Huge News: An Icon Joins Manward – Revealing His Six Steps to Becoming a Decamillionaire

Plus… the First Thing Every New Investor Must Do… and Fresh News From NASA Could Spell an Easy Double for This Hot Stock

Dear Reader,

So what’s the next step?

It’s one of my favorite questions. It’s gotten me out of a lot of jams. And it’s a question a lot of folks are asking themselves right now.

I’ve done a lot of crazy things (so far) in my life.

In my younger days I fought raging fires… arrested bad guys… and lived in the wilderness.

After that, I braved the world of Wall Street, launched a handful of companies and even put a couple of kids on this Earth.

And now a coronavirus panic…

Through it all, I’ve learned that nothing will get you what you want quicker and more easily than asking that question above – What’s the next step?

Longtime readers know about the time my floatplane nearly crashed in the Alaskan wilderness. If I didn’t have my next step in mind… I’d be dead today.

It was the same in the world of chasing bad guys and putting out fires. Many people die each year simply because they fail to react.

They don’t move. They freeze, letting calamity unfold around them. They never take their next step.

The fear of doing the wrong thing is so strong, they do nothing instead.

Did you know, for example, many folks who are killed in plane crashes don’t die because of a sudden impact with the ground?

Nope. It’s far worse.

They die because they panic and fail to move. It’s the fire and smoke that kill them.

You can probably see where I’m headed with this. It’s a question for you. When the smoke clears, what is your next step?

Dare to Get Rich

As you know, I live a much tamer life these days. The most heroic thing I do now is help folks make money.

In many ways, it’s harder than fighting a fire or talking a drunk out of doing something stupid. With money – especially in times of extreme volatility and panic – the next step isn’t obvious. Unlike a fire that begs attention right now… money seems to beg us to wait a bit and see what tomorrow brings. That’s dangerous. It will burn you.

That’s why I am so excited about this issue. Not only does it reveal the HUGE next step for Manward, but I’m confident it will help thousands of readers take their critical next step once we make it through these surreal times (and, make no mistake, we will).

After months of phone calls and emails, I’ve secured a fresh contributor to Manward. He’s an icon in the world of money, entrepreneurship and good, clear thinking.

I can say without a doubt that I would not have all that I have without Mark Ford and his sage advice on money.

I’ve read his books. I’ve printed and highlighted his essays. And now I am extremely honored to bring his ideas to you each month.

Mark is the founder of Early to Rise, which garnered him nearly a million followers. He’s involved with dozens of multimillion-dollar businesses. He’s an expert in fine art, a visionary in the realm of real estate and a champion in the world of martial arts.

But after making millions of dollars for himself, he’s got a new goal. He wants to give away 90% of his wealth over the next decade. You’ll learn more about his story, his incredible drive for success and his many moneymaking ideas in the pages (and months) ahead.

What’s Your No. 1 Priority?

But here are a few key lines that I beg you to keep an eye out for in Mark’s essay:

If you really – really – want to accomplish something, you have to make it your top priority. And that means putting all your other goals (mine included becoming a teacher and a writer, mastering martial arts, and traveling the world) in second place.

It ties perfectly to a bit of an unintentional theme in this month’s issue… If you want to reach your goals, you must take that first step.

You’ll see what I mean in my first essay. In it, I answer a question that every investor has asked at some point. I hear it almost daily.

In fact, if I had to pick just one thing that keeps folks from reaching their financial goals… it would be not knowing the answer to this question.

The answer is not complex. In fact, I break it down, step by step, to a final, simple action to take.

When you reach the final words, this powerful barrier to getting rich will be busted for good.

That’s perfect. Because you’ll need to get it out of the way if you want to take advantage of the many, many opportunities that are to come in the next few months and even years… starting with the stock I uncovered this month.

It’s a perfect stock for 2020.

It’s high-tech. It’s safe. And yet it has the potential to double your money by the time the year is out.

It’s the continuation of a theme I am very excited about – a theme that could end up being the hottest investing topic, not of the year or the decade… but of the 21st century.

I’m excited. My little passion project has come to life.

We’ve scored yet another of the greatest minds in the business. We’re sharing fresh ideas with tens of thousands of eager readers each month. And we’re sticking together in good times and bad.

It’s all because I had the guts to take the next step.

So I ask again… What’s your next step? Don’t just write it down. Take it.

