100X Pre-IPO Profits: Your Guide to Smart Private Equity Investing

It’s accepted as conventional wisdom in many investing circles that the best time to invest was yesterday and the second-best time is today. Meaning that any day your money isn’t in the market is a day it’s not growing and, by extension, a day wasted.

But whoever came up with that quote was dead wrong.

The best time to invest in any company is before it even hits the open market – before its initial public offering, or IPO.

If you’re investing in a company after it has gone public, you’re already too late to collect the biggest potential gains. You’re stuck exactly where Wall Street wants you, trading stocks that are already well past their periods of rapid growth.

There’s nothing wrong with holding blue chips (we’ve been quite successful recommending them over the years), but if you want to thrive in the modern market, you need to do more.

A lot more.

Most Main Street retail investors see an average gain of just 2.9% a year from stocks. That’s absolutely terrible. But it’s still significantly better than your run-of-the-mill savings account yield, %.

Regardless, both numbers are dramatically smaller than what you would need your money to grow to just to keep up with inflation, let alone outpace it.

When it comes to pre-IPO investing,

And the average investor was locked out of that market… until recently. Consider this report your guide to capitalizing on this market… and make up for lost time.

A Tale of Two Markets

It was the best of times. It was the worst of times. It was a time when most investors were barred from entering an entire sector of the market.

Prior to May 16, 2016, only the Wall Street elite were allowed to invest in companies before their IPO. Before that, it was the playground of angel investors, and they had the nerve to claim we were locked out of it for our own good.

See, it used to be you had to be an “accredited” investor to invest before a company went public. To be an accredited investor, you needed a net worth of $1 million – excluding your home – or an annual income of $200,000… which put pre-IPO investing well out of reach for everyday Americans.

Then, in 2016, retail investors were allowed to pool their money and buy into private companies. This practice – the lifeblood of modern pre-IPO offerings – is called equity crowdfunding. But even then, it was very limited…

For the first five years of crowdfunded investing, a company couldn’t raise more than $1.07 million in a 12-month period. That created a very short period for retail investors to get in on pre-IPO opportunities…

Often, by the time many people had heard of the hot new private company, that limit had been hit and they’d have to wait another year before they could buy in.

But the Securities and Exchange Commission’s regulations around pre-IPO investing for nonaccredited investors have finally slackened enough that everyday Americans can now actually take advantage.

The main bit for us is that the offering limit has been boosted to $5 million. This makes crowdfunding much more attractive to high-quality startups. Plus, it gives us more of an opportunity to get in. Even better, many of these companies can be bought into with as little as $100.

Now, this is still a short window, and the best companies meet their crowdfunding goals faster than you would expect. The earlier we are and the smarter we are about investing in these pre-IPO opportunities, the bigger the potential returns we can reap.

Because with this change in rules, companies can collect more in crowdfunded cash. That, in turn, will incentivize them to do it more. The more times a company raises money through crowdfunding, the more opportunities you have to invest in it and the bigger return you’ll earn when it goes public.

But even more so than with ordinary stocks, we have to do some legwork to make sure we’re buying the next Google or Amazon and not some gimmicky flash-in-the-pan startup, like WeWork.

For that, we’ve devised a set of criteria that will allow us to separate the wheat from the chaff. When a company meets all four of these criteria, it’s got the potential to be a 100X (or more) pre-IPO opportunity…

Hunting for Unicorns…

“Unicorns” are privately held startups… with a value of $1 billion or more. And they are the 100X pre-IPO opportunities we’re looking for…

Among those unicorns are some pretty incredible companies. Some of the biggest and most famous are SpaceX (which achieved a valuation of $100 billion), Epic Games at $28.7 billion and Plaid at $13.4 billion.

Previous examples of unicorns that have since gone public and created new billionaires in the process are Uber and Airbnb, which created three billionaires each; Snapchat, which created two; and Palantir, which created one. And any new unicorn going public is a chance for you to become a millionaire or even a billionaire.

It’s those companies we’re looking for, and they all have a few things in common. We’ve distilled the unicorn formula down to four key criteria: leadership, a massive market, a problem their products fix and a simple solution to that problem…

An Army Led by a Lion

Alexander the Great once said, “I am not afraid of an army of lions led by a sheep; I am afraid of an army of sheep led by a lion.” And he was 100% correct. In business and in war, leadership often makes all the difference.

