Update - April 13, 2021

Our Fastest 200% Gain Ever

The bulls continue to run.

They’ve been prodded into a stampede by the effects of dirt-cheap (even free!) money.

The real yield on the 10-year Treasury remains negative (below -0.6%).

It means our current thesis remains in play… and is treating us very well.

The only thing in our portfolio that’s not quickly rising in value is gold. That’s the way it should be. If we’re making money on our insurance play, something is wrong.

That’s why I don’t like the recent comparisons between gold and crypto.

They’re not the same. And our portfolio proves it.

After all, our biggest moneymaker is no surprise… crypto.

Filling up the digital money spot in our portfolio is Monero (XMR), the privacy-focused digital currency that has gotten a lot of attention from buyers in recent weeks.

As I write, our stake has surged by a whopping 235% since I recommended it in September. It’s the fastest triple-digit winner in Manward Letter history.

And while it may appear to be a play on the death of the dollar, that’s only a very small part of the story. The truth is whopping amounts of cheap money are behind the surge. Investors are looking for a place to park their cash… and the high-flying realm of crypto is the brightest spot they’ve found.

It’s no wonder then that lots of your fellow readers are rightfully asking me for more crypto plays.

But speculating on digital money is not the goal of this letter.

No, my goal with Manward Letter is to give you a broad view of what’s happening in the modern economy and help you create the very best – and amply diversified – portfolio to profit from it.

My intent is to show you what’s changed, why traditional strategies don’t work and how you can excel despite some of the troubles in the economy today. Use this portfolio to create a base portfolio that you can build lasting wealth with.

If that strategy hands you some extra money you can speculate with, then you can turn to our faster-paced research services – like Alpha Money Flow, which focuses tightly on volume trends… and, these days, lots of winning crypto picks.

(Here’s a link to a presentation on my favorite play right now.)

Another Double

While Monero has the top prize for now, it’s getting some serious competition.

Our stake in Scotts Miracle-Gro (SMG) has now surged well into triple-digit-gain territory. The gains are coming from two distinct pieces of its business.

First is the continuation of the theme that got us into the play last year – the booming home-gardening trend. It remains red-hot as more folks turn back to growing their own food.

My sources in the industry continue to report sales that they can’t keep up with. Major suppliers are still limiting their products to wholesale customers only.

It’s a boon for our play.

But it’s not the only thing pushing share price higher. I’ve written about the company’s Hawthorne division before. It’s the group that focuses on the cannabis market.

It’s the company’s biggest growth driver, with first quarter sales growth of more than 70%. That’s huge. And it’s not a one-time pop. The quarter marked the fourth straight three-month period with sales growth of 60% or more.

Compound that sort of growth over a few more quarters and we’ve got HUGE gains on the way.

As New Jersey and now New York open their doors to recreational marijuana, the trend will continue.

And while Monero and Scotts don’t have many direct ties, it’s important for me to note that both of them have valuations that are largely driven by decisions made by the government.

In our modern economy, that’s a critical factor that far too many analysts overlook. The investing textbooks certainly don’t put the weight on the idea that it deserves.

Doing so, however, pays off handsomely.

Government Spending

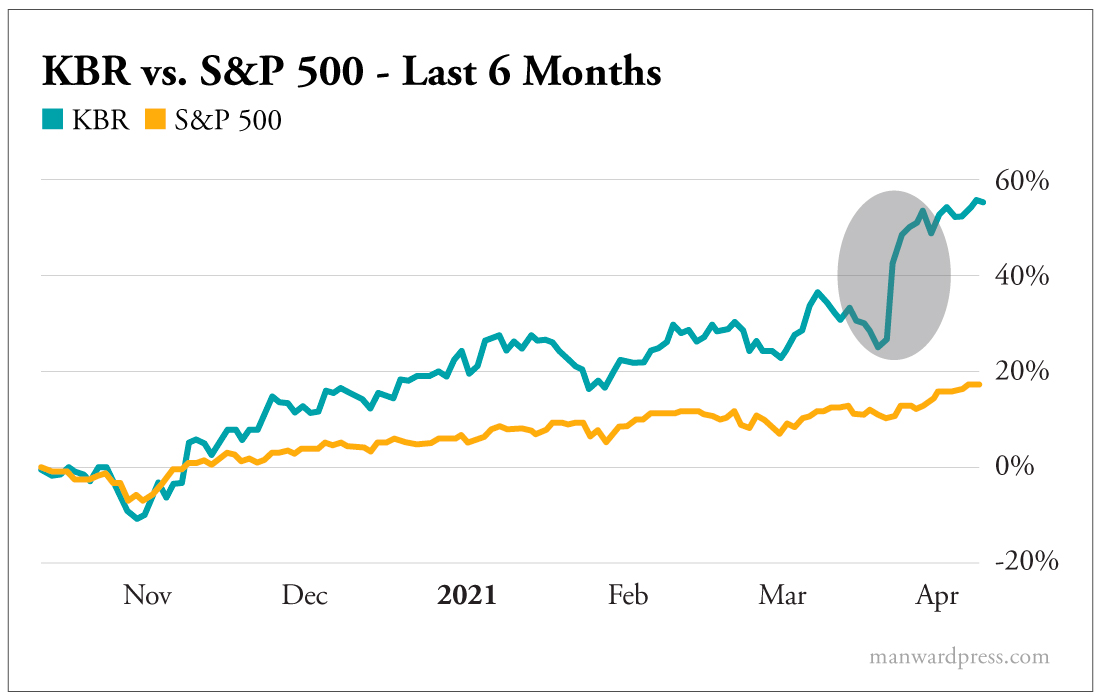

Again, just look at our stake in KBR (KBR). The play has worked out just as I said it would.

Big government spending is leading to BIG gains.

Just look at what has happened to the share price in the few weeks since President Biden announced his $2 trillion-plus infrastructure plan…

KBR continues to land one major infrastructure deal after the next. Today, it revealed it’s working on a large dehydrogenation plant in Pakistan. Last week, it announced a $470 million infrastructure contract with the U.K. naval defense sector. And before that, it laid out the details of a $100 million contract with the Pentagon.

Again, with interest rates near record lows and governments that are eager to open the spending spigot to get things stimulated again, this is exactly the sort of play we want to own.

We’re up 80% on it, and the gains are coming faster with each passing week.

As I’ve been saying for months… it’s a great time to be an investor.

There’s free money all over the place.

Follow it to find the big gains.

Be well,

Andy