Special Report

Biden-Harris Tax Escape Plan

Signs are pointing to a Trump presidential victory, which means the policies laid out in his Document 20 are just a step away from becoming the law of the land.

But even with Trump’s tax policies set to be put in motion, the reality is… it will take time for them to be enacted.

We are still talking about the government, after all.

In the meantime, we want to ensure Manward readers have every tool at their disposal to protect what’s theirs.

The history of the tax code in America is filled with misbegotten plans and red tape.

If it’s harmful, the government slaps a tax on it.

Gasoline… The federal government get $0.184 for each gallon sold. That’s about 7% of the retail price.

Cigarettes… Uncle Sam gets a buck for every pack sold. It’s about 20% of the total price.

Gambling… Washington gets 25% of everything you win.

And remember when states rejoiced that a 10% tax on soda reduced consumption by 10%?

If that reduction was truly a result of the tax and not simply a change in consumer tastes, it raises a question…

If taxing something truly reduces demand, why is it that the government has come up with so many ways to tax our assets? Does the state’s insistence on raising property taxes, for example, mean it doesn’t want folks to own real estate?

Of course, anyone who pays attention knows that the rhetoric Washington uses when passing a new sin tax is based on lies.

The government doesn’t tax sin because it wants us to stop sinning.

It taxes sin because it knows we’re all sinners. It knows we’ll keep paying and feeding its spending addiction – no matter what.

Our keepers know that when it comes to taxes, we’ll accept more of a squeeze in some spots than in others. We’ll buy that beer despite the hefty tax. But tax those Brussels sprouts… and we’re gone.

The intricacies of the tax system give a lot of folks a lot of trouble.

The government has done a fine job of baffling American savers… of tweaking the free market… and of creating economic incentives that make investing far more complex than it should be.

In many ways, it leads to what we call “analysis paralysis.” That’s when there are so many options and so many complicated choices to make that our mind simply closes up shop and walks away.

When it comes to investing and saving for retirement, the government has made the waters so muddy and choppy that many folks won’t even dip a toe into them.

There’s no simple solution. No matter who steps into the White House in 2025, Washington won’t fully rewrite its tax code anytime soon.

But by following the tips in this guide, we can make the best of a very bad situation.

Taxes and Investing 101

It’s impossible for us to cover all the nuances of how to best manage your portfolio to reduce your tax burden. Our lawyers would tell us to remind you that consulting a tax accountant is the way to get the very best advice.

We tend to agree. But if you’re not starting with much, a trip to the accountant will cost you far more than it’ll save you. And if you are starting with much… we bet you already know a good accountant.

So we’ll begin with the basics… which will serve as a compass to get you headed in the right direction.

To get started, it’s important you know the many, many ways Uncle Sam can dig into your pocket.

