How to Collect Cash on Stocks You Already Own

Most investors think that when they buy shares of a company, the only thing they can do is hold on to them in the hopes of generating a profit.

The traditional investing mantra is “buy and hold.”

These days, it’s more like “buy and pray.”

Fortunately, there’s another option.

In an unsteady market environment like today, writing – or selling – covered call options is another way many shareholders can generate higher returns simply by “renting out” the shares they own for monthly income.

Let me explain…

You see, writing a covered call option is like renting out a home with the option to buy.

Just imagine a lease in which the tenant agrees to pay a certain amount of rent each month to a homeowner for a certain period of time. And at the end of that time period, the renter then has the option to buy the home from the property owner.

When you write a covered call option, you’re basically doing the same thing.

In this case, you are the “landlord” since you own the shares you’re “renting out.”

The buyer of the call option would pay you – the seller of the call option – a premium for the right to become the new owner of your shares if that stock hits or rises above a certain price (i.e., the strike price) by a specified date (i.e., the expiration date).

The concept is really that simple… and particularly low risk.

In fact, many investors today get started in the options market by writing covered call options because this strategy is so low risk.

And while there is some risk involved – as with any trading strategy – most of it comes from owning the stock, not selling the call.

Now, before we get into how to actually sell a covered call in your brokerage account, there are three scenarios that can happen once you’ve sold your covered calls. So let’s take a look at each situation.

(Also, keep in mind that a single option contract represents 100 shares. So you’ll need to own at least that many shares of a particular company to use this strategy.)

Covered Call Scenario No. 1: Shares Go Up and Become “In the Money”

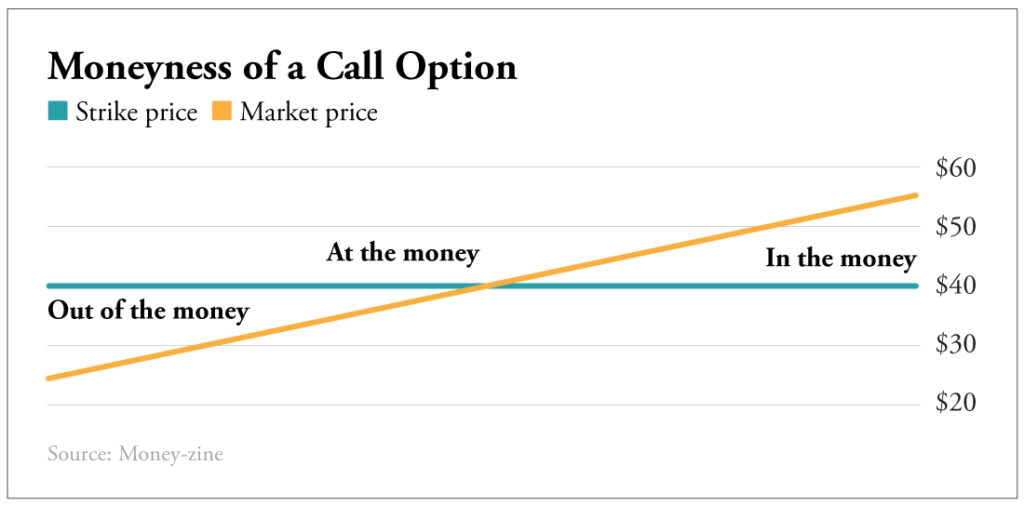

The stock price becomes “in the money” when shares rise above the strike price.

If your call option is in the money by the expiration date, the call option will be exercised and you’ll be obligated to sell the underlying shares to the buyer.

That’s okay. You’ve already made money on the trade.

You get to keep the premium that the buyer paid you, which adds to the returns you likely made as the stock rose to your chosen selling price.

The only bad news here is if the stock continues to climb higher, you’re going to miss out on any of the extra gains that come after shares hit the strike price. But in a volatile market, a profit in the bank is almost always better than a profit on paper.

Covered Call Scenario No. 2: Shares Go Up but Stay “Out of the Money”

This scenario is the sweet spot. This is when the stock’s price doesn’t rise above the call option’s strike price by the expiration date, causing the calls that you sold to expire worthless.

Since the stock never actually hit the strike price, you won’t be obligated to let go of your shares. But you’ll get to keep the premium paid to you by the option’s buyer.

And you’ll make money from any future price increase of the stock, which you still own.

Altogether, adding the option premium on top of the stock appreciation helps to supercharge your investment returns on a stock you were holding on to anyway.

