3 Startup AI Plays That Could Set You Up for Uber-Sized Gains

A special report for VIP Manward Letter subscribers

Artificial intelligence’s (AI) global takeover has already begun.

Analysts estimate that businesses that have started using AI are boosting their productivity by between 21% and 36%.

A Forbes Advisor survey found that 73% of businesses plan to use AI to beef up their customer service operations. And more than half of respondents said they’ve started using AI to automate their production processes.

It’s only the beginning.

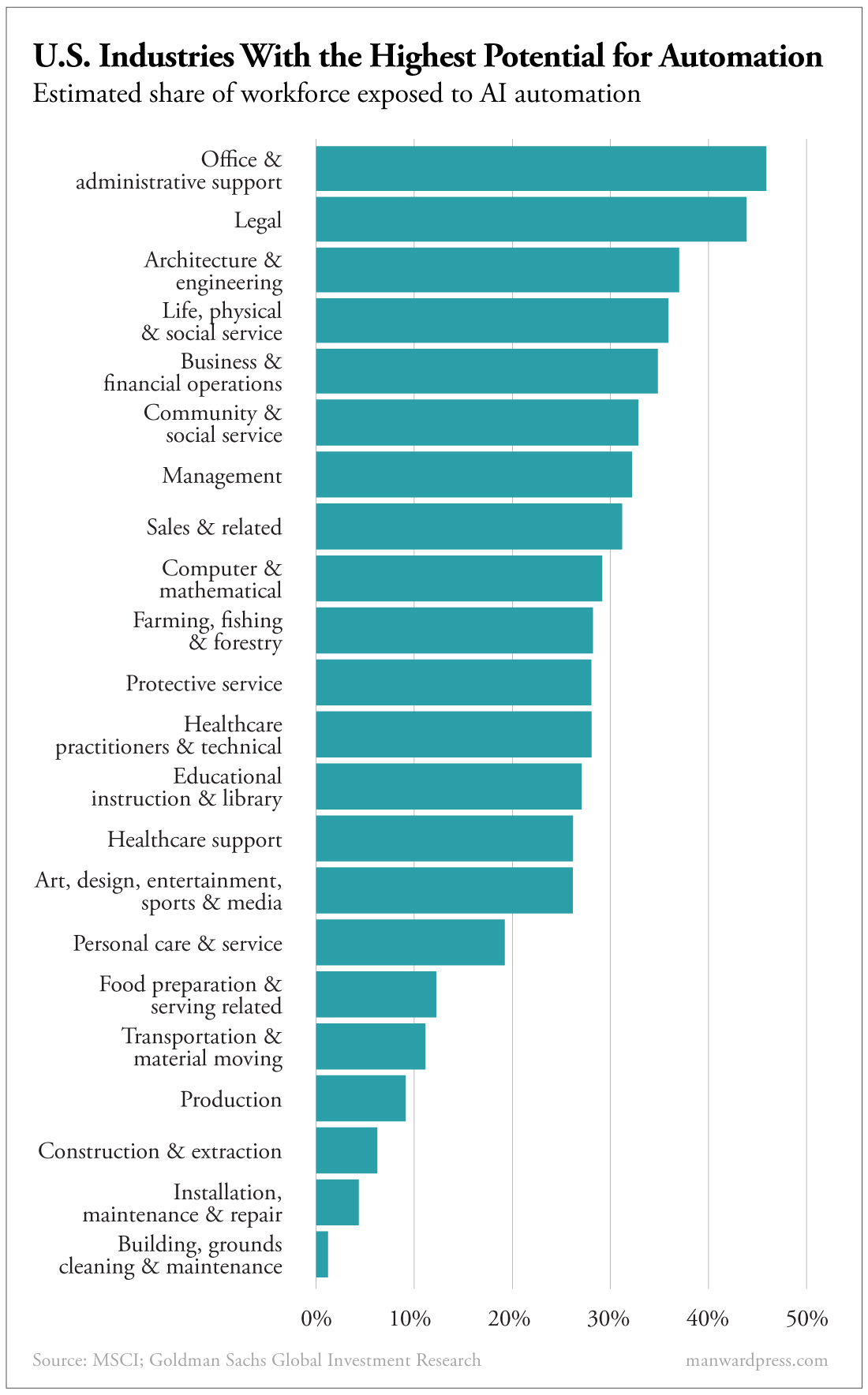

This chart shows the sweeping impact AI could soon have…

Looking ahead, experts believe AI holds the key to unlocking long-brewing technological advancements like autonomous cars… predictive healthcare that could greatly extend lives… and smart grid automation that could help put an end to blackouts and other disasters.