A startup, even one with a great idea or an innovative product behind it, is doomed to fail if it’s led by an empty-headed or incompetent person. Look no further than the aforementioned WeWork and its infamous CEO Adam Neumann.

Whatever you think of WeWork, the idea behind it attracted billions of dollars’ worth of investments and seemed like it would be the next big IPO…

Then it surfaced that Neumann was blowing the company budget on extravagant multiday tequila-fueled office parties, scheduling meetings at 2 a.m. and working his people like a deranged cult leader.

He was ousted by one of the company’s largest investors, Japanese giant SoftBank. But he tarnished the company’s reputation, and it has lost value dramatically since its IPO in October 2021…

We’re looking for the next Elon Musk, not the next Adam Neumann.

Elon Musk reportedly works 80 to 100 hours a week, split nearly evenly between his public company Tesla and his private unicorn SpaceX. (Twitter – or now “X” – is a current distraction, but Musk is looking for a CEO to run that company.)

He takes a direct role in the engineering and design aspects of both businesses’ products, all while getting just six hours of sleep a night.

Musk’s attitude and efficiency have attracted a veritable brain trust of people equally as capable and determined as he is to work at both companies. That, in turn, has allowed Tesla to revolutionize the auto industry and SpaceX to restart the space race. And it’s all because of Elon Musk’s leadership.

Obviously, he can’t do all the work that goes into both companies himself, but his leadership has pulled together the talent needed to build two of the most disruptive companies of the 21st century and has put all the energy, resources and brainpower into productivity and success.

Had either Tesla or SpaceX been run by someone like Adam Neumann, you probably wouldn’t know about either one today. They’d have been consigned to the trash bin of business history.

Musk is the perfect example of the sort of leader we look for. He eats, breathes and (barely) sleeps his companies. He has a clear vision and a perfect plan for executing it.

He has had success with Tesla and SpaceX… but they aren’t his first rodeo. He was foundational in PayPal and has numerous smaller companies he either founded or is heavily involved in, like The Boring Company and OpenAI.

Now, finding leadership like this takes very in-depth research, and it’s where many pre-IPO investors fail.

But while a leader can make or break a company, we can’t stop looking there…

Reaching Critical Mass… Market

The next criterion is a bit more straightforward and easier to see. Simply put, the potential market for the company’s products must be absolutely massive.

Look at Apple or Microsoft. You want a company with products that could go global. Apple put a phone in every pocket, and Microsoft put a computer on every desk. Amazon is rapidly becoming the store for… well, everything. And Uber has all but killed the taxi industry.

Creating a hot new item is great, but hot new items are often just a fad. Remember those obnoxious hoverboard things from a few years ago? Exactly.

The real money is made when that hot new item proves to be too useful to ignore and sees mass-market adoption.

Back to our Tesla example… Before the company hit the market with its Model 3, electric cars were a gimmick. They were science experiments that legacy automakers used to get the environmental crowd to shut up.

Then, Tesla took the electric car and made it fast, practical, sexy and desirable. Now, in any neighborhood you drive through, you can see multiple Teslas or their many imitators from legacy automakers trying to keep up…

