3 Perfect Stocks for “Devastation-Proof” Wealth

Major inflation is on the way…

The Fed is going to pump trillions of dollars into the economy to prop everything up.

It will cause a rapid increase in inflation. Initially, that inflation is likely to occur primarily in one place…

The stock market!

Thanks to trillions of dollars in funny money flying off the Fed’s printing presses, an unexpectedly strong surge in stocks is on the horizon.

Knowing that a bull market is coming is one thing. But knowing how to play it is another. Some stocks are going to do extremely well in this new free money environment.

Here are three of my favorites…

The Google of the Finance World?

I’ve got my thumb on the very best “wartime” stock to own as America fights for its fiscal life.

It’s not hard to see who took the spoils during America’s great wars. During the Civil War, it was the bankers. During World War II, it was the industrial giants. During the decadeslong fight in the Gulf, it was defense companies, Big Oil and Washington’s favored contractors.

But America looks far different than it did in the 1940s or even at the start of the 21st century.

It’s no secret that we no longer have manufacturing superiority. The companies leading the stock market higher these days make a lot of money… but don’t make a lot of stuff.

Google… Facebook… Netflix… even Apple…

They deal with data and intellectual property, not old-fashioned iron and steel.

That trend will not only continue but also strengthen. It’s the result of bad trade deals, a huge push for expensive college education and a strong dollar that makes imports unfairly attractive.

Those ideas aren’t going away. It’s why the war we face today won’t be fought with mechanical might. It will be fought with financial weapons.

This is a war to keep America No. 1 in the world of money. Therefore, it will be fought with money.

That’s why I want you to buy shares of a company that is poised to be one of the biggest beneficiaries of the battle ahead.

It’s a behemoth in the world of money.

And yet, like Netflix, Google and Facebook, it doesn’t produce anything tangible. Like these other billionaire makers, it makes its money in the rich world of data, intellectual property and products that others depend on to make their businesses better.

CME Group (Nasdaq: CME) is the world’s leading and most diverse derivatives marketplace. It’s the place investors go to trade alternative investments, commodities, futures and derivatives.

CME gets a cut of just about every major commodities, futures and derivatives trade that’s made. It doesn’t matter how the market moves. By investing in CME Group, you win either way.

Bombs Away

The financial meltdown we saw in March may have slashed stock prices by 30% and more… but it wasn’t all bad news for Wall Street. In fact, the companies that form the backbone of the nation’s financial trade are sitting on a windfall thanks to the crash.

Trading volume has surged. Despite all the bad news surrounding the economy and markets, investors have poured into the markets.

As of June 30, TD Ameritrade has opened more than 700,000 new accounts this year. Robinhood is seeing record deposits, and daily trading is up more than 300% compared with last year. Time spent on its platform has spiked more than 50% this year. And E-Trade saw a surge of more than 360,000 new accounts opened during a three-month period… and almost all were retail traders.

It’s good. It shows that thousands of folks see the buying opportunity in front of us. They know that it’s now… or never.

As several trillions’ worth of freshly printed dollars are now flowing through the economy, these folks have a vital weapon in their arsenal. They have access to the spigot that’s about to start spewing profit potential.

But like I said, not every stock will be a winner. Far from it. Bankruptcies are about to hit record highs.

I started in the financial business by studying volume anomalies and the rationale behind them. And I’ve spent much of the past two months using many of the skills I honed over the last few decades.

They’ve been extremely useful… especially as trading volume has crushed one record after another this year.

The New York Stock Exchange is seeing record trading volume month after month. At points, equity trades surged by 70% compared with the same time last year.

The Chicago Board Options Exchange is recording multiple months of more than 200 million options trades – up by as much 45% from a year ago.

And CME has seen its average daily trading volume surge by 119% year over year.

Its flagship E-mini Equity Futures saw a whopping 1.7 million contracts change hands each day. It’s not a surprise. This company’s products are the weapon of choice in America’s latest war.