If your goal is to come out stronger when the panic subsides… your path is blazed in the pages ahead. Enjoy.

Be well,

Andy

Answered: The No. 1 Question I Get Each Day…

How to Pick the Perfect (and Free!) Online Broker

Do you want to make some money? Do you want to lay your head back tonight and not worry whether the moves you made today are good enough for tomorrow?

Or, let me put it to you this way, do you want to get rid of that nagging feeling in the back of your head that’s telling you to do something different?

Doing what I’ve done for the last 20 or so years, I get asked a lot of questions about how to make money.

But I get one more than any other… by at least 10-to-1.

“How do I make my first trade?”

Here’s the crazy thing though.

This question doesn’t come from young adults or folks just starting in their careers. It most often comes from folks with the hopes of retiring soon and even those who pay me thousands of dollars each year for my investing advice.

At first, I thought it was insane.

These folks all know the virtues of investing. They all know that it’s the difference between the life they have and the life they want.

And yet… they’ve never taken their first step.

Are they lazy? No.

Are they not smart enough to make the right choices? Not unless you think your doctor or his attorney is stupid… because these are the sorts of folks I hear from.

The problem is pandemic.

Despite record low unemployment, 80% of Americans today say they live from paycheck to paycheck… and nearly half the nation doesn’t have a spare $400 to pay for an emergency.

Clearly there’s something big at play. I made it my mission to find out.

When I spoke at conferences… I asked the audience.

I polled my readers… hundreds of thousands of them.

And I read the typical “how-to” investing literature.

Overwhelmingly, I kept running into the same idea.

Folks simply don’t know where to start.

Google search data proves it. The phrase “how to start investing” has surged in popularity right alongside “11-year-old bull market” – exploding nearly tenfold since the market bottom in 2009.

It’s proof that Americans want to invest… but don’t know where to begin. Let’s fix that right now.

Over the years, I’ve found that one small, simple step is the biggest obstacle for new investors. Once they get it out of the way, the odds of them making their first successful trade go way up.

Once folks set up a brokerage account… they’re well on their way to what once felt only like magic – turning their dreams into reality.

So let me show you how to do it.

Even Pros Must Keep Reading

I’m writing this knowing that many readers have a brokerage account. Many of my readers are serious investors who come to Manward for our experience and fresh ideas.

If that’s you, don’t discount what’s ahead.

You may learn about a better platform… or how to do things cheaper or more efficiently.

I’m about to compare all the major online brokerages – which is all you need to start investing these days.

But first, it’s vital to know how the system works. You must know what happens when you make a trade.

When most folks think about buying a stock, they think of the trading pits on Wall Street. They envision a floor filled with men wearing colorful jackets, shouting out prices and fighting for the best advantage.

That was the case when I started in the industry, when stock prices were still quoted in fractions in the back of the daily newspaper. But things are a lot different now.

When we buy a stock online, there’s a good chance a human never even sees the trade. That’s because the broker is tied to the exchange’s computer system and the back-and-forth between buyers and sellers is handled automatically in a matter of milliseconds.

All we need to do is enter the ticker and the price we’re willing to pay… and the system does the rest.

It’s one of the reasons placing a trade is so cheap (it’s free in most cases). The expensive humans have been pulled out of the process.

But it’s also why you need to use a broker.

The average person doesn’t have access to these complex networks of buyers and sellers. They need a broker to act as an intermediary.

But just because there’s a middleman between you and the person who sells you his shares doesn’t mean you’re paying a higher price.

Like I said, most online brokers now offer free trades.

When It’s Free… Everybody Makes Money

Commission-free trading is a huge (and important) trend in the industry. It’s leveled the playing field, making Wall Street available to anybody and making it easier than ever to make a profitable trade.

But there’s no need to pray for your poor broker each night or send a thank-you note with each trade you make.

It’s making plenty of money… even while giving away trades for free.

In fact, free trades are actually creating more profits for brokers.

If you’ve followed the industry, you likely know that Robinhood arrived on the scene in 2013 with the Manward-esque mission of “providing everyone with access to financial markets, not just the wealthy.”

It stunned the market with the introduction of commission-free trading.

Anybody could create an account (with no minimum balance) and trade stocks without paying a penny for the service.

Within five years, Robinhood was competing with Wall Street’s big boys.

By early 2018, it found its 3 millionth customer… reaching the size of E-Trade.