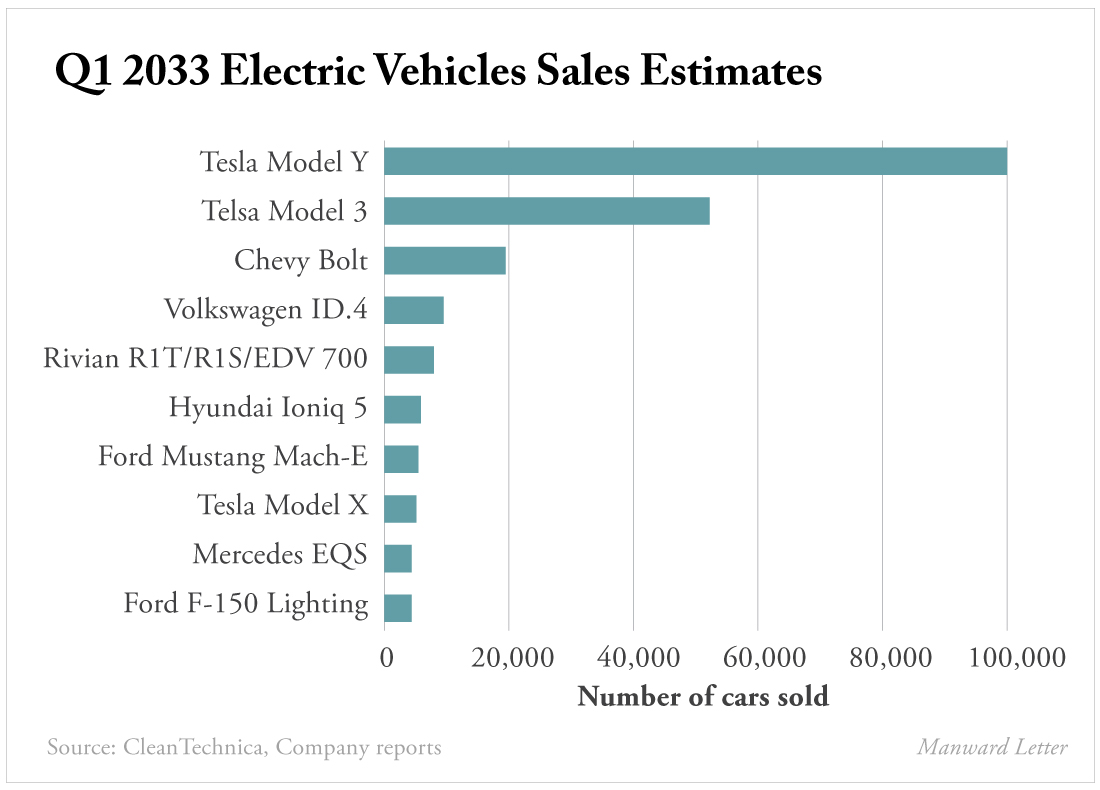

Tesla has already seen massive success and adoption, and electric vehicles still haven’t hit their full potential for mass market appeal. But seeing as Tesla occupies the No. 1 and No. 2 spots for America’s bestselling electric car by a zero-emission mile, Tesla will continue to dominate the market moving forward.

Problem, Solution, Profit…

Our third criterion is a problem… That is, a problem the pre-IPO company intends to fix.

The best unicorn companies – past and present – are the ones that have addressed a frustration that consumers have… Oftentimes, it’s a frustration they didn’t even know they had.

Phone cameras are a perfect example. Not long ago, your phone and your camera were two different devices you had to carry around… until they got fused together.

Nowadays, a high-quality camera in your phone is a given because it’s simply too convenient for the vast majority of people to ignore.

Fixing a problem like that is the key for a startup to achieve mass-market appeal.