Based on what we’re seeing today, we don’t doubt it. And while a growing number of stocks can help investors capitalize on the action – like the potential-packed pick we told you about HERE – there’s one important fact we must remember…

The best time to invest in any company is before it hits the open market – before its initial public offering, or IPO.

That’s how early investors in Uber were able to make as much as 1,800,000% in a decade.

We believe the three AI startups detailed in this report have the potential to follow a similar path.

Perhaps they’ll fly even higher.

One thing is for sure…

Considering that analysts now predict the market for AI will grow 20-fold by 2030, even a small investment in the private companies leading the charge could be a game changer for your portfolio.

Tapping Into AI’s Raw Potential With Startups

Pre-IPO investing makes it possible to tap into the raw potential of startups… and the industries they’re pushing forward.

Until quite recently, it wasn’t possible for ordinary investors to get into these types of deals. But as we explain in our report “100X Pre-IPO Profits: Your Guide to Smart Private Equity Investing,” that’s changed.

Now is the perfect time to capitalize on this market… and make up for lost time.

But before we introduce some of the most exciting deals available to you today, we want to encourage you to review that helpful guide. It will show you everything you need to know to get started as a pre-IPO investor – from how to create an account to how to manage your possible tax obligations.

You’ll also understand why we look for four specific things when assessing any pre-IPO opportunity…

- Leadership. Do the folks in charge have a track record of success? Are they the right people for the job?

- Massive market. Is the potential market for the company’s products massive? If not, it’s probably too niche for us.

- Problem. Is the company addressing a common problem for consumers?

- Simple solution. Is the company’s solution to the problem easy to understand? Is it crystal clear why its fix is the right one?

If a company can check all four of these boxes, that’s a strong indication we’re looking at a startup with 100X potential.

Again, we cover all of the basics in our pre-IPO investing guide. Check it out here.

And once you’ve done that, you’ll be all set to review our three favorite AI startups right now.

AI Startup #1: Pioneering a New Kind of Thinking Machine

When most folks think about AI, they think about large language models (LLMs).

If you’ve played around with these types of tools – such as the ultra-popular ChatGPT – you may have been impressed. But you’d probably agree that it still felt like you were conversing with a robot.

You’re not alone.

Even diehard fans of ChatGPT and its LLM competitors will admit that the technology has limitations. Sure, these chatbots can comb through massive amounts of data in a split second. And, yes, they can spit out an accurate response in a fraction of the time it would take a human.

But they don’t truly learn.

They don’t – as the folks at New Sapience put it – achieve knowledge.

To support their point, the company quotes Berkeley professor Alison Gopnik, who said, “We call it ‘artificial intelligence,’ but a better name might be ‘extracting statistical patterns from large data sets.’”

AI is obviously growing by leaps and bounds these days. But in order for it to move into the next phase of its evolution, New Sapience says we need to rethink AI… entirely.

The company is hard at work, applying its patented machine comprehension model to develop a new line of thinking machines that could become “AI 3.0.”

These machines are called sapiens. Think of them as upgraded versions of Alexa or Siri… versions that actually understand what you want and, better still, learn from your requests (instead of just collecting your data).

Here’s how the company describes its approach:

New Sapience’s thesis is that the most efficient way to build a thinking machine is by giving it something to think about. With this in mind, our team pursued a synthetic approach to knowledge in machines. We identified core cognitive building blocks, “atoms of thought,” and classified them in accordance with their properties of combination in a manner we believe is strongly analogous to the periodic table in chemistry.

Unlike previous iterations of artificial intelligence, our AI is based on layered models. First is the Cognitive Core, a model of knowledge itself. On top of that, a model of the commonsense world of sufficient scope to understand language and the everyday world. Finally, depending on the sapien’s application, layers of technical and expert knowledge curated from some of the best human minds and collected works. No need for lengthy training cycles on datasets.

Using this unique approach to AI, New Sapience has experienced what we consider to be incredible breakthroughs. We believe sapiens demonstrate the ability to expand upon existing knowledge, comprehend the contextual nuances of language, explain lines of reasoning, and even distinguish the difference between thoughts, perceptions and feelings.

That may all seem very philosophical. But the bottom line is this: New Sapience is setting out to disrupt the AI space by delivering truly intelligent AI. The kind that thinks just like a human brain… only much, much faster.