Ground Zero

Just as Google creates a hub for folks to do business on the internet, CME Group serves as a critical gathering point for investors to do business in the world of finance.

Most folks have never heard of CME Group, although one media outlet recently called it “the most powerful company you’ve never heard of.”

The group has several brands working under its umbrella that you may have heard of.

There’s the Chicago Mercantile Exchange, the New York Mercantile Exchange and the Chicago Board of Trade. They’re the biggest names in everything from corn and soybean futures to currency swaps and, especially these days, interest rate derivatives.

In a world where money is printed out of thin air, bundled into all sorts of exotic products and forms of debt, and traded by the big houses on Wall Street… CME Group is to the financial world what Facebook is to social media.

It’s at the center of it all.

And as the nation embarks on what looks to be a long battle for financial survival using a “whatever it takes” mentality, owning a stake in CME Group will be like owning a gunpowder-maker in WWII.

As I mentioned, all the major commodities trade through the company’s platforms. Corn, soybean and cattle futures… crude oil and natural gas… gold, silver and copper… dollar, yen and pound futures. These are all highly active contracts these days.

The company gets a cut of every trade. (Revenue was nearly $1.1 billion and operating income was $525 million in the third quarter.)

But it’s not just standard commodities that flow across the company’s exchanges. In fact, it’s the more exotic products that have me the most excited… especially right now.

With risk at record highs due to soaring volatility, Depression-era unemployment, government intervention and flat-out media mania, the world’s biggest investors (pension funds, banks, insurance companies, etc.) are searching for novel ways to invest.

They turn to CME Group and its products to get the job done.

A Financial Flak Jacket

CME Group has successfully pushed to restart trading of once-popular three-year Treasury notes.

At $17.2 trillion, the Treasury market is now twice as large as it was 10 years ago. Volume for futures has tripled.

Treasury derivatives are one of the most efficient ways for big investors to hedge their risk.

That’s why the company wanted to bring popular products back to market… like three-year Treasury note futures, which will bring even more volume to its platforms.

As the Fed toys with the idea of expanding and contracting its balance sheet, CME Group’s managing director, Agha Mirza, said, “We found ourselves at a juncture where there were not just one or two, but multiple reasons why some of our clients are interested in us reintroducing the product in a way that’s relevant to today’s market.”

That’s key. In a war like this one, it’s no different from a general marching up to a bombmaker and asking for several different types of bombs.

Each battle needs a fresh weapon. And CME Group offers an arsenal to choose from.

As we prepare for a long, nasty war that is bound to change the fate of America’s finances, owning a stake in this company makes you a winner no matter who ultimately claims victory.

It’s the ideal stock to protect your wealth from the devastation ahead.

The New Face of Unlimited Tech Growth

In late March, Joe Biden took to Twitter.

“I am calling on every CEO in America,” he wrote, “to publicly commit now to not buying back their company’s stock over the course of the next year.”

Whether it was politics or just prudent business in a cash crunch, lots of companies followed his order. McDonald’s stopped its massive buyback program. As did 3M, Best Buy, General Motors, Starbucks and nearly a third of all the companies in the S&P 500.

It was a fast halt to a huge boom. But it was short-lived.

As the economy recovers and the planet reopens for business once again, many of these companies will restart their buyback programs. In fact, many of them have already – including America’s eight largest banks, which pledged to halt their buybacks through only the second quarter.

Big banks aren’t the only ones…

One of my favorite technology companies has announced a fresh $250 million buyback plan.

From an investor’s perspective, I love to see these big buybacks… These are like superchargers that make good stocks great and, in this case, make a great stock even more attractive.

Logitech International (Nasdaq: LOGI) doesn’t care about Biden’s tweets. That’s because it’s not American. It’s Swiss.

Logitech designs, manufactures and markets products that helps people connect to digital and cloud platforms. Think keyboards, mice, headsets, video gaming products, home entertainment controllers and smart home devices.