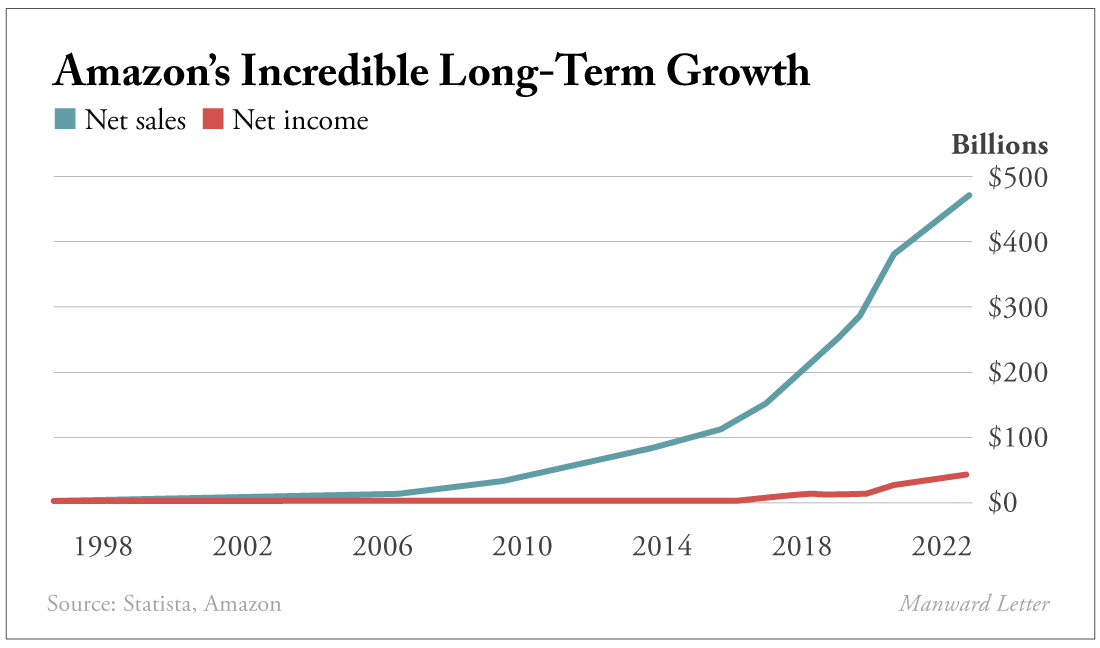

Take a look at Amazon. A long time ago, it just sold books, but it was one of the first companies to really nail online shopping and delivery.

As it expanded its inventory from books to include pretty much anything you can imagine, Amazon’s customer base grew. People didn’t realize that shopping in person was a problem…

Until they had a taste of something different.

Now more people shop online than ever before, and it’s slowly killing brick-and-mortar stores. It’s just so much more convenient to log on to Amazon and do your Christmas shopping than to drive to several different stores and possibly get into a tussle with another customer over the hot gift of the year.

Forget that… Using Amazon, you can do all your Christmas shopping from the couch. You don’t have to drive through the snow and walk around the mall for hours for the desired Lego set.

And just like that, Amazon fixed a problem people didn’t even know they had, and it’s become one of the world’s largest companies because of it…

Keep It Simple

Continuing in that same vein, the solution a pre-IPO company presents to the problem it wants to fix needs to be simple. We won’t spend too much time on this one because if a pre-IPO company meets my other three criteria, this one usually falls into place…

What we will tell you, though, is that many prospective private equity investors start here, and they lose a lot of money doing so.

They see a sleek new product and get taken in by the company’s elevator pitch. They jump at what they think is a golden opportunity and invest in the startup only to see it fail like the vast majority of its peers.

The other three criteria are what really make or break a pre-IPO opportunity. This one is just the icing on the cake.

So just like with baking, you don’t want to start with the icing. After all, delicious icing will only go so far if the cake under it is overbaked or you mistook the salt for the sugar…

Putting It All Together

Now that you know each element of our equation, let’s put them all together to show how the formula works in practice. Let’s take a well-known and relatively recent unicorn… Uber.

In the leadership department, Uber was headed by Garrett Camp. He’s a tech genius who sold his first startup to eBay for $75 million before partnering with Travis Kalanick to create Uber.

The two of them brought business and technology expertise and incredible drive to the young company back in 2009.

Uber’s addressable market, on the other hand, was, in theory, the tens of millions of people who frequently used taxis. Today, Uber has approximately 118 million customers worldwide, and that number is growing quickly…

And that’s because the problem Uber sought to fix was widespread and had an easy fix. Put simply, taxis were expensive, were inefficient and offered a terrible customer experience.

Uber’s solution was simple. It allowed anyone to become a cab driver. Couple that with an in-app rating system, and you’ve got a solution to every problem presented by the taxi industry.

And Uber all but killed the taxi industry while handing pre-IPO investors as much as 1,800,000% in a decade. That would have turned $100 into $1.8 million. All it takes is one pre-IPO investment like Uber to change your life forever…

And you can read all about how to do that in the next part of our guide.

Becoming a Pre-IPO Investor…

After reading all that, you might be concerned that getting into this market is beyond complicated. Well, you shouldn’t be. Becoming a pre-IPO investor is no more complicated than signing up for an account with an ordinary broker.

But more on that in a moment…

When you invest in pre-IPO companies, you’re not buying shares in the traditional sense. You’re buying what are called SAFE (simple agreements for future equity) contracts.