And it’s certainly got the ideal leadership team to be do it. The company’s founders include bona fide rocket scientists who’ve worked for NASA, Lockheed Martin’s AI center, DARPA and the NSA. Its board of advisors include Ronald Reagan’s assistant secretary of the Air Force and the founder of George Washington National Bank.

These folks have been at the forefront of AI for decades.

We’re also excited about the sheer size of New Sapience’s potential market. Its product stands to disrupt not just AI… but every industry that plans to incorporate AI into its business moving forward.

New Sapience’s technology has the potential to disrupt numerous multibillion dollar markets, including the $9.9 billion natural language processing and chatbot software industry and the $140 billion industrial automation industry.

To be clear, this tiny company – currently valued at around $75 million – is still in its prototype phase. It may be years before it fully catches hold.

Still, the potential here is so great that we thought it was worth the attention of anyone looking to place a speculative bet on the future of AI.

The company plans to invite investors to a beta test program later this year. Considering how much progress it’s made so far, New Sapience could be an attractive takeover target.

New Sapience is currently accepting new investors via Start Engine.

AI Startup #2: Fixing What’s Broken in a $138 Billion Industry

Here’s something that should come as no surprise to anyone…

The medical supply industry is broken. It can be difficult for doctors to get patients the life-saving products they need. And, as is the case with most things in the medical world, the experience for customers is often quite unpleasant.

Supply chain disruptions and supply shortages happen frequently.

That’s why more than 10,000 customers are already shifting their business over to iRemedy Healthcare.

Those customers include well-known names like Johns Hopkins, Johnson & Johnson, Kimberly-Clark, the Mayo Clinic, Trinity Health and many more.

Those customers include well-known names like Johns Hopkins, Johnson & Johnson, Kimberly-Clark, the Mayo Clinic, Trinity Health and many more.

They’re flocking to iRemedy in droves because the company is revolutionizing the medical supply ordering process… with the help of AI.

The company’s mission is simple. It’s to “solve complex pricing, contracting, and sourcing problems – automatically.”

Through its customer-friendly, AI-assisted platform, it offers more than 500,000 products. And if a customer doesn’t see what they need, iRemedy’s sourcing robots will immediately begin scanning external sources to find it.

Because of this customer-first approach, the company has quickly gained traction. Last year, it generated more than $52 million in sales. And this year, iRemedy expects to triple its growth in the ambulatory surgery center and multi-location ambulatory care markets.

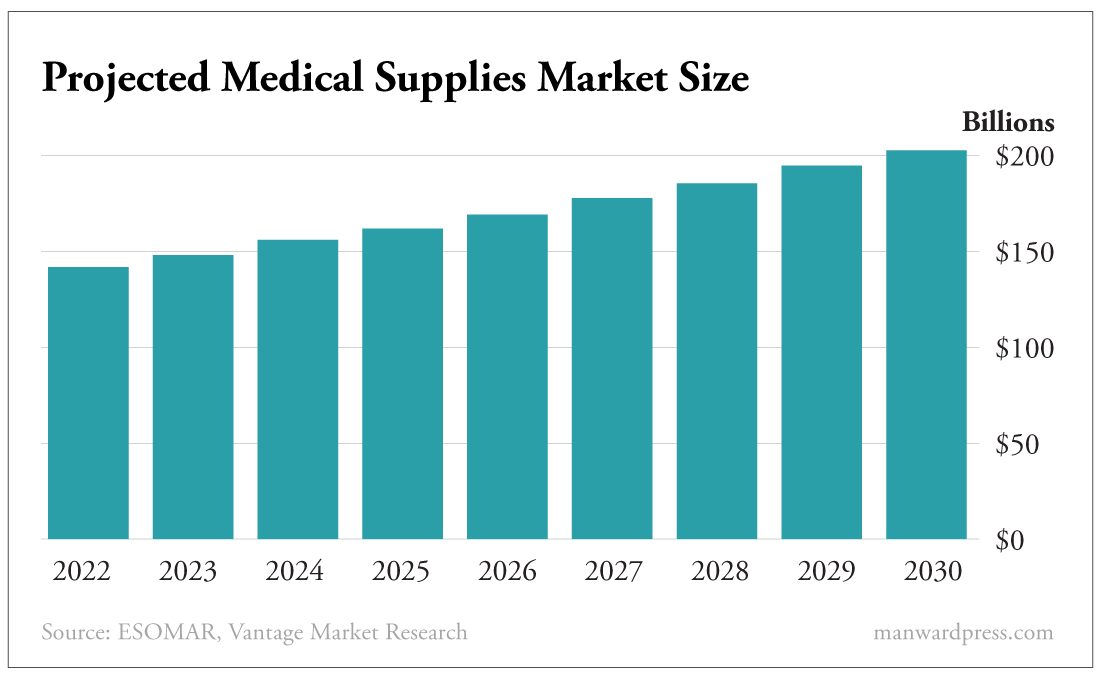

The medical supplies market as a whole is expected to grow steadily and hit more than $200 billion by 2030. It sits around $144 billion today.

