Why Cash Is Essential and Other Key Lessons From the Coronavirus Crisis

Andy Snyder|July 8, 2020

We’ve got an idea for a new book.

We don’t know whether we have the time to write it, but somebody should. The idea is simple. It would practically write itself.

Somebody needs to write down all the things our culture has learned over the last six months. “The ‘rona,” as the kids are calling it these days, exposed some powerful things about our nation and our economy.

We’re afraid that if they’re not written down, they’ll be forgotten in the next news cycle.

Things like…

- Our food system is just one sneeze away from total collapse.

- Our medical system operates on the cusp of disaster.

- Medical research is flawed and biased.

- Bad information spreads faster than good information.

- It is possible to grow your own food.

- When we need it the most, government fails.

- Most Americans have trouble living without government aid.

- We weren’t joking when we said to have an emergency fund.

We’d go on (this book could be inches thick), but you get the idea.

Plus, we want to share something else many Americans are learning these days.

They’re learning our monetary system is extremely fragile.

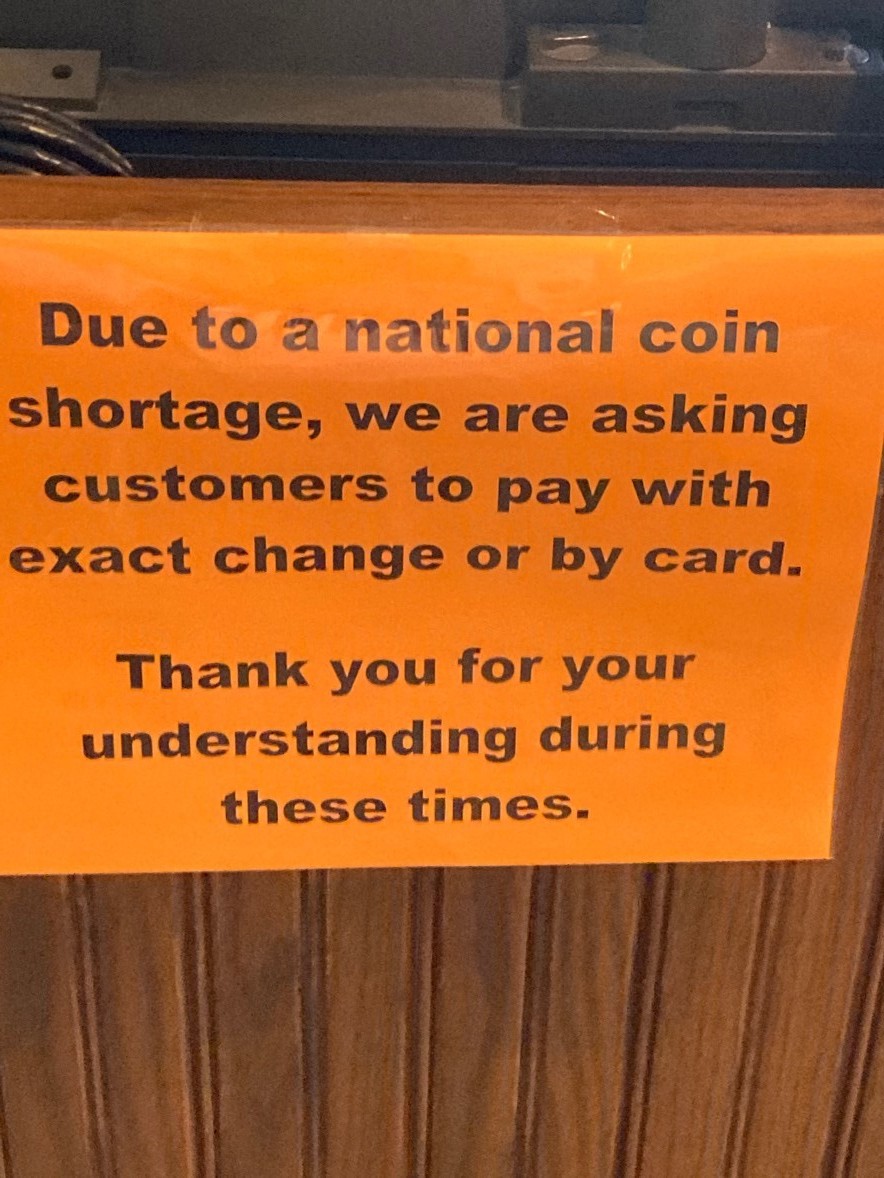

Take a look at this picture we took recently. It is from a huge chain store.

Strap on a mask and do some shopping and you’ll certainly see a sign like this. They’re all over the country. And they’re teaching Americans another valuable lesson.

Strap on a mask and do some shopping and you’ll certainly see a sign like this. They’re all over the country. And they’re teaching Americans another valuable lesson.

Our monetary system is old, outdated and works best when it’s inches from failure.

When Money Gets Sick

What’s happening now is another unforeseen (but quite predictable) outcome of the coronavirus panic.

Coins are in short supply.

Many news sources are saying it’s because the mints have shut down due to the virus. That’s true. But it’s far from the full story.

This is a distribution issue.

Think of the nation’s money system like the letter T. Consumers, stores and anybody who actually uses coins form the horizontal line at the top. That’s where coins change hands.

The vertical line starts with banks at the top and the Federal Reserve at the bottom.

If banks have excess coins or need some more, they don’t call the store down the street or barter with the bank across town.

No. That’d be too simple.

Instead, they must push their change down to the Fed.

They call up an armored truck. It picks up the coins and takes them to the Fed’s vault. There, they are counted and sorted and, if things go well, shipped back up to another bank.