In other words, the company makes things that many of us use every day…

But because of its strong commitment to its buyback program and the amount of freshly printed money that is headed its way, Logitech solidly belongs in your portfolio. After all, it’s designed to shine while the stock market soars and we enter what is likely to be America’s final stage of economic dominance.

A Must-Own Stock

Beyond having a well-funded buyback program, there are three things that make Logitech a must-own stock right now. We’ll start with the most obvious and perhaps the least influential.

The company is a certain work-from-home play. In fact, it even launched a product bundle – a wireless keyboard, mouse and headset – aimed at the market. It’s a leader in webcam sales as well. That’s good. The market research firm NPD Group tells us that as the lockdown began, keyboard sales soared as much as 64%. And sales of headsets (which help with online meetings) soared by more than 130%.

While this trend will certainly help with this year’s earnings, it’s nothing you’d want your retirement to lean on. It will come and go. It already has.

Instead, it’s sustained, long-term growth we’re after. And Logitech offers it in spades…

In the recently reported quarter, sales exceeded the $1 billion mark for the first time ever, skyrocketing 75% to $1.2 billion. Operating income grew 372% to $322 million. Cash flow from operations jumped 162% to $280 million.

And, perhaps most appealing, the company’s cash stockpile grew by more than $342 million, rising to $917.2 million. This provides a nice piggy bank for a robust buyback program.

Bracken Darrell, Logitech’s CEO, had this to say recently:

We have delivered five consecutive years at or near double-digit growth, and Logitech’s products have never been more relevant. Video conferencing, working remotely, creating and streaming content, and gaming are long-term secular trends driving our business. The pandemic hasn’t changed these trends. It has accelerated them.

It’s that cash stockpile that matters most for the company’s buyback plans and, my third reason for urging you to buy this stock right away, its dividend plans.

Growth That Pays

At the same time the company announced its fresh buyback plan, it told shareholders to expect a solid 10% increase in the dividend this year. In a world where dividends have been slashed or, worse, flat-out tossed out the door, double-digit growth is quite attractive.

It makes Logitech not just a solid growth stock… but a decent income stock as well. The stock currently yields 1.26%. You won’t get rich on the payout. But then again, show me another stock that has the potential to double your money over the next 12 months that pays as much.

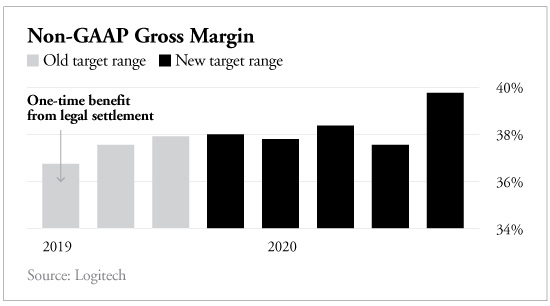

Now, I don’t want to get too deep with my analysis or bore you with numbers, but there’s an important aspect of this recommendation that has me convinced the company’s buyback and dividend ambitions not only are here to stay… but will continue to grow. It comes thanks to this chart…

It shows that the firm’s sales are growing… and so are its margins. The fact that the company has boosted its target range for its gross margins (that’s the percentage of sales left after product costs are removed) shows that efficiency is on the rise.

Input costs are falling, and Logitech is selling more of its high-margin products. That’s simply good business and a chief sign of good leadership.

It gives me no doubt that the company will make good on its buyback program and keep raising its dividend in the future. After all, much of that extra cash generated by margin strength will flow straight to the bottom line and into the hands of you… the shareholder.

Many Reasons to Buy

Put it all together… and it’s simple. This is a growth stock with immense potential. Its products are selling like never before. Its income statement is something to drool over. And the management team has not only proven effective but also shown that it is very shareholder-friendly.

When so many other companies are halting their buyback programs, Logitech is expanding its plan. A new $250 million share buyback program was announced in May.