IRemedy is set up to capitalize on that growth thanks to its AI-powered (and patent-protected!) marketplace.

And its leadership team is no doubt up to the challenge. Chief Technology Officer Jim Harding was formerly the architect behind Jeff Bezos’ “everything store” – aka Amazon. So you might say he knows a thing or two about supply chains.

IRemedy Healthcare is currently accepting new investors via Republic.

AI Startup #3: Revolutionizing How We Treat a $966 Billion Health Crisis

Our final startup is also in the medical realm. Like iRemedy, it’s out to solve a complex problem that impacts hundreds of millions of people all over the world.

Globally, more than 530 million people have diabetes. And experts predict that number will grow exponentially in the years ahead.

Anyone who suffers from this deadly disease knows regular glucose testing is an unfortunate necessity. Painful finger pricks are a common method of checking glucose levels.

To make matters worse, these types of tests can be quite costly, as they require new equipment for each use. According to GoodRx, some glucose monitoring systems can cost several thousand dollars per year.

The experience can be so painful – physically and financially – that an estimated 6 out of 10 diabetic patients abandon treatment altogether.

It’s a sad state of affairs. But that’s precisely what led the team at Viit Health to leverage the power of AI to develop a first-of-its-kind, noninvasive glucose monitor. It’s called Bioviit.

In addition to blood glucose levels, the device measures oxygen saturation, heart rate and temperature.

All patients have to do is place their fingertips inside the machine, which is about the size of a tissue box. The device then uses a high-powered light to measure the energy footprint of glucose in the patient. Next, the data is fed to the company’s proprietary AI system, which uses machine learning to render a diagnosis.

No blood draws, no painful finger pricks. Accurate results are delivered in mere moments. Even better… the device can be reused. In fact, it can be used by multiple patients.

Worldwide, a whopping $966 billion is spent on diabetes treatment each year. With the potential to completely disrupt how diabetic patients test their glucose levels, it’s no surprise that Viit Health was a regional winner and global finalist at last year’s Startup World Cup in Silicon Valley.

The company is led by a team of seasoned veterans in the space. CEO Luis Fernando is well known for creating a “startup factory” when he was 20. It’s gone on to successfully launch seven tech companies. His co-founder, Luis Gomez, graduated from Harvard before beginning a career in corporate law. He’s held high-ranking management positions at Citibank Mexico, AT&T, Chrysler and more.

According to the company…

Leading health experts and investors understand the true cost of diabetes and the need for better diagnosis and monitoring tools. It’s why Mexican and American leading scientists and institutions, entrepreneurship organizations, engineering companies and global social investors have lined up behind Viit’s work. It’s the public consumer healthcare breakthrough the world’s been waiting for.

So far, Viit Health has raised more than $2.5 million from private investors. It’s also received a $3 million grant to aid in research and development.

Consider this your invitation to learn more about the company and see what all the fuss is about.

Viit Health is currently accepting new investors via WeFunder.

Note: We’ve found that readers tend to buy the stocks in these special reports at different times. Keep in mind that we may have taken profits or stopped out of a recommendation by the time you read this report. Please refer to the current portfolios for the most up-to-date recommendations.

© 2025 Manward Press | All Rights Reserved

Nothing published by Manward Press should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investment advice. We allow the editors of our publications to recommend securities that they own themselves. However, our policy prohibits editors from exiting a personal trade while the recommendation to subscribers is open. In no circumstance may an editor sell a security before subscribers have a fair opportunity to exit. The length of time an editor must wait after subscribers have been advised to exit a play depends on the type of publication. All other employees and agents must wait 24 hours after publication before trading on a recommendation.

Any investments recommended by Manward Press should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Protected by copyright laws of the United States and international treaties. The information found on this website may only be used pursuant to the membership or subscription agreement and any reproduction, copying or redistribution (electronic or otherwise, including on the world wide web), in whole or in part, is strictly prohibited without the express written permission of Manward Press, 14 West Mount Vernon Place, Baltimore, MD 21201.

August 2023.