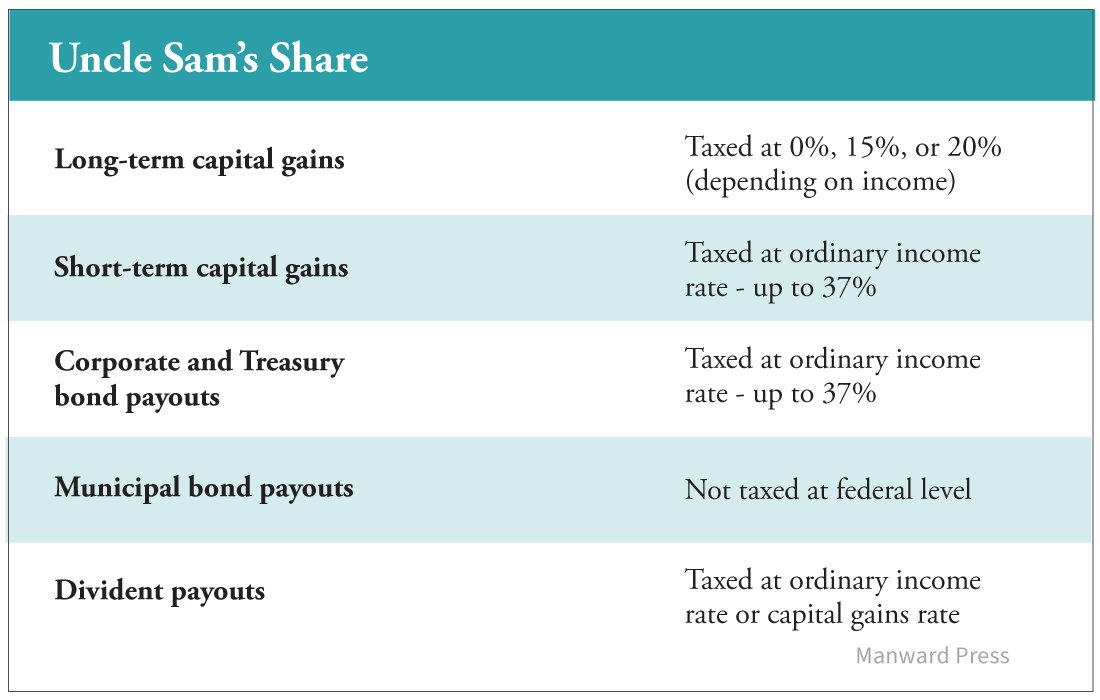

The most common tax that investors have to deal with is the levy on capital gains.

It’s pretty simple. If you make money on your investments, you have to cut a check that represents a percentage of your profits.

The long-term capital gains rate – which applies to stocks held for more than a year – is 0%, 15%, or 20%, depending on your income.

But, of course, the federal government charges us more for the things it knows we won’t stop doing. That’s why profits on assets owned for less than a year (short-term capital gains) are taxed at our ordinary income tax rate, which can be as high as 37%.

Clearly it’s best (from a tax standpoint, at least) to hold stocks for a year or more.

Of course, not all the money we make from investing comes from selling our stocks for gains. There are also things like bond payouts and dividends to consider.

Interest received from corporate and Treasury bond payouts is taxed at your ordinary income tax rate, meaning that up to 37% of the payout could go to the feds. Interest from municipal bonds, on the other hand, is not taxed at the federal level.

Confused yet?

Like we said… the government sure doesn’t make it easy.

But don’t worry. Here’s a table with all the need-to-know information.

Now we know the problem. But that’s only the start… the first step.

The question from here is, what can we do about it?

Fighting Back

As you’ve probably heard, there are lots of ways to lower your taxes. You just need to be savvy enough to know how to use them.

We can’t dive into the many ways companies and big-league investors are able to slash their tax rates (many of them aren’t fit for print).

Fortunately, a solid understanding of the basics will do you just fine.

Broadly speaking, there are two main types of investment accounts – taxable and tax-advantaged.

We’ll start with the latter.

Tax-advantaged accounts are tools the government created to incentivize Americans to save for retirement.

The most popular form of tax-advantaged account is an individual retirement account (better known, of course, as an IRA).

There are two types of IRAs.

The older, “traditional” IRA is tax-deferred. An investor can deduct the money he puts into the account from his ordinary income, and he doesn’t have to pay any taxes on dividends or other forms of income he collects from the IRA along the way.

But he does have to pay his ordinary income tax rate – not the standard capital gains rate – on the money he withdraws from the account.

Again, this rate can be as high as 37%. But since that rate applies only to those with incomes of more than $600,000… most folks pay nowhere close to that much. A tax rate of around 20% is much more likely in retirement.

Of course, there are some downsides to an IRA.

First, if you want to use your money before you hit the minimum age of 59 1/2, you’ll pay a penalty of 10% and you’ll lose your tax benefits.

Another downside of a traditional IRA is that once you reach the age of 72 (or 73 if you turned 72 after December 31, 2023), the government forces you to take minimum withdrawals each year.

And don’t forget, big accounts can run into heavy taxes. If you’re lucky enough to be in a high-income bracket when you retire, the taxes are going to hurt.

That’s not as much the case with a Roth IRA (named after one of the original sponsors of the idea, Senator William Roth).

These tax-exempt IRAs don’t require taxes to be paid on the back end and don’t come with a minimum distribution requirement. In other words, your assets grow tax-free, and any money you withdraw is not subject to Uncle Sam’s sting.

But calling a Roth IRA tax-exempt is actually a misnomer. Your investments aren’t exempt from being taxed entirely – you simply pay taxes on them upfront.

It means Uncle Sam gets his money today, leaving you not just with less cash to invest but also more downside exposure if your investments don’t pay off.

It’s a roll of the dice… but if you think America’s debt burden will force the government to raise rates in the future – or if you think you’ll retire in a higher tax bracket than you’re in now – a Roth IRA is a good idea.

Of course, Uncle Sam doesn’t want you to get too much of a good thing.

While Washington would never limit how much you can gamble, how much you can drink, or how much gasoline you can buy… it does have some pretty strict caps on how much you can put in your tax-saving IRA each year.

The limit for 2024 is $7,000 if you’re under the age of 50 and $8,000 if you’re over.

Plus, there are income limits. If you are married and have a household income of more than $230,000… the amount you can invest in an IRA starts to fall. Earn more than $240,000, and you lose the tax benefits.

