Red-Hot Prices: Three Inflation-Loving Tickers

Inflation has just hit some of the highest levels since the early 1980s.

The prices of food, energy, clothing, building supplies… just about everything… are on the rise.

The folks in charge of such things say it’s temporary. They say the nation and the world are simply rebounding from one of the most depressed times in recent history.

It’s all talk.

They say there’s nothing to worry about… that the trillions of dollars’ worth of money pulled out of thin air won’t devalue our cash. They say the data and the textbooks that interpret it don’t show a problem.

But here’s the thing about inflation… it’s as emotional as it is rational.

Inflation is as much of a behavioral being as it is a monetary phenomenon. And, last I checked, the Federal Reserve can’t control what’s in our heads.

This is what so many folks get wrong about inflation… and how to avoid its many dangers.

Shrinks vs. Economists

According to the textbooks, inflation occurs when the supply of money is greater than the supply of goods. The bigger the shock in that simple equation, the bigger the inflation potential.

The keyword in that last line, though, is “potential.”

That’s because history is riddled with instances where the math is greatly lopsided… and yet inflation never occurs. In other instances, though, the equation is nearly perfectly balanced on paper and yet soaring prices spell the demise of a country and its economy.

It means there’s another important ingredient in this recipe… our brains.

Economics is not a science. It’s an art. Too many folks are duped into a false sense of control when they wrongly believe it’s only a matter of numbers. If that were the case, controlling the economy would be as easy as the government pretends it is.

But it’s not. Far from it.

Throughout history, inflation takes hold when citizens believe that tomorrow will be worse than today.

In other words, when folks stop investing… when they stop saving… and when they believe money converted into goods will buy more today than it will tomorrow… that’s when trouble brews.

And the more money that’s trickling throughout the economy when that mental switch flips… the worse the problem.

Panic-Buying

America’s current housing market is a fine example. It proves what’s happening these days is less a monetary phenomenon and more of a “gold rush” mindset.

Homebuyers have moved well beyond offering more money to sellers. Sure, in Seattle, a home that was listed for $725,000 just sold for more than $400,000 above the asking price. But, in the end, it took the wannabe buyer waiving all contingencies and all inspections before the deal would close.

It’s the same thing across the country. In fact, in some regions, sellers are unloading their house… and not moving out. As part of the contract, they’re negotiating leaseback agreements that allow them to stay in the house for as long as a year.

These nonmonetary offers prove the problem isn’t because there is too much money floating around. No. Instead, it proves that buyers are rushing in because they believe if they don’t buy today… they won’t get a chance tomorrow.

Or, in the case above, next year.

That’s when inflation takes root. That’s when it becomes so dangerous.

Once that psychology spreads throughout a culture and its economy, it’s game over.

A monetary free-for-all only adds fuel to the fire.

Worried About Tomorrow

A recent survey done by the folks at the Federal Reserve shows that one-year inflation expectations are higher right now than they’ve ever been before.

At these levels, it doesn’t matter what the textbooks say. If enough consumers believe that prices will rise, they’ll rush into the market to get what they fear they won’t be able to afford tomorrow. Prices will rise, and inflation fears will fulfill themselves.

The Federal Reserve and its monetary brethren can pull all the levers they want. But until they convince the masses that tomorrow isn’t all that different from today… inflation will reign.

History proves it. Every example of devastating inflation follows the same model.

But we’re not here for a history lesson. We’re here to ensure that your portfolio doesn’t get harmed by what’s ahead. The following are details on three stocks likely to benefit from rising prices. They will help you maintain your buying power… even as prices rise.

The Hand That Feeds Us

There is a host of reasons Archer-Daniels-Midland (ADM) is an ideal stock to own when inflation takes hold.

For those of you who aren’t familiar with the company, well, let’s just say the world would be in serious jeopardy of going hungry if it disappeared overnight. It’s one of the world’s largest food processors and grain-trading firms.

To say it dominates the nation’s agricultural industry is an understatement. It flat-out owns it.

But its dominance is not just here in the United States. The company is a major exporter of grain and all the products made with it. That’s why the value of the dollar is so critical to its business.

Look back at a decade’s worth of the company’s earnings reports and you’ll see that nearly every time the dollar loses strength, Archer-Daniels-Midland’s profits rise. That’s because when the dollar is weak, foreign countries tend to import much more of America’s crops.

That’s the nature of the commodities business. Money flows to where it is treated best. And when inflation is roaring, it treats Archer-Daniels-Midland quite well.