So how was Robinhood able to offer free trades when everybody else was charging five bucks or more?

Well, it did it by accepting payments for order flow… a process reportedly made popular by none other than Bernie Madoff.

The broker took payments from third parties that were able to process the deals and extract a profit by fulfilling the trades at prices slightly higher (for buys) or lower (for sells) than the market’s current price.

In other words, investors paid a few extra cents for each trade… but saved on commissions.

It’s a controversial practice the firm says it no longer employs. A $1.25 million fine from the Securities and Exchange Commission last year likely helped with the decision.

These days Robinhood makes its money in the same way big-name brokerages like TD Ameritrade, E-Trade and Morgan Stanley make their profits. It works like a bank.

Money for Nothin’

Yes, the majority of the money that goes into a person’s account is invested in stocks or bonds. But some of it isn’t. There’s liquid cash sitting in almost all accounts – whether it’s just a few bucks or a few hundred thousand bucks. Across millions of accounts, it adds up.

The brokers take that money and lend it out… just like a bank.

They get interest on it… just like a bank.

And they profit handsomely from it… just like a bank.

Take Charles Schwab, for instance. Late last year, the value of its clients’ accounts totaled $3.7 trillion. About $265 billion of that was cash that earned the company interest.

Schwab made more than $5 billion from it… which was more than half its net sales for the year.

At TD Ameritrade, these funds accounted for more than 20% of its revenue. And at E-Trade, interest earned on customer cash was good for $2.8 billion in net revenue.

Again… there’s no need to cry for brokers that offer zero-commission trades. They’re doing alright.

In fact, here’s a mandate for all new investors. DO NOT pay a commission to make your trade.

Here’s a list (there may be more) of brokers that offer free trades:

- TD Ameritrade

- Fidelity

- E-Trade

- Charles Schwab

- TradeStation

- Interactive Brokers

- Merrill Lynch

- Robinhood.

Thanks to the competition kicked off by Robinhood nearly a decade ago, the industry standard is now zero commission. Do not stand for anything else.

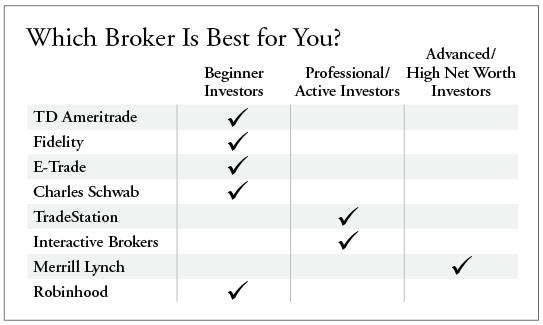

But how do you know which of those brokerages is best for you? That’s the question I hear all the time. My answer comes down to one thing… investing experience.

Where Are You?

Check out that list above again. I put it in that order for a reason. The brokers at the top of the list have the best and easiest-to-understand platforms for beginners. They offer no-fee stock trades, great research resources and strong customer service. If you’re just starting out… start there.

If you’ve got more capital to invest (more than $500,000) or are looking for more hand-holding, Schwab may be for you.

Morgan Stanley is also an option if you’ve got more money to put down. We didn’t include Morgan Stanley in the list because it doesn’t offer free trades. But you may have heard that Morgan Stanley recently made a big bid to acquire E-Trade. It’s a smart move, and if you’ve paid attention so far, you’ll nod along as I tell you why.

Morgan Stanley has typically been a mid- to high-end broker. It works with some 3.5 million clients (totaling $2.7 trillion in investable assets) and has a fleet of 15,500 advisors to cater to them. The company does not target the masses.

E-Trade, on the other hand, does. It has more than 5 million retail customers, but it has just $360 billion in total investable assets.

On average, an E-Trade customer has an account size of $70,000… whereas the average one at Morgan Stanley has closer to $900,000.

By acquiring E-Trade, Morgan Stanley hopes to gain a larger base of clients… get its fingers on a lot more cash to lend… and, hopefully, turn some of those lower net worth customers into high net worth clients.

Assuming the deal gets approval, it makes E-Trade an appealing portal for new investors to make their first trade. Few other brokers can boast such a robust offering.

But not all of our readers are new investors. For folks looking for a richer research platform with greater access to options tools and strategies, TradeStation and Interactive Brokers are solid choices.