As more stimulus money comes out of governments across the globe and central banks continue to prop up the markets, this is a stock to own. It has the potential to double your money in the next 12 months… and pay you a decent dividend in the meantime.

The Deal(maker) of the Decade

It’s been a long time since I rolled up to a gas pump and said, “Fill ’er up.”

Unless you live in a state like New Jersey that requires an attendant to do the pumping for you, uttering those three words is about as commonplace these days as refilling the icebox.

But if you hit your turn signal and pull into to an Exxon gas station, you may soon have the chance to say them once again.

This time, though, you won’t be saying those words to the man wiping down your windshield… You’ll be saying them to Alexa.

“Alexa… pay for my gas” may soon be a common phrase at a gas station near you.

And while the idea may not feel like a revolution in the realm of high technology… don’t make up your mind until you hear all I have to reveal on the subject.

This is big.

Paying It Forward

You see, this new way to pay is the result of a big deal between Amazon (Nasdaq: AMZN), Exxon Mobil (NYSE: XOM) and a company you’ve likely never heard of… Fiserv (Nasdaq: FISV).

Fiserv provides financial services technology worldwide. It serves business, banks, governments, processors, credit unions, alternative financial institutions, merchants and other clients. It’s become the go-to technology provider for new, sophisticated, yet highly user-friendly payment solutions.

Fiserv, Amazon and Exxon Mobil have teamed up to try out a new form of payment that allows a person to pay for things right from their car… while using nothing but their voice.

In this case, a driver will roll up to a pump and utter a simple command, and Alexa will respond by confirming the location and pump number.

The driver never has to pull out a credit card or open their wallet.

Again, it’s not like we’ve just discovered fire here, but the deal between this trio isn’t really about paying for gas. It’s about the technology that makes it happen.

Some incredible things have to happen when a driver tells Alexa to foot the bill. Identities must be verified… companies must communicate… and money must flow from one hand to the other. And all of it has to happen quickly, securely and reliably.

Amazon can’t do it. Exxon certainly can’t do it. But Fiserv can.

As perhaps the world’s oldest fintech firm (it was founded in 1984, long before the term was first uttered), Fiserv is the leader in this sort of technology.

Leading the Revolution

It’s the company that creates the spokes that tie consumers, banks, merchants and all their technology together.

And although most folks have never heard of the company, it’d be tough to find a major bank or retailer that does not use its technology.

Its list of customers is long and includes names like Amazon (of course), Google, Apple, Visa, Mastercard, Bank of America, Wells Fargo, SAP… and on and on.

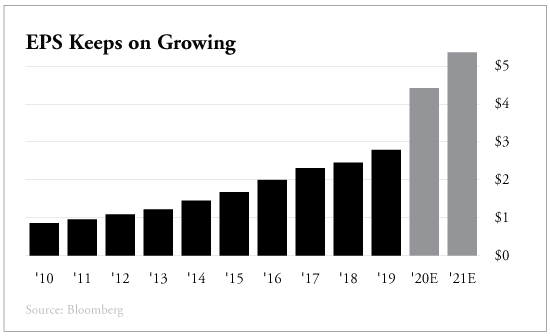

And those alliances have created a booming business… The company has achieved 34 consecutive years of double-digit adjusted earnings per share (EPS) growth!

Here’s a chart of Fiserv’s progress during the past 10 years…

But take a look at what is expected for EPS this year and next.

That’s because Fiserv is beginning to receive a payday bonanza from a whole different set of companies. That idea comes from our story above.

There’s no doubt the banking world is going digital. Thanks to companies like Varo (the first consumer fintech to become a national bank), the industry’s business model is quickly changing. Companies that can’t keep up will fail.

But here’s the thing… Many small-town banks and credit unions (and there are a lot of them) don’t have the people or technology to do what Varo and its fintech brethren are doing.

They’re bankers… not tech geeks.

That’s why Varo is quickly signing up more and more customers.

Take American Eagle Financial Credit Union, for instance. It’s a small 85-year-old bank with 20 locations throughout Connecticut. It doesn’t have a lot of employees… let alone tech experts.