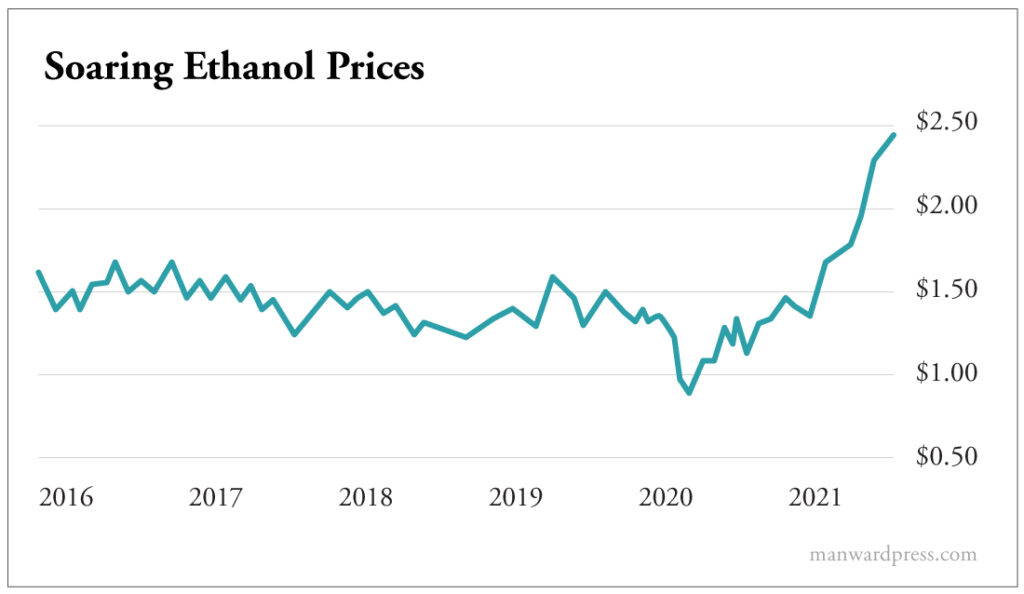

Look at this chart. It shows the price of ethanol, one of the company’s top products.

It’s quite clear that all that freshly printed money is having wild effects on ethanol prices. Rising oil prices bring the corn-based fuel along for the ride. And since Archer-Daniels-Midland is a major price setter in the world of corn and other grains, the price spike is a boon for profit margins.

Finally, we can’t talk about this company and its role as an inflation winner without talking about its massive stake in the grain business. Like I said, it’s a price setter. It’s so big that its traders virtually set the price farmers get for their crops.

With the company’s scale, its pricing pressure ensures that margins will remain robust as supply and demand battle for dominance. Better yet, because of the company’s massive commodities trading business, the more prices move, the more profit potential is hidden within the ticker.

Bottom line, if you’re worried about inflation, Archer-Daniels-Midland is a must-own stock.

The Ultimate Home Equity Play

Perhaps the greatest time to be a homeowner is when inflation is roaring. When folks are battling to buy, the value of all properties rise. During the housing boom in the early 2000s, home equity minted many, many millionaires.

But imagine if you didn’t just own one or two homes… but instead had a claim to more than 60,000 properties.

Imagine the joy as all 60,000 of those properties climbed in value as inflation took hold. Even more, imagine the joy as the rental income from each of those properties kept up with inflation.

That’s the opportunity you have with a stake in Essex Property Trust (ESS), a leader in apartment rentals on the West Coast.

The company is set up as a real estate investment trust – a business entity that’s given special treatment by the tax code.

It’s no secret that the rental industry took a shot on the chin during the height of the pandemic. Not only did the government tell renters it was okay to skip their monthly payments, but demand plunged in major cities as folks fled large population centers.

That’s quickly turning around, though. With the national average now 5% higher than it was a year ago, rates are quickly making up all lost ground.

But, remember, this is an inflation play… not a rental-rate play.

Shares of Essex get their value not just from the cash flow generated by monthly rent checks but also from the underlying value of those tens of thousands of apartments the company owns.

As real estate prices rise with inflation and as rent rates surge along with them, the value of each share of Essex will rise in kind.

It’s an ideal, income-generating play on inflation.

Forget Gold… Own This Metal

There’s one thing common in every home in America… copper. In fact, copper has its place in just about everything around us. It’s in our cars, our TVs, our phones… and even our money.

Because of its many uses, copper is considered the top industrial metal. Where its price goes, everything else tends to follow.

That’s why it is another must-own inflation play.

One of the best ways to take advantage of its benefits is by owning the companies that take the stuff out of the ground. Rising prices are a big boon for their business and the shareholders who own them.

When it comes to copper, there is none bigger than Southern Copper Corp. (SCC). It’s the world’s largest publicly traded copper miner.

Based in Mexico, the company has operations throughout Mexico and Peru – one of the most copper-rich regions on the planet. It’s why the company can easily claim to be the owner of the largest copper reserves on Earth.

That’s good news for shareholders. Having that much copper in the ground is like having money in the bank. And as inflation drives the price of that copper higher… the value of those deposits soars.

What’s even more interesting about this play – versus a typical miner based in America – is that its input costs are not denoted in dollars and it sells its products all across the globe, with Asia good for 43% of total demand.

That means as the American dollar loses value, the company’s input prices are not likely to rise nearly as far as those of its American competition. It also means it will get the benefit of selling a dollar-based commodity into a global market… where prices will rise as the greenback weakens.

Bottom line… a stake in Southern Copper is another ideal inflation play. It has the biggest reserves. It pulls its copper from the ground at one of the lowest prices among its peers. And it sells copper into a global market that is about to see its prices soar.

If you’re worried about pending inflation… get some shares.

It will prove that we don’t have to be afraid of inflation. If we know what’s really driving the rise in prices and if we’ve got the right stocks in our portfolio… there’s nothing to worry about.

Prices will rise. But your wealth can rise even faster.

Take a close look at all three of the stocks above. They love when inflation abounds.