They’re the go-to choice of many professional traders and ultra-active investors.

As for the two companies at the bottom of the list, well, they’re on opposite ends of the spectrum. I’d recommend Merrill only to high-end investors with a good deal of net worth. It has robust personalized options but also high fees and large minimums.

Robinhood, on the other hand, doesn’t get much love from me. Now that competition has killed commissions across the industry, Robinhood doesn’t offer anything more than a simple easy-to-use platform. It doesn’t feature much research, how-to or any sort of hand-holdings. It’s as basic as basic can be. You can do better.

My money… quite literally… is in TD Ameritrade and Fidelity. It has been for years. But if I were just starting today, I’d go with E-Trade.

It has a rich array of tools and guides. It’s cheap. And the deal with Morgan Stanley will surely make it the broker to beat in the industry.

Make your next step… and open an account today.

Andy Snyder has made his followers rich. After leaving one of the nation’s leading brokerages, Andy decided to take his wealth-exploding advice to the masses. Using his nearly two decades in the investing business to create award-winning model portfolios, he provides clear and easy-to-follow guidance on the best stocks to invest in each month in Manward Letter.

The Best Stock Since the Dutch East India Company?

Yes. This One Will Dominate the Biggest Trade Route of the 21st Century

I’ve found the perfect new investment for a rocky 2020.

Whether you’re a novice investor looking to score your first big win or, like so many readers, a seasoned pro eager to score your next big double… this is a grand opportunity.

This company is an appealing combination of high-tech wizardry and good old-fashioned American business sense.

It has big contracts with the boys in Washington… plays a vital role in keeping the nation (and much of the world) fueled up and running… and is working in a cutting-edge industry that I’m convinced represents the biggest opportunity of the 21st century.

We’ll start there.

The 18th and 19th centuries were times of great global expansion. Technology helped the expansion, but new worlds came largely under the feet of the brave men who were willing to risk their lives to see what was over the horizon of the rolling waves or on the other side of the snow-covered peaks.

Europe sailed west. And then Europeans-turned-Americans hitched their wagons and followed the setting sun.

Thanks to their toil, the 20th century brought on a different kind of expansion.

A century of exploration uncovered a bounty of natural resources. Americans took full advantage of them to unlock an industrial boom like the world had never seen. Cars, planes and eventually the internet made the beginning of the 20th century look hardly recognizable to the folks living at the end of it.

The Next Big Exploration

These days, as I detailed in the February issue of Manward Letter, mankind is exploring space like never before.

We’ve combined our lust for exploring new lands with our technological might to push our way into space like never before. I’m very excited about what’s happening – especially how the private sector is flat-out trumping the government’s tired and expensive efforts.

The revolutions that will come from the fierce work going on over our heads right now will no doubt lead to the biggest breakthroughs of the 21st century.

How we treat disease… communicate… and even wage war is all being decided hundreds of miles above us… right now.

There are lots of companies working in space.

Many are high-tech startups with lofty balance sheets, unproven business models and a dream as big as the galaxy around them.

That’s good. It’s the stuff that great transformations are born out of.

But plenty of ships sank ahead of and behind the Mayflower. And Columbus tossed the bodies of many men over the gunwale while he was lost at sea exploring new worlds.

Speculation is a requisite of exploration. But what gets me truly excited is when the big firms of the world put their sails into the wind and head west.

Men like Henry Hudson and Giovanni da Verrazzano may have first explored the New World… but it was private-sector behemoths like the Dutch East India Company (the first publicly traded company, by the way) that truly brought expansion.

I’m convinced KBR (KBR) is the modern-day equivalent.

This Will Be Huge

Take, for example, the company’s work in the heavens above us.

For the first time in its history, Washington has just granted a private company – KBR – the right to train astronauts at NASA facilities.

This one-of-a-kind Space Act Agreement is yet another huge victory for the private sector as it sets up to dominate the biggest space race yet.

KBR is now set to train private citizens to operate various systems on board the International Space Station – ranging from mission planning and emergency response to routine, daily tasks.

This deal represents a huge step forward as NASA makes good on its word to enable a healthy, sustained low Earth orbit economy.

In all, KBR is one of the most important NASA suppliers. It works out of at least 11 of the agency’s facilities and helps with nearly every aspect of its operations.

Again, just as the Dutch East India Company got critical support from the government, KBR works hand in hand with the folks in Washington.

