Gold Says We’ve Got Problems the Fed Can’t Fix

Andy Snyder|July 30, 2020

The free-money ride to the moon continues.

Everywhere we look, we see folks tapping their foot as they poke Uncle Sam in the belly with their hat-filled hand.

“Hurry up and give us our money” seems to be the theme of the week – perhaps the decade.

And why not… it sure seems to be working.

Despite the atrocities of a global shutdown, most folks made more money during the first half of the year thanks to the coronavirus than they would have made if the bug had passed us by.

The latest personal income figures show – thanks to a whopping 10.8% stimulus-fueled surge in April – that there’s more money in the pockets of households now than in January.

And just to make sure the figures stand, there’s more money on the way.

More mailbox money… more cash for not going back to work… more money for small businesses… and, of course, more money for big businesses.

Some old favorites are on the list.

Funny enough, the latest free-money proposal (involving more than $1 trillion in all) includes $8 billion in funds for the nation’s missile defense system and fighter jet upgrades.

Apparently, the feds worry this virus may mutate into a communist.

Thanks, Andy!

But who cares, right?

The stock market is loaded with money-doubling opportunities. They are all over the place.

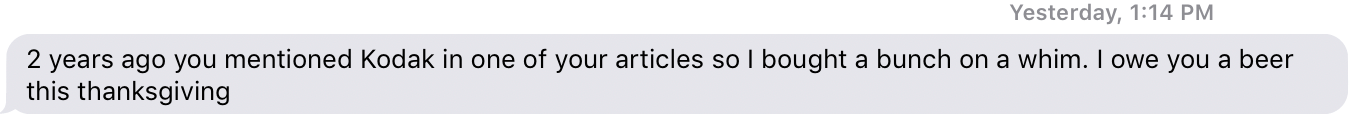

We received a heartwarming (and thirst-quenching) text message from a friend this week.

It shows what we’re talking about…

Free beer!

Free beer!

Now this stimulus stuff is making sense.

You probably heard the news this week from Eastman Kodak (KODK).

In a move we certainly had no clue was coming two years ago, President Trump just handed the old-school camera company a $765 million loan so it can start making drugs.

Shares went from $2.50 to more than $40 each.

But it’s not just these little down-and-out companies getting a boost.

As we’ve said, Pfizer (PFE) is in on the action. Moderna (MRNA) quadrupled its share price. And Novavax (NVAX) – as my Alpha Money Flow subscribers are happy to report – has surged by more than 1,700% since I featured it in a special report this year.

All are sponsored by Uncle Sam’s generosity… and fueled by the Fed’s printing press.

Even Big Government-loving windbags like Paul Krugman see what all this spending has done.

“It’s very hard to escape the sense that there’s mania now, that this is a FOMO [fear of missing out] market,” he said. “When you look at the way that people have piled into the stocks of bankrupt companies like Hertz, there’s clearly something, a bit of mania, going on.”

But Krugman would never blame the government for causing such a mess. It’s the people, not the system, who are stirring the “mania.”

“I don’t see what else the Fed could have done,” he said. “They could not have stood by and allowed a financial crisis on top of the viral crisis, so this is what had to happen, and if there’s some mania in the markets, well, that’s what happens.”

Hmmm…

The gold market seems to disagree.

Death of the Dollar

Just as we predicted way back in September, gold is having a great year (one of our mining plays is now up more than 520%… since June.)

Goldman Sachs just said what we’re all thinking…

“Combined with a record level of debt accumulation by the U.S. government, real concerns around the longevity of the U.S. dollar as a reserve currency have started to emerge.”

Hoo boy…

That’s a problem the Fed can’t fix. Not even those missiles and fighter jets we’re stimulating into life can fix it.

It’s a heck of a tale.

Krugman says not to worry… to fix today’s problems first.

Gold says today’s fixes are tomorrow’s unfixable calamity.

And we say hold your nose and buy like hell.

Buy gold… buy stocks… and get ready for Dow 100,000.

It’s coming.

We’re only a few trillion bucks away.

Are you worried about the Fed firing up the printing press again? Let us know your thoughts at mailbag@manwardpress.com.

Andy Snyder

Andy Snyder is an American author, investor and serial entrepreneur. He cut his teeth at an esteemed financial firm with nearly $100 billion in assets under management. Andy and his ideas have been featured on Fox News, on countless radio stations, and in numerous print and online outlets. He’s been a keynote speaker and panelist at events all over the world, from four-star ballrooms to Capitol hearing rooms.