Covered Call Scenario No. 3: Shares Go Down

This last scenario can be bittersweet. But it’s much better than the alternative. In this case, your shares not only are trading below the call option’s strike price at the expiration date but also are down from when you bought them.

That’s never great news.

But there is an upside to this situation.

The cash you received when you sold the call option helps to offset your losses, which means your downside is actually reduced.

In fact, depending on how much your stock position is down, the option premiums might be just enough to keep your position in the black.

So really… writing covered calls is a win-win situation.

How to Sell a Covered Call

Here’s how to do it in your account…

(Note: Every brokerage account will appear different, but the same general process applies for most brokerage services.)

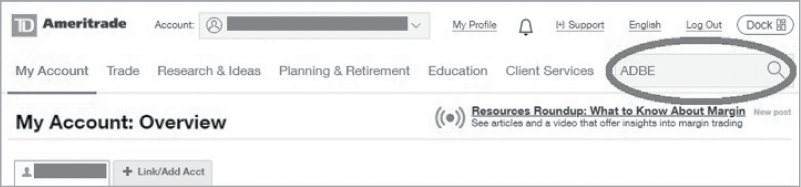

First, choose one of your stocks you wish to sell a covered call on and type its ticker symbol into the broker’s search bar.

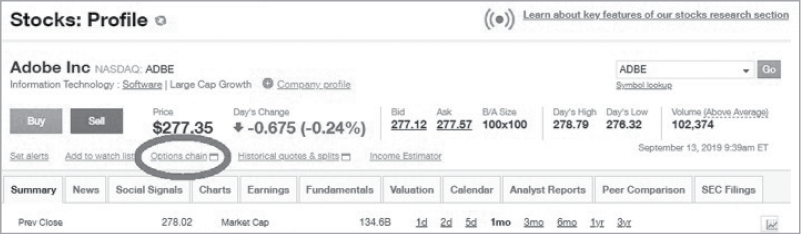

You’ll then be brought to a profile page for the stock.

There, find the “Options chain” for the stock.

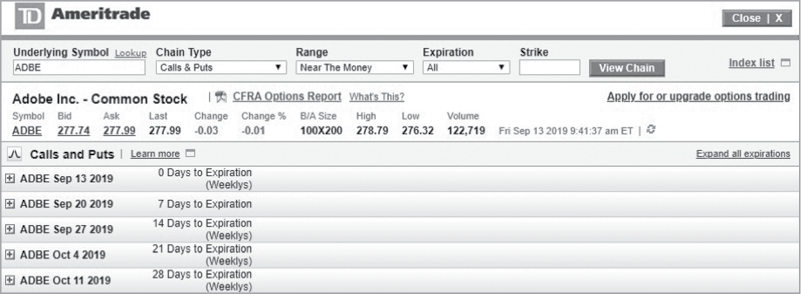

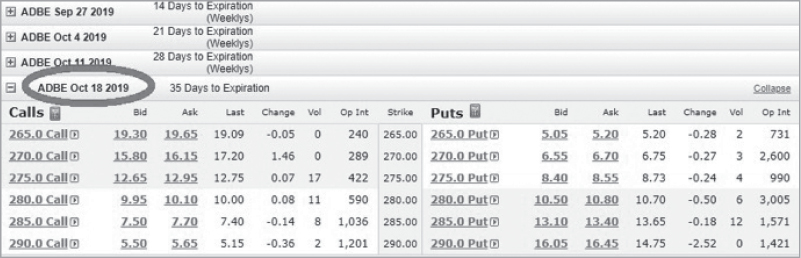

Click through to the options chain section and you’ll see a list of options with different expiration dates.

You can sell any call option you’d like to earn income. But I recommend choosing the closest option expiring in the next available month. For example, if the current month is September, choose a call option expiring in October.

Select a call option trading out of the money. Remember, that means the call option’s strike price is above the stock price. We’ll choose the October $280 calls in this example because they offer a large premium and we don’t mind selling our shares if prices climb that high.