For investors… it’s a vital aspect of why this is an ideal company to own a stake of in 2020.

Recession-Proof

KBR’s contracts are not going away. They can’t. If anything, Washington and its global counterparts will soon be sending more checks to the company.

After all, this $3.8 billion mega-company is hardly just a space contractor.

KBR works all around the globe installing bridges, building critical highways, helping to make fertilizer for our farmers and even working to pull energy out of the ground.

It’s building the famed Qatar Expressway, working on a high-tech wastewater treatment plant in Victoria, Australia (which includes a virtual reality mock-up so stakeholders can “try out” the facility before a single ton of dirt is moved), and wrapping up work on the first new nuclear power plant in the United Kingdom in nearly a generation.

Clearly the company is doing big things.

This is exactly the sort of stock you should own in a year as contentious and volatile as 2020.

It’s big. It’s steady. And yet it’s on the cutting edge of some of the most important innovations of the 21st century.

The company fits our investing model perfectly. We can’t go outside without seeing its work. Its equipment fuels our cars… Its engineering lights up our homes… And now its expertise and drive are playing a key role in the boom that’s taking place over our heads.

Its business is simple to understand and not easily replaced.

And, perhaps most appealing these days, the company is good pals with Uncle Sam and his checkbook. In a world that’s looking for stimulus, he’s a fine pal to have.

This is the ideal stock for our Own What You Know Portfolio. Whether you’re new to investing or have a reserved parking spot on Wall Street… KBR is a must-own stock.

Action to take: Buy shares of KBR (NYSE: KBR) at the market’s price. We’ll use our standard 25% trailing stop with this position.

Mark Ford is an icon in the realm of wealth and business. His common-sense advice has the power to change the lives of everyone who takes it. And now… we’re thrilled to bring his ideas to you through Manward Letter.

Six Steps to Becoming a Decamillionaire, From a Man Who Started Out Broke

By Mark Ford

I had my first dream of being rich when I was 6 or 7 years old.

In my dream, a sleek, white limousine pulls up to the playground. My classmates stop and look. A chauffeur comes around the car and opens the back door. Little me, in a white tuxedo and holding a gold-tipped cane, steps out. The gasps of astonishment and admiration are audible.

The reality for my family and me was otherwise. Ten of us were crammed into a dilapidated little house across the street from the municipal gravel pits. I wore hand-me-down clothes donated by local charities. We drank powdered milk because we couldn’t afford real milk.

I had many such dreams as I grew into an adult. But it wasn’t until I was 32 that I did a series of things that made me rich. By my 50th birthday, against all odds, I had accumulated more wealth than I was ever going to be able to spend.

So I took a stab at retirement. In 2000, I dropped or delegated away most of my business activities and focused on writing about what I’d learned…

I wrote about marketing and management and starting entrepreneurial businesses and earning wealth. Under the pen name Michael Masterson, I wrote eight books on those topics and more than 2,000 essays for my blog Early to Rise.

In 2010, I passed Early to Rise on to the reliable supervision of Craig Ballantyne. I thought I was done writing about wealth. But in recent years, I’ve written loads more. More importantly, I’ve learned more.

I’ve still got plenty to learn. But I’m pretty sure of one thing: With the right mindset and game plan, any ordinary, unconnected, wage-earning American can become wealthy.

Most people – like 98% – who fantasize about becoming rich never will. But for those who do the right things in the right order over a reasonable amount of time, the chances are very good. I’d say 90%-plus.

Doing the right things in the right order over a reasonable amount of time – what does that mean?

Here are six things that worked for me and that I’ve found – through all these years of writing and talking and mentoring on the subject – have worked for many others. That includes dozens of my protégés. In fact, I’d bet they are the same strategies that are working for the 1,700 people who become millionaires every day.

1) Get Your Priorities Straight and Be Straight With Them

I set to work on building wealth at an early age. I worked for my neighbors starting at 8 or 9 years old, published and sold my first “book” at 11 (Excuses for the Amateur), and worked two jobs (a paper route and car wash on the weekends) when I was 12.

I learned some important lessons about making money back then, but the big breakthrough came much later, when I was 32.

I was the editorial director for a newsletter publishing company in Boca Raton, Florida, at the time. But I was also taking a Dale Carnegie course to acquire public speaking skills. I learned a bit about that, but I also learned an important lesson about achieving goals.

