The Pandemic’s Hidden Inflation… and What to Do About It

Andy Snyder|October 29, 2020

We went out to dinner the other night.

It was a place we’d normally be proud to be seen in.

We masked up, waited in the car until a table was ready like we were told to and then were quickly shuffled by the tables full of maskless potential super-spreaders.

Oh my.

We accidentally looked one of them in the eye.

The hostess seated us and quickly took off for the safety of the front desk.

“Wait,” we cried. “What about the menus?”

“No,” she shot back. “We don’t use them anymore. Use your phone.”

It turns out we had to scan a code at the back of the table, enter our information and then swipe up and down to find something appetizing.

“What if I don’t have a smartphone?” Mrs. Manward asked from across the table.

“Well then,” we joked, “you’re just going to starve.”

Welcome to modern America… and a grand lesson in economics.

Going Broke… the Ugly Way

According to the Federal Reserve, the nation’s inflation rate is a mere 1.2%.

We beg to differ.

That’s because the bean counters tally the prices of things, and we tally what you get for the prices of things.

You see, that meal out over the weekend cost us the same as it would have a year ago. But we got far less.

We had to use our phones to look at the menu… use our phones to pay the bill… and the “waiter” was merely the fella who carried our food from the kitchen.

It was the same price, but far less service.

If you want the same product… you’ll have to pay up.

It’s inflation. It’s rampant. And it’s hacking away at your quality of life.

Less… and Less

Of course, it’s not just at our restaurants.

We thought college was a scam before this mess. But now… oh boy.

Our sister is a professor at a fancy expensive school. Eighteen-year-olds fly from all over the world for her classes. These days, though, she logs in to the class from her kitchen table while the students remote in from very expensive dorm rooms.

The cost is the same… but the service sure isn’t.

It’s the same in our public schools.

Around here, the kids now have a day off each week for “independent” study. There’s no teacher in sight.

We aren’t holding our breath for the refund of our school taxes… or a cure for cancer anytime soon.

But don’t think this is merely an effect of the virus. Oh no… what’s happened over the last seven months is an acceleration of a trend you’ve been paying for for decades.

It’s called “shrinkflation.”

Meh… So What?

The textbooks say it’s no big deal – that the effects are minimal and contained to things like prepackaged food and candy bars.

Once again, we say the textbooks are old and out of touch.

Shrinkflation is everywhere.

We called our doctor the other day. We used to get somebody on the first ring. Now, to save costs, our calls go to a call center. It took us three tries over three hours.

Oh… and we lied.

She’s not a doctor. She’s a physician assistant.

But going to the “physician assistant’s office” doesn’t have the same ring… plus my insurance rate is the same.

Once again, same cost… lower service.

It’s true with our food too.

The fruit at the store today is far less nutritious than the stuff we bought even a decade ago.

And today’s beef is nothing like yesterday’s beef.

Sure… you can still get the good stuff, but it will cost you more.

But, of course, don’t ask the cashier at the front for help. She got replaced by a self-checkout machine.

It’s cheaper that way.

Same price… less service.

It’s all around us. Airplane seats are smaller. Newspapers are thinner. Commercials on the cable channels you pay for are longer.

Same price… less product.

We’d go on. But it’d do you no good.

You need to know the root of the issue so you can do something about it and overcome it.

Not What You Think

If this is where you think we’ll take a swipe at Uncle Sam for his tax rates or blame the Fed for its careless policies, you’ll be disappointed.

Those beasts play into the idea… but not all that much.

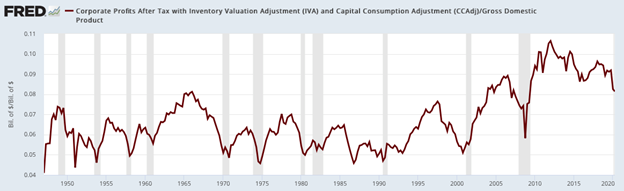

There’s something else at play. To spot it, we merely need to look at corporate profits.

They’re high… just below record levels.

This shrinkflation, in other words, isn’t due to a desperate fight for survival. It’s not because surging tax rates or rising interest rates are squeezing out all profits.

This shrinkflation, in other words, isn’t due to a desperate fight for survival. It’s not because surging tax rates or rising interest rates are squeezing out all profits.

It’s just the opposite.

We’re getting less because, sorry to disappoint, we allow companies to get away with it.

The average Joe is willing to accept less (just look at the election lineup).

As far as we could tell, we were the only ones not excited to have to dig out our phones to look at a menu…

Most folks like the convenience of checking themselves out at the grocery store…

And if all those ads on your favorite cable network are a bore, just pay more.

But what if you like the way things were?

Ah… this is where things get controversial.

What if you don’t want to trade your standard of living just to have cheap junk?

Well, then we ask you to go back to that chart above.

Corporate profits are near record highs. If you want to eat at a steak house with menus (a line we thought we’d never write), either you’d need to find a better stream of income (best of luck) or you’d better own a slice of those rising margins.

It’s the only way out.

Remember, the waiter doesn’t get paid more for doing less… the physician assistant doesn’t get paid a doc’s salary for doing a doc’s job… and the layoffs and job cuts that come with efficiency bring salaries down across the economy.

It’s more proof – Manward Letter subscribers, this should sound familiar – that the only way to get ahead is to put your money where it’s treated best.

And right now, that’s in the market.

Inflation comes in many forms.

If you want to maintain a high quality of life… invest accordingly.

Where have you seen “shrinkflation” in action? Tell us about it at mailbag@manwardpress.com.