That system is broken right now.

Many bank lobbies are still closed. The money can’t flow where it needs to go.

But the news isn’t all bad.

In fact, something quite good is happening. It’s something we’ve seen a lot these days.

It will surely be a big theme in our book.

DIY Banking

Store owners are skipping their banks. They’re creating their own system and going around the obstacle.

Laundromat owners are trading their excess coins for cash. Coffee shops are working with grocery stores to get the change they need. And companies like Coinstar are becoming the new kings of the industry.

It’s a beautiful thing.

But here’s where we worry.

We worry folks will get used to this idea that money is scarce and its digital version is an equal alternative.

We fear folks will be fine with signs like the one above and the rush to a cashless society will only gain speed from here.

Someday – perhaps soon – we won’t need signs to tell us physical money is in short supply. It’ll be assumed.

That’s bad news.

Liberty in Short Supply

After all, this virus mess has taught millions more Americans about a powerful idea. They learned the government would love to control their money.

It wants to put it directly into your bank account. It wants to remove it when necessary. And, someday soon, we’re absolutely convinced it’ll use this newfound skill to speed up and slow down the economy.

It’s far easier than buying corporate bonds… and it buys a whole lot more votes.

There are a lot of lessons to learn in all this. The way our money works – and the many ways it can fail – is a great one. But there’s one idea that binds it all together. We hope you’ve caught on.

Ultimately, this is a tale of Liberty.

The nation is finally learning just how valuable it is.

And we pray it learns it’s worth a whole lot more than a few coins.

P.S. We recently published a Death of Cash Survival Kit. It details everything that’s going on, plus a hot stock to take advantage of what’s happening and a new way to use gold when you shop instead of paying with physical cash. All the details are here.

What lessons have you learned over the last six months? We’d love to hear them. Drop us a line at mailbag@manwardpress.com.

Andy Snyder

Andy Snyder is an American author, investor and serial entrepreneur. He cut his teeth at an esteemed financial firm with nearly $100 billion in assets under management. Andy and his ideas have been featured on Fox News, on countless radio stations, and in numerous print and online outlets. He’s been a keynote speaker and panelist at events all over the world, from four-star ballrooms to Capitol hearing rooms.