The lesson was that if you really – really – want to accomplish something, you have to make it your top priority.

And that means putting all your other goals (mine included becoming a teacher and a writer, mastering martial arts, and traveling the world) in second place.

After much mental haggling, I chose – as my one and only top priority – the goal of becoming rich.

That changed me. It changed the way I worked. It changed the way I spoke. It changed virtually every choice I made at work and many of the choices I made at home.

By having “getting rich” as my one and only top priority, my financial DNA changed almost overnight. I became an instinctive wealth builder.

You can do this too.

It requires sacrifices. And you must accept the fact that you will be living an out-of-balance life. But if you want a 90%-plus chance of getting rich, make it your No. 1 goal and put everything else in second place.

2) Have the Right Numerical Targets

If getting rich and retiring is your goal, you need to know where you are, and you need to know where you’re going. That means you need to make a plan.

When it comes to financial planning, there are three numbers you need to know:

- Your lifestyle burn rate (LBR)

- Your start-over-again fund (SOF)

- Your take-a-hike target (TaH).

Pursuing wealth without a specific knowledge of these three numbers is like driving around a city searching for a restaurant without any idea of its address.

Most people – high earners as well as working-class people – go through their lives striving for financial peace of mind without any idea of what these numbers are or should be. As a result, wealth is always around the next corner.

I’ve explained in detail how to find these three numbers in various essays over the years. But here’s the gist:

- Your LBR number is how much you need to spend each year to enjoy the lifestyle you want. It’s easy to find this number. Simply calculate how much you are currently spending each year, and then increase that by the yearly cost of all the extra things you’d like to have that you don’t have now.

- Your SOF number is what you need to have socked away in case everything else fails. It’s basically your monthly LBR expenses multiplied by the number of months you would need to get back on your feet, plus whatever money you might need to start a new business (if you are an entrepreneur or professional). This is the safety net you must construct to have true financial security.

- Your TaH number is the amount of money you need to have self-sustaining wealth without working. The simplest way to estimate this number is to take your LBR, subtract any side-business income you have (and expect to continue to have after you quit your main job), subtract any income from Social Security or a pension, and then multiply that total by 15. That amount, kicking off 6.75% returns in income, will give you enough money for you to be able to say to your boss, “I don’t need this stupid job. Take a hike!”

If you don’t know these numbers, you can’t expect to make smart choices about your finances.

3) Grow Your Active Income and Net Investable Wealth

I retired for the first time when I was 39. I had a net worth in the eight-figure range, half of which was liquid. You’d think that would be more than enough. But my LBR at that time was very high.

The millions I had socked away would not give me the income I needed to continue enjoying my big-shot-spending life.

I had a choice: I could drastically cut down my spending (and thus my lifestyle) or I could go back to work. I thought about it for a while. And then I went back to work.

I’m being cute here, but there’s a serious point:

Neither your earning power nor your investable income can increase by saving money. And those two things – much more than how much you can save – will determine your future wealth.

Plus, let’s face it: Ratcheting down on your lifestyle isn’t fun.

Going back to work was a great decision for me. I found a great person to partner up with, an exciting wealth-building challenge, and a chance to double and then triple my wealth in the ensuing years.

So say no to the Scrooge in you. Focus on these two things:

- Increasing your active income

- Saving most of that to increase your net investable wealth.

And if you want to know the best way to earn more income, it’s to…

4) Develop a Financially Valuable Skill

A financially valuable skill is one that allows you to make a lot of money – a lot more money than the average Joe. It also allows you to quit your job and take a better one or start your own business. In terms of your financial education, developing one of these skills is objective No. 1.

When you boil it all down, there are only a handful of financially valuable skills: marketing, selling, creating saleable products and managing profits.

There are plenty of financially valued skills (like doctoring or lawyering or plumbing), but only those I listed above are valuable regardless of the business or circumstance.

Yes, societies and companies value people who know how to design a car engine, analyze a spreadsheet or fix a broken arm. But if you want to be 90%-plus sure of becoming wealthy, you have to develop a skill that you can use anywhere, anytime, in any situation. And that means a financially valuable skill.

5) Live Rich

I said above that I don’t believe in scrimping. I hate and disagree with the idea that, to become wealthy (or even have enough money to retire on), I must spend 30 or 40 years denying myself the richness of life.