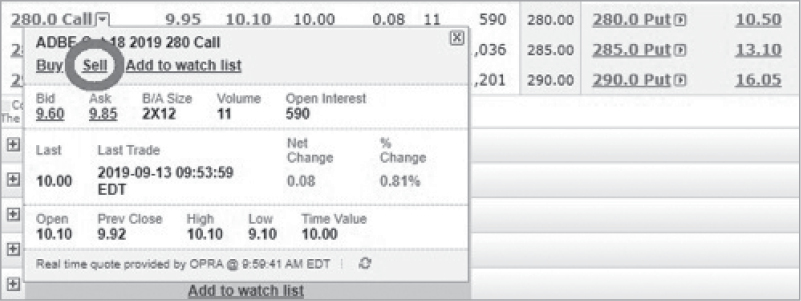

Click “Sell” to begin your order.

You’ll then be taken to an order screen.

In this example, the October $280 call options last traded for $9.65.

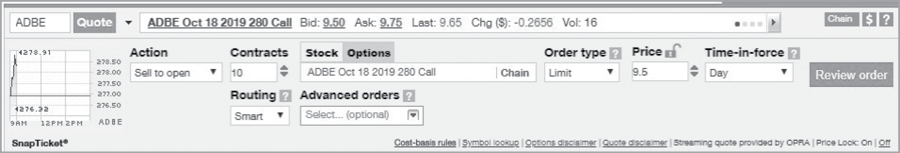

Since each contract represents 100 shares, that means selling one contract could generate $965. However, selling 10 contracts would earn you $9,650. But don’t forget this is a “covered” strategy, which means you must own an amount of shares equal to or more than the total covered by your contracts. In this case, 100 shares for one contract or 1,000 shares for 10 contracts.

Under the “Action” tab, choose “Sell to open.” Then type in the number of contracts you want under the “Contracts” section.

Under “Order type,” always use a limit order. And under “Price,” choose a price between the bid and ask.

When you’re done, select “Review order.”

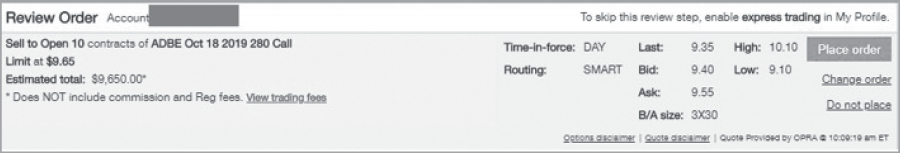

Check to see that all of the order details are correct, including the total premium you’re expected to receive.

Then, all you have to do is click “Place order” and you’re done!

In today’s market environment, this little-known options strategy may be a useful tool for investors to boost their returns even higher, without adding any unnecessary risk.

Final Thoughts

Here are three things to keep in mind when selling covered calls…

First, average call options volume must be 1,000 contracts or more.

That means the market for these options is liquid and you’ll be able to find ready buyers for contracts you sell in order to collect a premium.

Second, the implied volatility of the company’s stock is no less than 20% below its average historical volatility over the past 90 days.

Implied volatility is a mathematical measure of a stock’s future price volatility based on the call options markets.

When implied volatility is within close range of the stock’s recent past volatility, the option is likely fairly priced.

But when implied volatility is higher than historic volatility, it suggests the stock price is likely to move up in the coming days or weeks.

Since volatility is a major factor in pricing an option, finding stocks with higher implied volatility means you’ll likely get a better premium price for the option.

That means more income for you to collect.

And last, my third criterion is the stock price.

Chances are, options prices increase relative to the price of the underlying stock. So the higher the stock price, the bigger the option premium.

This income-generating secret will give you access to one of the market’s smartest and most profitable investing strategies.

Note: We’ve found that readers tend to buy the stocks in these special reports at different times. Keep in mind that we may have taken profits or stopped out of a recommendation by the time you read this report. Please refer to the current portfolios for the most up-to-date recommendations.

© 2026 Manward Press | All Rights Reserved

Nothing published by Manward Press should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investment advice. We allow the editors of our publications to recommend securities that they own themselves. However, our policy prohibits editors from exiting a personal trade while the recommendation to subscribers is open. In no circumstance may an editor sell a security before subscribers have a fair opportunity to exit. The length of time an editor must wait after subscribers have been advised to exit a play depends on the type of publication. All other employees and agents must wait 24 hours after publication before trading on a recommendation.

Any investments recommended by Manward Press should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Protected by copyright laws of the United States and international treaties. The information found on this website may only be used pursuant to the membership or subscription agreement and any reproduction, copying or redistribution (electronic or otherwise, including on the world wide web), in whole or in part, is strictly prohibited without the express written permission of Manward Press, 14 West Mount Vernon Place, Baltimore, MD 21201.

June 2022.