There’s no way it could compete with what Varo has done through its app and mobile offerings. But that’s okay. Fiserv can.

As so many similar banks are doing, American Eagle Financial Credit Union recently struck a deal with Fiserv that puts the credit union on Fiserv’s “DNA” program.

If the connections between retailers, banks and consumers are the spokes, this platform is the computer system that serves as the hub of it all. It’s happening just as I said…

Pennies on the Dollar

“Members increasingly expect Amazon-like experiences in every aspect of their lives and want us to understand and even predict their needs,” said Jim Evans, the credit union’s chief information officer. “The extensibility and scalability enabled by the open architecture of DNA will allow us to be more flexible in how we deliver services to our members.”

Another credit union boss put it this way…

“Our goal is to transform operationally and culturally from a credit union that uses technology to a technology company with a purpose: to serve our members and communities,” said Sean Cahill, CEO at True Sky Credit Union.

He has also teamed up with Fiserv. It’s how the company is making big money as dollars go digital. The tech giant can get a slice of every dollar that goes through its system.

This trend is a big deal… especially as the “Amazoning” of the banking sector gains immense speed.

But remember, Amazon isn’t just a retailer. And banks can’t just be banks these days.

Jeff Bezos wouldn’t be the world’s richest man if he didn’t tap into the gold mine of data his company collects each day. It’s the same with Varo. Data is key. And Fiserv knows it.

The Deal of the Decade

That’s why, last year, Fiserv merged with First Data… the leader in banking sector data. It offers payment processing to some 6 million merchants, handling roughly half of all debit and credit card transactions.

That makes it a powerful force, especially when we consider how it relates to its namesake product… data.

With 2,800 transactions per second flowing through its network, First Data has access to a lot of consumer information. It pulls it all together and markets it in various ways – including by selling it back to the merchants making sales, investors looking for the most up-to-the minute sales data and big-name companies looking to keep up with consumer trends.

The merger with Fiserv marries this data with the technology it takes to do 21st-century things with money.

And make no mistake about it… Data and high tech are the future of retail commerce, banking and all types financial transactions across the globe. Without it, banks, credit card companies and lenders can’t know who is creditworthy, who can pay and who can’t.

As more and more banks and retailers are forced to compete with data-driven business models, they will need the help of a company like Fiserv more and more every day.

This is an ideal play for your portfolio. As American money goes digital, the printing presses roll and the rules of the banking sector change, it’s companies like Fiserv that will prosper the most.

Protect Your Wealth From the Great Devastation of 2021

If you simply throw up your hands and go to cash, you are going to be left behind in the new world of unlimited free money.

And make no mistake… the stock market is the primary place all of this free money is going to flow. We are about to see the biggest stock price inflation ever in a very short period of time.

I expect the three companies in this report to soar in the months and years ahead.

Note: We’ve found that readers tend to buy the stocks in these special reports at different times. Keep in mind that we may have taken profits or stopped out of a recommendation by the time you read this report. Please refer to the current portfolios for the most up-to-date recommendations.

© 2025 Manward Press | All Rights Reserved

Nothing published by Manward Press should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investment advice. We allow the editors of our publications to recommend securities that they own themselves. However, our policy prohibits editors from exiting a personal trade while the recommendation to subscribers is open. In no circumstance may an editor sell a security before subscribers have a fair opportunity to exit. The length of time an editor must wait after subscribers have been advised to exit a play depends on the type of publication. All other employees and agents must wait 24 hours after publication before trading on a recommendation.

Any investments recommended by Manward Press should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Protected by copyright laws of the United States and international treaties. The information found on this website may only be used pursuant to the membership or subscription agreement and any reproduction, copying or redistribution (electronic or otherwise, including on the world wide web), in whole or in part, is strictly prohibited without the express written permission of Manward Press, 14 West Mount Vernon Place, Baltimore, MD 21201.

November 2020.