You can live rich – i.e., enjoy all the benefits and pleasures of being wealthy – long before you become, say, a millionaire.

I’ve spent a lot of time thinking and writing about this subject. In fact, I published a book on it called Living Rich.

My thesis, in a nutshell, is that there are two ways you can experience wealth – in what you can buy and how you spend your time.

The myth is that you get what you pay for (or that if you want the best, you have to pay the most). That’s completely untrue. Here’s one example:

We can agree that good, restful sleep is essential for a happy life. Ideally, you’re going to spend around one-third of your life sleeping. So rather than “pay up” for an expensive car or necklace, buy a great mattress.

By getting a great mattress (which can be bought for less than $2,000), you’ll sleep as well as any billionaire… and be just as happy.

Your family can be just as happy in a house that costs $350,000 as they’d be in one that costs $10 million or $20 million. Likewise, a $25,000 car will get you where you want to go just as well as a car that costs 10 times that amount.

There are dozens of ways to live like a millionaire on a modest budget. If you learn those ways, you’ll have a tremendous advantage over everyone else at your income level.

6) Don’t Count on Passive Investing to Make You Wealthy

I’ve said this time and again: You cannot become wealthy by investing in passive instruments like stocks and bonds.

The investment advisory industry – and by that, I include brokerages, private bankers and insurance agents, as well as investment newspapers, magazines, newsletters and internet publications – is a multibillion-dollar business based on this little white lie.

They want you to believe that you need them to grow your wealth. But the only sure thing about investing with them is that they will become wealthier (from all the fees and commissions they charge you!).

Passive investments are not bad. But believing that they are the best and safest way to build wealth is downright foolish.

The truth is, building real wealth involves much more than just investing in stocks and bonds.

In fact, most of the rich guys I know spend little or no time investing in passive financial instruments.

They got rich – every one of them – by following the six strategies I’ve just described.

If you want to do more than dream about getting rich, you have to abandon the myths that have been tethering you to financial habits that aren’t working. You have to be willing to do something different. You have to be willing to take these six steps.

Here’s to hoping you do!

Investing in a Crisis

How Manward Readers Will Thrive No Matter What’s Ahead

By Andy Snyder

Times are tough.

March was a devastating month for stocks. It was hell for the healthcare sector. And our culture and the economy it supports were shaken to the core.

An invisible bug showed that it’s not size or strength that matters… it’s persistence.

The virus spread fast, and it latched onto nearly everyone it came near. When one country fought back, it moved to the next, then the next until nowhere was left uninfected.

The government’s reaction to the event is unprecedented. The message was simple – shut down and worry about money later. An economy can’t thrive when bars are closed, factories are shut down and folks are locked in their homes. But persistence never fails.

Healing With Hope

Our model portfolios are a ghost town these days. I’m fine with that – perfectly fine.

Our safety valves opened up and relieved the pressure. We follow a trailing stop strategy that’s designed exactly for situations like these.

It keeps our emotions out of an already complicated equation. It doesn’t rely on “averaging down” or “picking the bottom” – fools’ errands that will empty your pockets faster than any virus.

From here, the strategy is straightforward. We won’t stop. We’ll remain persistent and full of fury.

We’ll buy good companies at good prices… and we’ll sell them only when our exit strategy tells us to.

Even in the face of adversity, I’m more convinced of the idea than ever. That’s because I spent some time over the last few weeks digging through my archives of the nation’s last big crisis.

It was proof that we’ve been here before… and made it out not just fine, but flat-out better for the worry.

I plugged in my old hard drive and scrolled through the dozens and dozens of articles, essays and research reports I wrote in 2008 and 2009.

They were filled with bad news – bank stress tests, soaring unemployment, talks of bailouts and bankruptcies.

I was telling subscribers of my trading services to buy puts, sell covered calls and take advantage of the volatility.

We were persistent.

Stronger, Fitter… and Richer

And then it happened. The sun began to shine.

In April of 2009, I told my readers it was time to look the other direction. I wrote them and said it’s time to get out of cash and start looking ahead. Stocks were rebounding, and, my favorite indicator, money flow was once again positive.

The stocks I wrote about over the next few months went on to surge by 2,002%… 1,500%… 1,200%… 574%… and on and on as the bull market aged into one of the greatest in history.

Six months later, I was writing about how subscribers of my options service were sitting on gains of 87% in one day… 79% in four days… 72% in four days… and 83% in a single day.