A SAFE contract grants an investor the right to receive equity at a future date when the startup sells shares. They’ve been used by startups raising money from accredited angel investors for a long time, and the reason is simple…

Early-stage companies in particular have used SAFE contracts to delay figuring out exactly how much they’re worth.

They’re also far simpler and cheaper than priced equity rounds, which may require months of negotiation and 30 pages or more of dense legal documents and may cost tens of thousands of dollars.

You can then do what you want with those shares – sell them, hold them, whatever. They’re yours. Each SAFE contract is unique, and as such, it will specify any applicable hold times.

Alternatively, the startup could become a merger and acquisition target. Most companies will have specific merger and acquisition language in their SAFE contract. For instance, you might get your initial investment back. But in most cases, you’d be compensated under the acquiring company’s terms.

Now that you know exactly what you’re buying, here’s how you can actually buy “shares” in pre-IPO companies…

The Pre-IPO Market’s Brokers

There are a few different businesses that allow you to crowdfund pre-IPO companies, but for our purposes, we recommend Wefunder, StartEngine and Republic. And setting up an account with any of them is pretty simple…

Wefunder

Founded in 2012, Wefunder is among the oldest startup crowdfunding businesses on the internet.

And it likes to conjure up a crowdfunding peer and describes itself as the “kickstarter for investing.”

And it allows you to invest as little as $100 in startups working in every industry you can imagine.

Signing up with Wefunder is as simple as signing up with any other brokerage. On the company’s homepage, simply click “Signup” in the top right-hand corner of the screen.

Then, as 1.3 million other people have already done, simply enter your name and email and create a password. Then, follow the on-screen prompts, and you’ll be able to invest in pre-IPOs, just like that.

StartEngine

Just like Wefunder, StartEngine allows you to invest in pre-IPO opportunities. Signing up for it is simple.

Simply click “Sign In” in the upper right-hand corner and then click “Sign Up.” Then, pick the account you’d like to use to sign up. You can use Google, Facebook, Apple or your email. Pick the one you’d like to use, enter your information and follow the on-screen prompts. Then you’re all set.

Republic

Founded in 2016, Republic is the last of the pre-IPO “broker” sites we recommend, and it works just like the other three…

Once you arrive on Republic’s homepage, you’ll see a space to type in your email address. Do that and then click on the blue box that says “Become an investor” below it. Follow the on-screen prompts to insert your name and create a password.

After you’ve created an account, you’ll need to deposit money to invest. For this, you’ll need to follow on-screen directions, but it’s similar to depositing money with whichever broker you already use.

When that’s done, you’re all set to start investing in pre-IPO opportunities.

Sidestepping the Taxman

But we won’t let you go without one more tip on how you can keep your money safe from everyone’s least favorite alphabet soup agency, the IRS…

There’s a little-known tax law on the books that sounds far too good to be true. But it is true, and it allows you to potentially save millions of dollars in taxes.

It’s called the qualified small business stock gain exclusion, or Section 1202. And unlike the laws that opened up the pre-IPO market to us regular folks, this law is quite old – almost 30 years old, in fact.

Enacted in 1993, Section 1202 was designed to encourage investment in small businesses. In simple terms, it allows individuals to avoid paying taxes on up to 100% of the taxable gain recognized on the sale of qualified small business stock, also referred to as QSBS.

But here’s the rub: “Small” is a relative term, and sometimes the companies in question can be pretty large.

Section 1202 is available for stock issued after August 10, 1993, and it applies to either $10 million or 10 times the aggregate adjusted basis of the stock at the time of issuance, whichever is larger.

The law can create effective tax rate savings of 23.8% for federal income tax purposes… This can effectively negate the federal tax on your shares, allowing you to keep 100% of your money. Many states follow the federal government’s lead here, so depending on where you live, you may be able to avoid state taxes as well.

The only catch is the requirements to qualify for a 1202 exemption…

On the shareholder side, here are the requirements:

- You must be an eligible shareholder, meaning you’re a noncorporate shareholder, which includes individuals, trusts and estates.

- You must have held the stock for five years or more before it’s sold. Generally, the holding period begins the date the stock was issued.