As we said, the government doesn’t want you getting too much of a good thing.

Free Money

Another common tax-advantaged investing account is the 401(k) – named after the subsection of the IRS code that outlines the plan.

For 2024, Americans can invest as much as $23,000 in their 401(k)s. If you are 50 or over, you can contribute an additional $7,500. But there’s a catch. You must be employed… and work for a company that offers a plan.

The rules for 401(k)s are not that much different from those for IRAs. The main difference is that a company must sponsor a 401(k) plan and can therefore limit the types of investments its employees can buy.

Historically, the plans have been a boon for mutual fund and ETF providers, which tend to steer less knowledgeable investors into their high-fee products. But self-directed forms are becoming more and more popular.

Perhaps the biggest benefit of a typical 401(k) plan is that the employer often matches its employees’ contributions. Of course, most businesses place a limit on the free money, but the average match is somewhere between 3% and 6% of an employee’s salary.

If you make $100,000 per year, for example, and pull 3% from your paycheck to put in your 401(k), your employer will contribute $3,000 of its own cash each year to the plan.

It’s free money. If you are lucky enough to work for a firm that matches, be sure to take full advantage of the opportunity. Unlike with IRAs, there are no income limits. But a person can contribute no more than $23,000 to their 401(k) in 2024.

Fortunately, the law does allow an investor to fund both an IRA and a 401(k).

And as with IRAs, there is a Roth alternative for these 401(k) plans. Under that option, invested dollars grow tax-free and are withdrawn without tax because they’re taxed prior to going into the account.

Again, with a “traditional” 401(k) account, a person can deduct their contribution from their annual income and then pay income taxes on the funds when they withdraw them.

When the big day comes and you get to start taking money from your 401(k), the rules are similar to those of IRAs. Withdrawals are penalty-free after the age of 59 1/2. And both forms of 401(k)s have no minimum distribution requirements.

When “Taxable” Is Your Best Bet

As the saying goes, “The Lord giveth and the government taketh away.”

But when it comes to saving for retirement, the fine folks in Washington give us a bit of a reprieve.

Of course, they do it only until we attain a certain level of wealth. After that, the limits kick in and Uncle Sam reaches as deep into our pockets as he can.

But because we may be maxing out our tax-advantaged accounts and investing some of our cash outside of an IRA or 401(k), it’s vital to understand that a “taxable” account can be managed in a very efficient way.

It’s not all that hard.

There are two main types of investment accounts – taxable and nontaxable (or tax-advantaged). We’ve covered the latter.

Fortunately, we don’t have to worry about putting you to sleep with more words about limits and complicated rules.

Taxable accounts are quite easy to understand. These are your standard brokerage accounts.

Money gets taxed on the way in… and any profits the cash generates is taxed on the way out.

There are no penalties for taking money out before you retire. There are no required distributions. And you can invest as much as you’d like in just about anything you’d like.

But just because these accounts are not considered tax-advantaged doesn’t mean there aren’t savvy ways to use them to reduce your taxes.

Location… Location… Location

There’s long been a saying in the money management world that it’s not just your asset allocation that matters… but also your asset location.

We know we can stuff only so many assets into our tax-advantaged accounts. That means we need to select which assets we put in these accounts very carefully.

If we’re investing in tax-heavy assets that pay big annual dividends or interest, we should put those assets in our IRA or 401(k). That way, the income will grow within our account and be taxed only when we withdraw it.

On the other hand, if you’re investing in stocks that you plan to hold for a long time, those assets will do fine in a taxable account, especially if your tax-friendly accounts are already maxed out with less efficient investments.

And don’t forget, not all saving is about saving for retirement. This is key.

Once money is put into an IRA or 401(k), withdrawing it before you reach the proper age will come with a hefty penalty. That’s not the case for a standard account.

Perhaps you’re saving to buy a sailboat in a few years. Or maybe you want to celebrate a big anniversary with a grand trip to Europe. A smart investing strategy can make these things happen. But taking a 10% penalty on top of your taxes because you withdrew too early from an IRA won’t help.

That’s where a standard “taxable” account will be very useful – and very valuable.

Lesser-Known Alternatives

But before you go pouring money into a standard trading account, there are two other tax-advantaged accounts you should be aware of.

They aren’t for everybody, which is why we didn’t include them above. But if they fit your situation, they could keep thousands of your hard-earned dollars out of the hands of Uncle Sam.

One of the hardest financial decisions today’s generation of youngsters must make is whether to go to college… and how to pay for it if they do.