In fact, during one seven-day span, we locked in options gains of 40% on Chesapeake Energy Corp… 18% on FuelTech… 80% on Cabela’s… 171% on NCI Building Systems… and 42% on Rio Tinto.

Persistence paid off… handsomely. We will get there again. I promise. We locked in some gains last month. We took some losses too. These things happen. But rebounds always come.

We must be more persistent than that damned little bug.

Note: Our portfolio has shrunk significantly over the last month – just as it is designed to do in a market crisis. If a position is not listed in the model portfolio, it means it hit our trailing stop and we exited it, minimizing our risk and maximizing our profits. For the most up-to-date information and a portfolio that’s updated daily, log on to our website. ◽

THIS Is Doctor-Recommended for Fast Pain Relief (Hint: It’s NOT Pills)

Today we’re blowing the lid off the best kept pain secret in the medical community. This ONE controversial solution could eliminate your pain, starting in 7 seconds or less.

Dr. Sanjay Jain of Johns Hopkins Medicine says, “It’s a godsend.” Greg B. got this solution for his ailing fiancée. “She did not believe anything would work in 7 seconds,” Greg said. “When she finally tried it, she was amazed at how fast she felt relief!!! Now we are not allowed to travel anywhere without it. She thinks it is a miracle.”

To END your pain for good, click here.

Appendix

About the cover image:

This Dutch East India Company trading post was located in India, next to the Ganges. The Dutch East India Company (Vereenigde Oostindische Compagnie in Dutch, or VOC) is the father of modern corporations. In 1619, the company established a central position in modern-day Jakarta. Over the following 200 years, the company acquired ports around the world and took over surrounding territory to protect its interests. The VOC was seen as symbolic of the Dutch empire’s power. The company’s innovations and business practices laid the foundation for the mega-companies of the future.

Further Reading

“The Secret Shame of Middle-Class Americans,” The Atlantic: https://www.theatlantic.com/magazine/archive/2016/05/my-secret-shame/476415

“Brokers Profit From You Even If They Don’t Charge for Trading,” Bloomberg Businessweek: https://www.bloomberg.com/news/articles/2019-10-10/brokers-profit-from-you-even-if-they-don-t-charge-for-trading

“This App Completely Disrupted the Trading Industry,” CNN: https://www.cnn.com/2019/12/13/investing/robinhood-free-trading-fractional-shares/index.html

© 2020 Manward Press | All Rights Reserved

Manward Press is a financial and lifestyle publisher that does not offer any personal financial advice or advocate the purchase or sale of any security or investment for any specific individual. Members should be aware that although our track record is highly rated by an independent analysis and has been legally reviewed, investment markets have inherent risks and there can be no guarantee of future profits. The stated returns may also include option trades.

We expressly forbid our writers from having a financial interest in their own securities recommendations to readers. All of our employees and agents must wait 24 hours after online publication or 72 hours after the mailing of printed-only publications prior to following an initial recommendation. Any investments recommended by Manward Press should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Protected by copyright laws of the United States and international treaties. The information found on this website may only be used pursuant to the membership or subscription agreement and any reproduction, copying or redistribution (electronic or otherwise, including on the world wide web), in whole or in part, is strictly prohibited without the express written permission of Manward Press, 14 West Mount Vernon Place, Baltimore, MD 21201.

Manward Letter is published monthly for $149 per year by Manward Press, 14 West Mount Vernon Place, Baltimore, MD 21201, www.manwardpress.com.

© 2024 Manward Press | All Rights Reserved

Nothing published by Manward Press should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investment advice. We allow the editors of our publications to recommend securities that they own themselves. However, our policy prohibits editors from exiting a personal trade while the recommendation to subscribers is open. In no circumstance may an editor sell a security before subscribers have a fair opportunity to exit. The length of time an editor must wait after subscribers have been advised to exit a play depends on the type of publication. All other employees and agents must wait 24 hours after publication before trading on a recommendation.

Any investments recommended by Manward Press should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Protected by copyright laws of the United States and international treaties. The information found on this website may only be used pursuant to the membership or subscription agreement and any reproduction, copying or redistribution (electronic or otherwise, including on the world wide web), in whole or in part, is strictly prohibited without the express written permission of Manward Press, 14 West Mount Vernon Place, Baltimore, MD 21201.