- The stock was acquired on original issuance. For our purposes, this one is easy. If you invest in a pre-IPO company, you’re issued shares at IPO, meaning you get them at issuance.

On the corporate end of things, the company must be a domestic class C corporation. A class S corporation is not eligible, but an LLC that has chosen to be taxed as a class C is. In addition, the company must not have held more than $50 million of tax basis in its assets from August 11, 1993, through the moment immediately after the issuance of its shares.

Also, the company cannot issue redemptions to its other shareholders. This is an area where many companies fall short of the 1202 exemption, and we advise speaking to a tax expert to ensure this requirement is met.

The company must also be engaged in a qualified trade or business, which means any business not included in the table below. But there’s little guidance on that. The terms the IRS uses are vague and open to interpretation. Again, we recommend reaching out to a tax expert here.

Finally, the company must use at least 80% of the fair market value of its assets in the active conduct of a qualified trade or business. Essentially, it needs to be reinvesting its money back into its business.

A company will automatically fail to qualify if 10% or more of its net assets include stock or securities in other companies in which the company in question does not own more than 50%, or if 10% of its assets are in real property not being used in the active conduct of a qualified business.

We know that’s a lot to throw at you, but any loophole allowing you to avoid 100% of taxes on up to $10 million is bound to come with a few strings attached, right?

Anyway, here’s how a 1202 exemption would work in practice…

Say you are issued stock in Company X when it goes public on January 1, 2025, in exchange for $1,000 invested when it was still a pre-IPO opportunity. Ten times your initial cost basis would be $10,000, so the higher tax exemption would be the “up to $10 million” mentioned in Section 1202. That means if Company X turned out to make you $10 million on your initial $1,000, you would be exempt from paying taxes on that $10 million.

Say between the time you were issued the stock and January 1, 2030, Company X proved to be the next Netflix and your initial $1,000 investment was worth $100,000. You could sell it all right then and pay $0 in taxes.

That’d be a 9,900% gain – certainly not an impossible gain for a pre-IPO investor – that you don’t have to pay a single cent on. Without the 1202 exemption, you’d have had to fork over 23.8%, or $23,800, of that to Uncle Sam.

That would cut your effective gain down to 7,520%, or a total of $75,200, not taking state taxes into account. Still not bad, but the IRS took 0% of the risk, so why should it get that huge chunk of money?

So definitely consult your financial advisor or a tax expert to see whether you qualify. With pre-IPO investing, we’re talking about life-changing money. Don’t give the government any more than you absolutely have to.

Strength – and Profits – in Numbers

The opening of the pre-IPO market to Main Street America has empowered lots and lots of little guys to finally go toe to toe with the Wall Street elite.

The generational wealth built by angel investors is now available to every investor. All you have to do is reach out and take that opportunity.

Startup investing is risky; there’s no getting around that. But the right pre-IPO opportunity could change everything, and seeing how you don’t have to invest too much to reap massive profits, pre-IPO investing is a no-brainer.

For as little as $100, you could easily see returns of hundreds or even thousands of percent.

This is your opportunity to level the playing field with Wall Street and take a few wins home to Main Street, where the gains pre-IPO investing can offer are truly life-changing.

Note: We’ve found that readers tend to buy the stocks in these special reports at different times. Keep in mind that we may have taken profits or stopped out of a recommendation by the time you read this report. Please refer to the current portfolios for the most up-to-date recommendations.

© 2025 Manward Press | All Rights Reserved

Nothing published by Manward Press should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investment advice. We allow the editors of our publications to recommend securities that they own themselves. However, our policy prohibits editors from exiting a personal trade while the recommendation to subscribers is open. In no circumstance may an editor sell a security before subscribers have a fair opportunity to exit. The length of time an editor must wait after subscribers have been advised to exit a play depends on the type of publication. All other employees and agents must wait 24 hours after publication before trading on a recommendation.

Any investments recommended by Manward Press should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Protected by copyright laws of the United States and international treaties. The information found on this website may only be used pursuant to the membership or subscription agreement and any reproduction, copying or redistribution (electronic or otherwise, including on the world wide web), in whole or in part, is strictly prohibited without the express written permission of Manward Press, 14 West Mount Vernon Place, Baltimore, MD 21201.

August 2023.