If they make poor decisions, they’ll be riddled with debt (monthly student loan payments can easily rival a mortgage) and earn a degree that’s virtually useless. It’s one of the greatest threats to American kids.

But thanks to a little-understood strategy, there is a solution. Most serious investors have heard of 529 plans. But few realize their true power.

They are not just for young parents. Far from it.

They’re perfect for grandparents… aunts… uncles… anybody who wants to boost their own economic fate by lowering their taxes.

Washington Did Good?

Congress created the plans in 1996 as a way to spark interest in saving for college education (and, of course, to funnel more dollars to its state-funded schools).

Earnings generated through the plans are not subject to federal tax and, in most cases, are not subject to state tax when the money is used to pay for necessary college expenses (the list of qualified expenditures is actually quite expansive).

Right off the top, that could boost your profits by as much as 20%. But in at least 34 states, the tale gets even better.

You can deduct 529 contributions from your state income tax each year. If you live in Pennsylvania, for example, you can deduct as much as $36,000 worth of income… per beneficiary.

And what’s really powerful is that the law allows us to transfer funds from one beneficiary to another without triggering a taxable event.

In other words, in many instances, it makes sense for high-income earners to open a 529 plan just for the annual deduction on their state income taxes.

They may never use the money, but it can easily be withdrawn or transferred to their children or grandchildren. (Many states’ 529 plans, like Pennsylvania’s, also provide appealing inheritance and gift provisions.)

Another little-known benefit of these plans is that you can open an account in any state. You’re not locked into your home state’s plan.

We recommend looking at Utah’s. It allows savers to invest in a wide array of assets, including ultra-cheap Vanguard funds. Its most expensive option comes with an annual program management fee of as little as 0.09%.

And here’s one of the best perks of a 529 plan: You are in control of the money.

In other words, any money you invest in the plan is still yours. If a medical bill or other financial emergency hits, you can withdraw funds from the account and simply pay the taxes you would normally owe.

The money remains in your control until it is spent.

If you’re planning to help a loved one pay for college anyway, doing it through a 529 is the ideal way.

Best of the Best

Finally, another way to keep money out of Washington’s hands is through a health savings account (HSA).

Not everyone qualifies for one, though. If you want to contribute to one of these underutilized accounts, you must be enrolled in a high-deductible health insurance plan.

If you are, you can contribute as much as $8,300 each year… in one of the most tax-efficient accounts available. (Folks 55 and older can make additional “catch-up contributions” of up to $1,000 annually.)

The dollars you put in can be deducted from your income. The earnings the money generates won’t be taxed. And if you use the cash to pay for a qualified medical expense, the money you withdraw will be tax-free.

And get this… if the account has money in it after you turn 65, you can withdraw it and use it for anything. You’ll have to pay only your ordinary income tax rate – as you would with a traditional IRA or 401(k).

Done right, it’s a way to instantly save 20% or more on your healthcare costs. And that figure is compared with a “tax-advantaged” account. The savings are much, much higher compared with a traditional investing account.

That’s huge… and it shows the immense value of protecting your money from the taxman.

If you are looking to maximize your IRA and/or 401(k) each year, we recommend seeing a tax accountant to help determine the best place to put each of your assets. Every situation is different… and every person will benefit from these accounts in a different way.

Clearly this is something you want to get right.

The more you know about how to reduce your taxes, the more freedom you’ll have in retirement.

You can either accept and take full advantage of what we said above or deny it and just blow your money on cigarettes, booze, and gambling.

Either way, Uncle Sam will come looking for your cash.

We say give him as little to find as possible.

Note: We’ve found that readers tend to buy the stocks in these special reports at different times. Keep in mind that we may have taken profits or stopped out of a recommendation by the time you read this report. Please refer to the current portfolios for the most up-to-date recommendations.

© 2024 Manward Press | All Rights Reserved

Nothing published by Manward Press should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investment advice. We allow the editors of our publications to recommend securities that they own themselves. However, our policy prohibits editors from exiting a personal trade while the recommendation to subscribers is open. In no circumstance may an editor sell a security before subscribers have a fair opportunity to exit. The length of time an editor must wait after subscribers have been advised to exit a play depends on the type of publication. All other employees and agents must wait 24 hours after publication before trading on a recommendation.

Any investments recommended by Manward Press should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Protected by copyright laws of the United States and international treaties. The information found on this website may only be used pursuant to the membership or subscription agreement and any reproduction, copying or redistribution (electronic or otherwise, including on the world wide web), in whole or in part, is strictly prohibited without the express written permission of Manward Press, 14 West Mount Vernon Place, Baltimore, MD 21201.

October 2024.