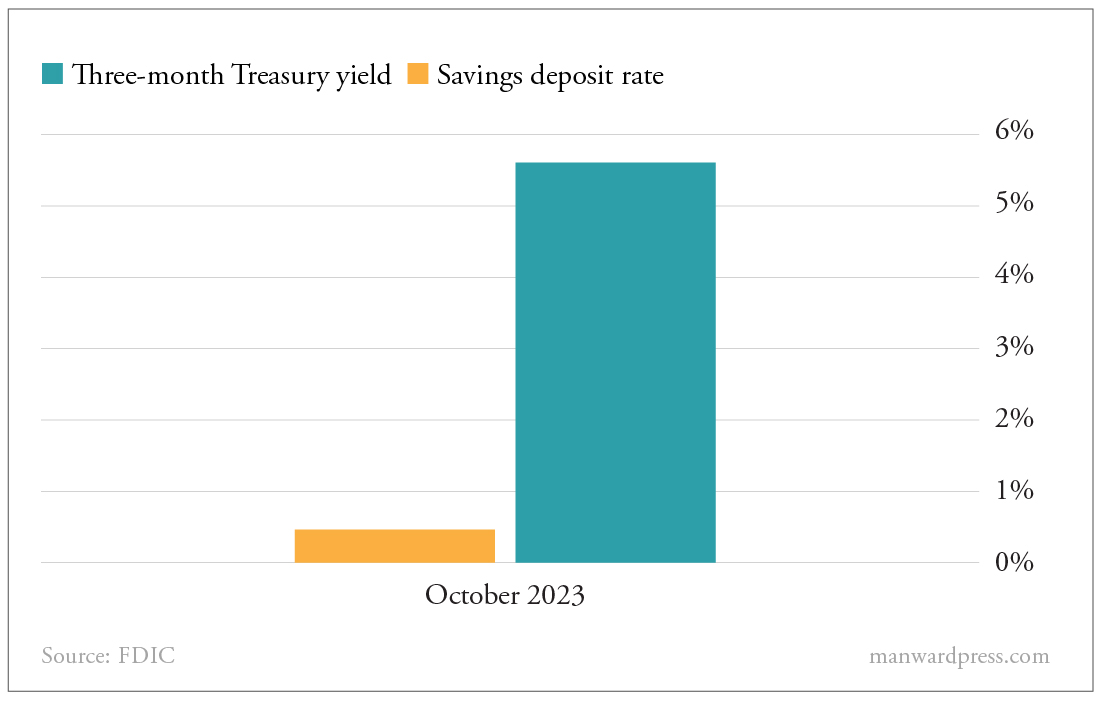

The return you get at most banks is paltry by any standard. The average savings deposit rate is less than 0.5% right now.

When you can get over 10 times that on, say, a three-month Treasury bond… why bother with a bank?

No wonder cash is fleeing the banking system.

But that leaves us with a huge problem. Banks have less funds to lend out to individuals and businesses… leading to stricter lending standards.

That’s a big uh-oh for our debt-addicted economy.

Historically, tightening financial conditions hurt GDP growth. The higher borrowing costs get, the more pressure it puts on our economy.

And it’s not just rates.

The strength of the dollar… housing prices… stock market performance…

They all play a role here as well. And they’re not helping much either.

Of course, strong economic growth could overcome the drag caused by these tightening financial conditions. But that seems unlikely to happen in the year ahead.

The data points squarely against it… as I’ll explain in next month’s issue.

Businesses will need to be in very strong financial positions to weather these conditions.

And the liquidity crisis is bound to become a major headwind for cash-strapped, highly indebted companies.

That’s why we’ve focused on companies with the exact opposite qualities recently.

For instance… Sprinklr (CXM) and Recursion Pharmaceuticals (RXRX) have debt-to-equity ratios of 0.05 and 0.11, respectively. And they have little to no interest expenses.

Both can pay off their entire debt loads with a small fraction of their cash on hand. And both have enjoyed explosive revenue growth over the past few years.

But most importantly… both are capable of thriving under tight financial conditions.

That’s a big advantage (especially in today’s market). And it will be for a long time.